EV Roundup: Q3 Highlights of NIO, WKHS, SOLO, HYLN & RIDE

Zacks Investment Research | Nov 16, 2021 04:16AM ET

Third-quarter 2021 results from NIO Inc. .

3. ElectraMeccanica incurred third-quarter loss per share of 11 cents, which matched the consensus mark. This Canada-based EV manufacturer had cash and cash equivalents, and short-term deposits of $228.8 million as of Sep 30, 2021. For the quarter under discussion, the firm’s R&D and G&A costs totaled $5.3 million and $7.4 million, up from $1.5 million and $1.9 million, respectively, in the corresponding period of 2020.

ElectraMeccanica delivered 21 flagship SOLO EVs to reservation holders and fleet customers last month. Since August 2020, the company has manufactured 182 SOLO vehicles. Revenues from initial commercial SOLO deliveries would be recognized in the fourth quarter.

SOLO currently carries a Zacks Rank #4. The Zacks Consensus Estimate for 2022 earnings implies no change year over year.

4. Hyliion recorded third-quarter adjusted loss per share of 15 cents, narrower than the Zacks Consensus Estimate of 24 cents. This Texas-based hybrid truck powertrain maker expects to recognize revenues on Hybrid eX powertrain deliveries starting from the fourth quarter of 2021. R&D and SG&A expenses for the quarter totaled $18.2 million and $8.7 million, significantly higher than $2.9 million and $2.1 million recorded in the year-ago period, respectively.

Hyliion now expects full-year 2021 operating expenses in the band of $110-$120 million, down from the prior guided range of $130-$140 million amid timing delays of truck chassis purchases for development purposes. As of Sep 30, the firm had cash and cash equivalents of $289.5 million.

HYLN currently carries a Zacks Rank #3. The Zacks Consensus Estimate for 2022 earnings implies a year over-year-deterioration of 30%.

5. Lordstown recorded third-quarter adjusted loss of 54 cents a share, narrower than the consensus estimate of 56 cents. SG&A and R&D costs of the firm for the quarter under review totaled $31.3 million and $57 million, flaring up 160% and 90%, respectively, on a year-over-year basis. This Ohio-based provider of electric light-duty trucks exited the quarter with cash and cash equivalents of $233.8 million.

Lordstown expects to commence commercial production and deliveries of the Endurance truck in third-quarter 2022. For full-year 2021, the firm anticipates capex between $330 million and $350 million. Full-year R&D and SG& costs are projected at $320-$340 million and $105-$120 million, respectively.

RIDE currently carries a Zacks Rank of 3. The Zacks Consensus Estimate for 2022 earnings implies a year-over-year improvement of 57.2%

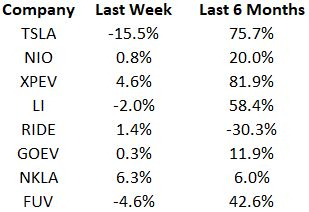

Price Performance

The following table shows the price movement of some of the major EV players over the past week and six-month period.

What’s Next in the Space?

Stay tuned for announcements of upcoming EV models and any important updates from the red-hot industry.

Zacks' Top Picks to Cash in on Artificial Intelligence

In 2021, this world-changing technology is projected to generate $327.5 billion in revenue. Now Shark Tank star and billionaire investor Mark Cuban says AI will create "the world's first trillionaires." Zacks' urgent special report reveals 3 AI picks investors need to know about today.

See 3 Artificial Intelligence Stocks With Extreme Upside Potential>>Want the latest recommendations from Zacks Investment Research? Today, you can download 7 Best Stocks for the Next 30 Days. Zacks Investment Research

Trading in financial instruments and/or cryptocurrencies involves high risks including the risk of losing some, or all, of your investment amount, and may not be suitable for all investors. Prices of cryptocurrencies are extremely volatile and may be affected by external factors such as financial, regulatory or political events. Trading on margin increases the financial risks.

Before deciding to trade in financial instrument or cryptocurrencies you should be fully informed of the risks and costs associated with trading the financial markets, carefully consider your investment objectives, level of experience, and risk appetite, and seek professional advice where needed.

Fusion Media would like to remind you that the data contained in this website is not necessarily real-time nor accurate. The data and prices on the website are not necessarily provided by any market or exchange, but may be provided by market makers, and so prices may not be accurate and may differ from the actual price at any given market, meaning prices are indicative and not appropriate for trading purposes. Fusion Media and any provider of the data contained in this website will not accept liability for any loss or damage as a result of your trading, or your reliance on the information contained within this website.

It is prohibited to use, store, reproduce, display, modify, transmit or distribute the data contained in this website without the explicit prior written permission of Fusion Media and/or the data provider. All intellectual property rights are reserved by the providers and/or the exchange providing the data contained in this website.

Fusion Media may be compensated by the advertisers that appear on the website, based on your interaction with the advertisements or advertisers.