EUR/USD: Dollar Is Coming To A Soft Landing

LiteForex | Jan 09, 2019 02:49AM ET

The global economy is far from recession, it is slowing down

The U.S. dollar tried to get use of its main rival’s, the euro, weakness in the form of weak data on German industrial production; however, good news about the US-China trade talks and stabilization of financial markets discourage the EUR/USD bears. Investors are also encouraged to sell the greenback by the forecasts of the authoritative organizations, related to a slowdown in global GDP growth.

As a rule, the USD is rallying up if the US economy-growth outperforms over the global economic expansion. It was so in 2018; however, in 2019, to anticipate the further USD trend, one should ask another question: which GDP rate will be slowing down faster, global indicator or that of the USA. According to the World Bank, the first indicator will be growing slower, at 2.9%, compared to the previous rate of 3%; the second rate will be down to 2.5% from 2.9%. The dollar doesn’t already look to be the G10 leader; however, a potential slowdown in the euro-area economy growth to 1.6% from 1.9%, doesn’t suggest good prospects for the euro. Especially since Germany's industrial production has been in the red zone for the second time. In November, the indicator was down by 1.9% M-o-M, which increases the risks of the technical recession of the largest euro-area economy and encourages the ECB to hold low-interest rate for a long time.

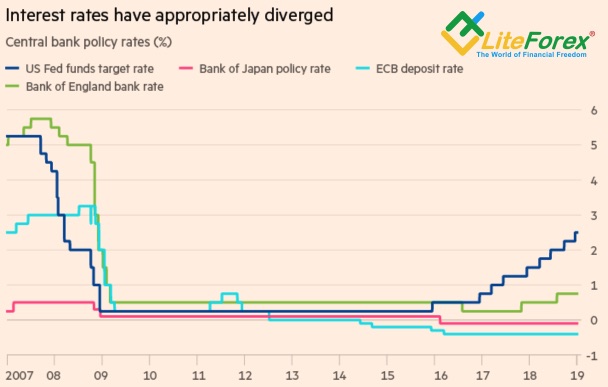

Interest rates of global leading central banks

Source: Financial Times

In case of global crisis, the regulators won’t have a sufficient volume of means to manage it. The Fed, like during the previous recessions, will have to reduce borrowing cost down to -2.5%; let alone the ECB or the Bank of Japan! The good news is that the global economy is far from recession. In the current situation, it is more about a soft landing. If it is so, the idea of Goldman Sachs (NYSE:GS) to by the US stocks at the rebounds looks quite reasonable. The S&P 500 correction is going on for a long time, there are nor reasons for panic, and the Fed’s willingness to have a long break in normalizing its monetary policy calms down the financial markets. The US stock indices and the Treasury yields are going up, the CME derivatives increase the chances of one monetary tightening in 2019 up to 20.6%. Remember, a few days ago, they didn’t believe in any federal funds rate hikes.

Gradual converging of the FOMC projections and the indicators of the derivatives market reassure investors. They again believe in the Fed. They believe that the central bank will take decisions according to the incoming data. Potential shutdown of the US government and usually bad for this season weather in the USA increase the risks of a strong slowdown in the US GDP rate in the first quarter. Weak economic data on Germany and euro-area, on the contrary lays a foundation for the European economic recovery in the January-March period. With this regard, the EUR/USD growth towards 1.163-1.165, if the resistance at 1.1485 is broken out, looks natural; however, the pair needs fresh drivers to continues rising up.

Trading in financial instruments and/or cryptocurrencies involves high risks including the risk of losing some, or all, of your investment amount, and may not be suitable for all investors. Prices of cryptocurrencies are extremely volatile and may be affected by external factors such as financial, regulatory or political events. Trading on margin increases the financial risks.

Before deciding to trade in financial instrument or cryptocurrencies you should be fully informed of the risks and costs associated with trading the financial markets, carefully consider your investment objectives, level of experience, and risk appetite, and seek professional advice where needed.

Fusion Media would like to remind you that the data contained in this website is not necessarily real-time nor accurate. The data and prices on the website are not necessarily provided by any market or exchange, but may be provided by market makers, and so prices may not be accurate and may differ from the actual price at any given market, meaning prices are indicative and not appropriate for trading purposes. Fusion Media and any provider of the data contained in this website will not accept liability for any loss or damage as a result of your trading, or your reliance on the information contained within this website.

It is prohibited to use, store, reproduce, display, modify, transmit or distribute the data contained in this website without the explicit prior written permission of Fusion Media and/or the data provider. All intellectual property rights are reserved by the providers and/or the exchange providing the data contained in this website.

Fusion Media may be compensated by the advertisers that appear on the website, based on your interaction with the advertisements or advertisers.