EUR/USD Slips, Investors Eye German Consumer Confidence

MarketPulse | Apr 26, 2023 01:05AM ET

- German consumer confidence projected to improve

- US consumer confidence slips, housing sales surge

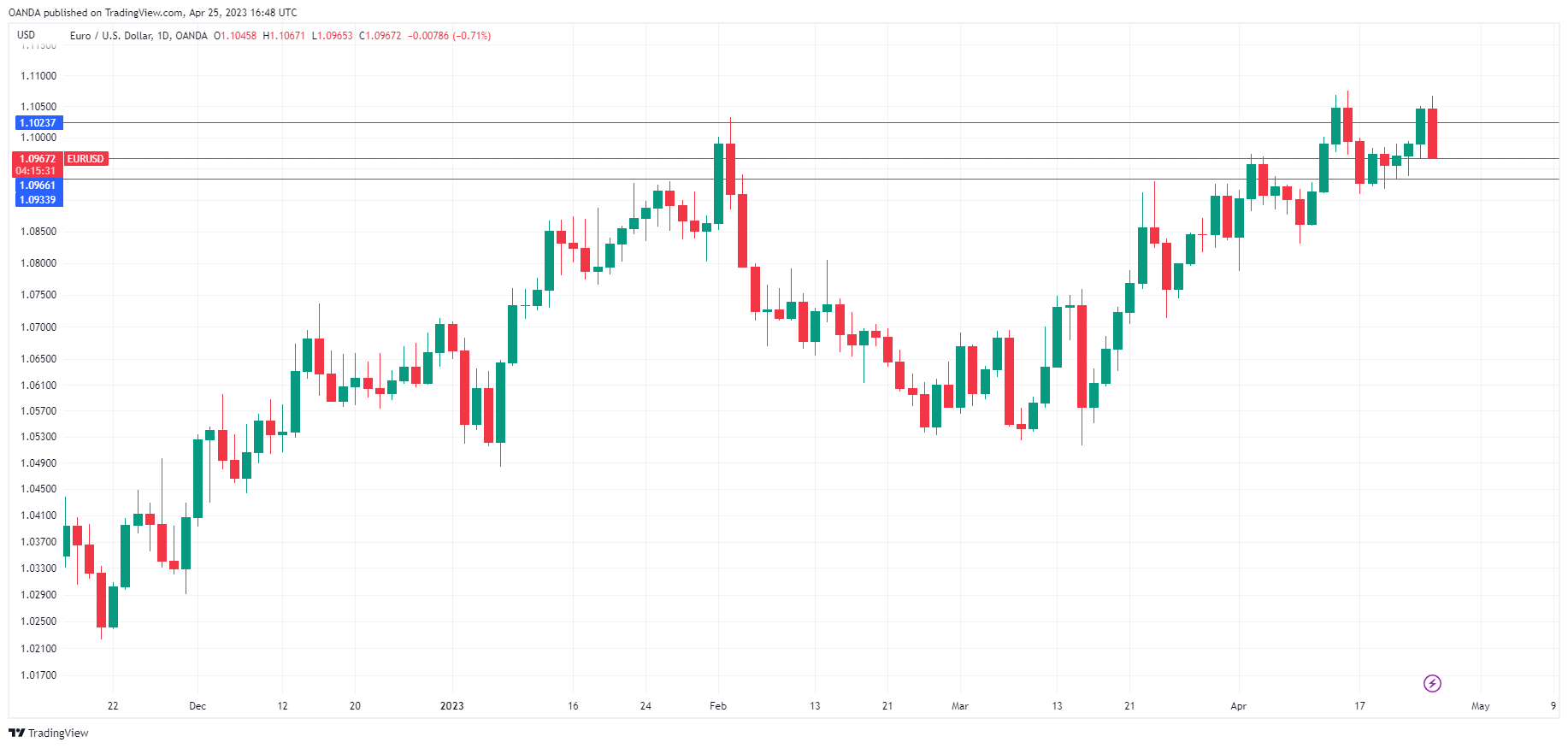

- EUR/USD has pushed below support at 1.1023 and 1.0966

- There is resistance at 1.1176

EUR/USD is trading at 1.0968, down 0.69% on the day.

German consumer confidence is expected to improve

Germany releases GfK Consumer Sentiment for April on Wednesday. The index is still deep in negative territory, but it has improved for six straight months and the upswing is expected to continue in the upcoming release. The market consensus stands at -27.5, following -29.5 in March.

Germany has emerged from the winter unscathed after major concerns over an energy crisis failed to materialize. Eurozone inflation remains high but fell to 6.9% in March, its lowest level in a year. This was mainly due to a drop in energy costs. Lower energy bills helped consumers and improved confidence, and the extended upswing in confidence shows that consumers may feel that the worst is behind them. The German economy is still in recovery mode, which won’t be easy while the ECB remains aggressive with its rate policy in a bid to bring inflation back down to the 2% target.

In the US, today’s data was a mix. UoM Consumer Sentiment for April, disappointed, falling from 104.0 to 101.3, missing the estimate of 104.0 points. There was better news from New Home Sales, which soared 9.6% in March, rebounding from -3.9% in February and crushing the estimate of 1.1%. There is a blackout on Fed speakers until the May 2nd meeting, so the markets will have to rely on economic releases in the search for hints ahead of the Fed rate decision. A 25-basis point is widely expected, with an 84% likelihood, according to the CME Group.

EUR/USD Technical

Original Post

Trading in financial instruments and/or cryptocurrencies involves high risks including the risk of losing some, or all, of your investment amount, and may not be suitable for all investors. Prices of cryptocurrencies are extremely volatile and may be affected by external factors such as financial, regulatory or political events. Trading on margin increases the financial risks.

Before deciding to trade in financial instrument or cryptocurrencies you should be fully informed of the risks and costs associated with trading the financial markets, carefully consider your investment objectives, level of experience, and risk appetite, and seek professional advice where needed.

Fusion Media would like to remind you that the data contained in this website is not necessarily real-time nor accurate. The data and prices on the website are not necessarily provided by any market or exchange, but may be provided by market makers, and so prices may not be accurate and may differ from the actual price at any given market, meaning prices are indicative and not appropriate for trading purposes. Fusion Media and any provider of the data contained in this website will not accept liability for any loss or damage as a result of your trading, or your reliance on the information contained within this website.

It is prohibited to use, store, reproduce, display, modify, transmit or distribute the data contained in this website without the explicit prior written permission of Fusion Media and/or the data provider. All intellectual property rights are reserved by the providers and/or the exchange providing the data contained in this website.

Fusion Media may be compensated by the advertisers that appear on the website, based on your interaction with the advertisements or advertisers.