EUR’s Breakdown Contained By Options And GDP

MarketPulse | Aug 12, 2014 07:04AM ET

Geopolitical concerns are not going away, they are trying to move to the background, while remaining within easy reach. The 18-member single unit has been negatively tied to both weaker corporate earnings and economic data in recent weeks. The morning's euro focus has been on German economic sentiment. With Russian actions continuing to weigh on the consumer, German ZEW economic sentiment was expected to be lower, but by how much?

The eight straight consecutive drop in the German ZEW headline for August is not new or a surprise. However, the size of the drop to 8.6 (previous 27.1, expected 18.2) will have sent a few alarm bells off. This is certainly stronger proof that geopolitical tensions are evidently hitting sentiment. It's worth noting that the ZEW is complied via a survey of investors and financial institution and not businesses - it does not necessarily translate into economic weakness. Nevertheless, investors will remain wary of the lowest level in nearly two-years, and coupled with the recent weaker German Ifo index would indicate that Germany has started Q3 on weaker footing.

Investors to see German GDP

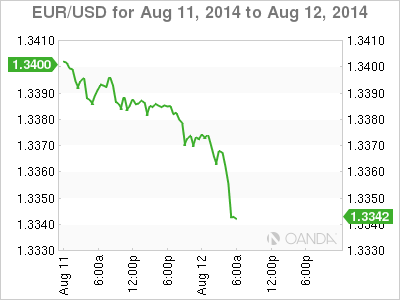

What the market needs to gage now is how much of the weaker German headline has already been priced in? The initial impact on the single unit has caused it to make an assault on the last week's nine-month low (€1.3333). The self-contained trading ranges makes dynamic pricing much harder to gauge. Investors would be better off looking to Thursday's Q2 GDP figures for a stronger indication - Germany is expected to have stagnated or even contracted a bit. The EUR in the short term has a lot of wood to chop through with strong corporate bids scattered ahead of €1.3325-3300 option barriers. A +2b €1.3340-50 EUR option that expires later this morning should help to contain the single unit in the short term, and may even help to squeeze the EUR higher on the back of some nervous shorts. However, a daily close below €1.3389 will be a blow to the EUR bulls who have positioned themselves with contrarian positions on the back of recent record 'long' USD reports.

German Bund Supply

For some further insight, the EUR bear should continue to watch Bunds and the Bund/Treasury spreads for clues. The Bund 'bull' has been in fine form of late, pushing 10-Year yields to record lows (+1.02%). With this morning's disappointing headline, the market would be looking to make additional progress back towards record high prices, however, advancement could be difficult with dealers wary of tomorrow's 10-year Bund supply coming to market. All dealers will want to make room to take down the issue, which look rich on the curve and would prefer to back up yields. A depressed yield environment coupled with the thin populated state of the markets could make for a messy issue.

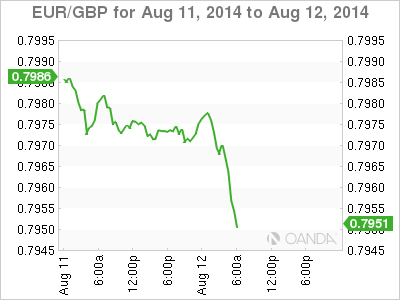

The rapidly shifting market positions, mostly favoring the dollar, are just one factor behind why volatility may be ready to increase in the forex market. While many have added to their short EUR positions outright (August 5th CoT reports), they have also made bets that the 'mighty' buck would advance against the JPY, GBP, CHF and Australian and Canadian dollars. This has led to the largest grouping of long USD positions in 12-months. Risk aversion and Treasury buying have mostly been driving the dollar's rally. Throw into the mix poorer global growth prospects, and collectively it probably justifies the dollars medium term support. However, with sometimes-questionable liquidity, due to the European holiday season in full swing, the weaker dollar longs are hoping not to be squeezed. Expect them to live with short-term consolidation as they pin their hopes on global growth prospects continuing to underwhelm.

Aussie 'longs' not dead yet

The AUD ($0.9250) is not dead and buried just yet. The currency has been a favorite member of the highly coveted 'carry' trade, financed mostly in EURs. A trade made popular in a low rate, less volatile trading environment. Despite direct 'jawboning' from the RBA's Governor Stevens, the AUD is finding it difficult to go directly down. However, when CBank monetary policy eventually begins to tighten, one should expect the 'long' AUD carry position to come under more pressure. With Aussie stocks rallying overnight (S&P/ASX 200 +1.3%), despite lower trade volumes on the back of geopolitical concerns, coupled with stronger business data for July and stronger house price growth, will make it difficult for the RBA to cut rates anytime soon. The speculator is 'short' the AUD or rather 'long' the USD and the currency's demise will only be a grind.

Original post

Trading in financial instruments and/or cryptocurrencies involves high risks including the risk of losing some, or all, of your investment amount, and may not be suitable for all investors. Prices of cryptocurrencies are extremely volatile and may be affected by external factors such as financial, regulatory or political events. Trading on margin increases the financial risks.

Before deciding to trade in financial instrument or cryptocurrencies you should be fully informed of the risks and costs associated with trading the financial markets, carefully consider your investment objectives, level of experience, and risk appetite, and seek professional advice where needed.

Fusion Media would like to remind you that the data contained in this website is not necessarily real-time nor accurate. The data and prices on the website are not necessarily provided by any market or exchange, but may be provided by market makers, and so prices may not be accurate and may differ from the actual price at any given market, meaning prices are indicative and not appropriate for trading purposes. Fusion Media and any provider of the data contained in this website will not accept liability for any loss or damage as a result of your trading, or your reliance on the information contained within this website.

It is prohibited to use, store, reproduce, display, modify, transmit or distribute the data contained in this website without the explicit prior written permission of Fusion Media and/or the data provider. All intellectual property rights are reserved by the providers and/or the exchange providing the data contained in this website.

Fusion Media may be compensated by the advertisers that appear on the website, based on your interaction with the advertisements or advertisers.