EUR/USD Pulls Back to 1.13, but Long-Term Charts Signal Breakout

FxPro Financial Services Ltd | May 22, 2025 10:07AM ET

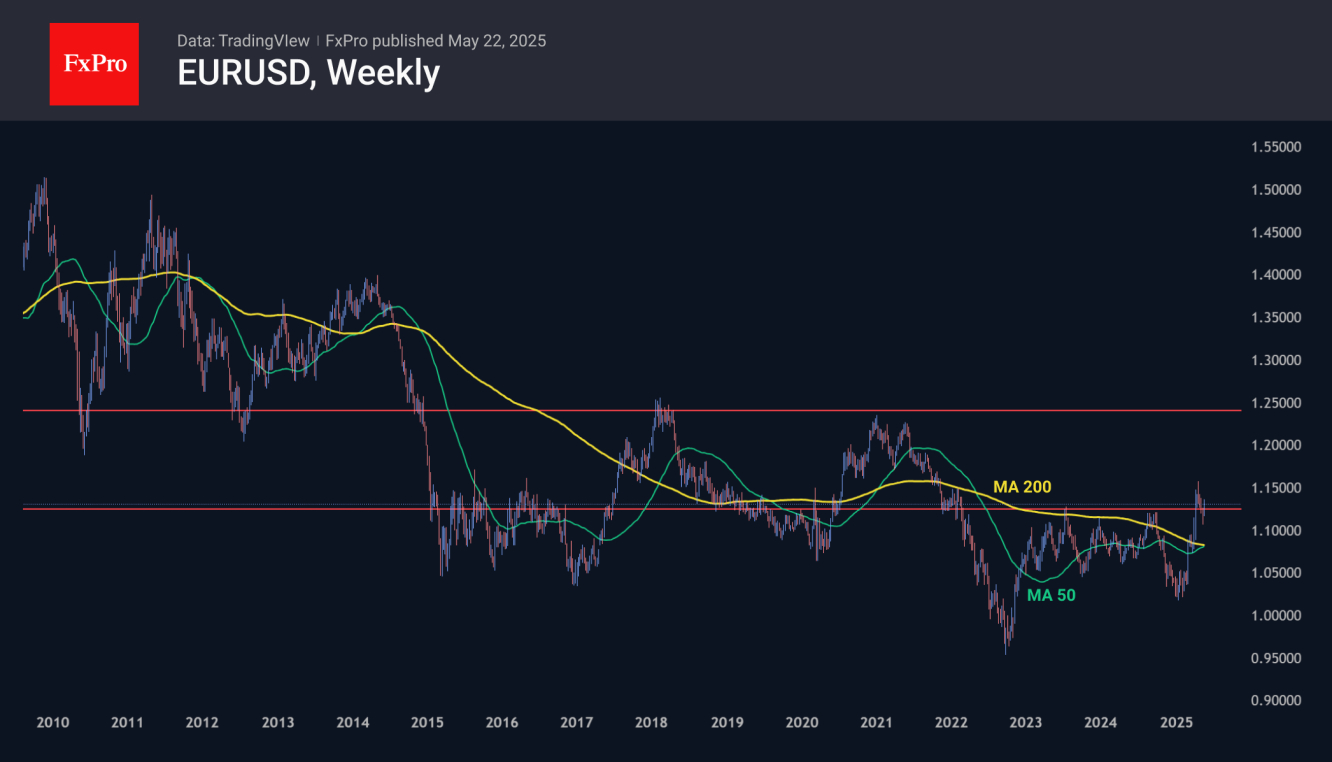

The single currency is losing ground against the dollar, pulling back to 1.13 on weak PMIs. This helps the 1.12-1.15 area cement its title as a multi-year pivot area. However, today's momentum may prove to be just a short game within a longer-term uptrend towards 1.20-1.25.

On the daily timeframes, EURUSD pushed away from the 50-day moving average in March, starting a rapid rise and later breaking above the 200-day. From late April to mid-May, the overheated market corrected within a classic Fibonacci pattern, and EURUSD regained support at the 50-day touch.

The recovery of the uptrend reinforces our belief that we have seen a corrective pullback and not a reversal. This is also evidenced by the fact that EURUSD quickly returned above 1.12, which served as a reversal point from upside to downside for the previous two years. Now it is working as support.

Only overcoming the previous peaks at 1.1570 will confirm the uptrend. However, a bullish signal is already forming on the weekly timeframes—a golden cross, as the 50-week moving average is preparing to exceed the 200-week moving average.

A consolidation above the broad 1.05-1.12 corridor is likely to be followed by an entry to a new floor with support at 1.12 and resistance in the 1.25 area, where the market reversed down in 2018 and 2021, but from 2008 to 2014 the ‘ceiling’ of this range was support for the pair.

That is, the EURUSD's corrective pullback since late April could be just a tactical consolidation of forces before a further breakout with a long-term target at 1.25.

The FxPro Analyst Team

Trading in financial instruments and/or cryptocurrencies involves high risks including the risk of losing some, or all, of your investment amount, and may not be suitable for all investors. Prices of cryptocurrencies are extremely volatile and may be affected by external factors such as financial, regulatory or political events. Trading on margin increases the financial risks.

Before deciding to trade in financial instrument or cryptocurrencies you should be fully informed of the risks and costs associated with trading the financial markets, carefully consider your investment objectives, level of experience, and risk appetite, and seek professional advice where needed.

Fusion Media would like to remind you that the data contained in this website is not necessarily real-time nor accurate. The data and prices on the website are not necessarily provided by any market or exchange, but may be provided by market makers, and so prices may not be accurate and may differ from the actual price at any given market, meaning prices are indicative and not appropriate for trading purposes. Fusion Media and any provider of the data contained in this website will not accept liability for any loss or damage as a result of your trading, or your reliance on the information contained within this website.

It is prohibited to use, store, reproduce, display, modify, transmit or distribute the data contained in this website without the explicit prior written permission of Fusion Media and/or the data provider. All intellectual property rights are reserved by the providers and/or the exchange providing the data contained in this website.

Fusion Media may be compensated by the advertisers that appear on the website, based on your interaction with the advertisements or advertisers.