EUR/USD Dollar Puts the Cart Before the Horse

LiteForex | Nov 20, 2018 07:44AM ET

Despite the USD bearish outlook, it is not a good idea to sell it right now

The number of traders, selling the dollar is growing by the day. The sellers are based on the old drivers: weak macroeconomic statistics (this time, the negative has been suggested by the U.S. housing market), implications in the Fed representatives’ speeches, and bearish projections for the USD by large banks. The greenback opponents, like Morgan Stanley (NYSE:MS) and Goldman Sachs (NYSE:GS), were joined by Citigroup (NYSE:C). According to the bank, the U.S. economy is slowing down, and the federal funds rate hikes don’t provide any advantages to the dollar any longer. However, the EUR/USD bulls have ignored the information that the bank expect the dollar to strengthen on the monthly investment horizon, followed by a decline in three months and further. The markets are like humans. They hear only what they like.

It is especially relevant for New York Fed president’s speech. John Williams has noted that the U.S. economy is strong, but the rate is still low and should be driven to a neutral level. It sounds rather hawkish; but investors paid their attention only to the statement that the Fed’s policy will be determined by the input data. If the supporter of aggressive monetary restrictions sounds like this, what should the others think? Oh, those fears of missed profits!

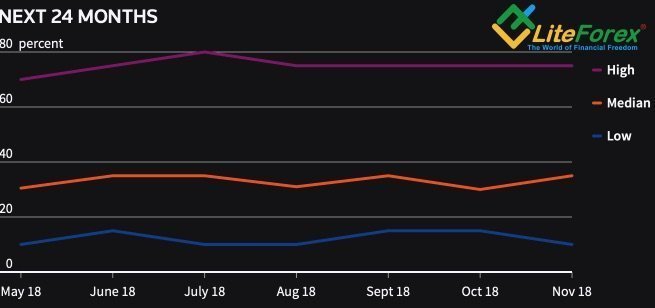

In fact, I also believe that the dollar has few chances to develop its success in 2019, and it is likely to grow weaker against most G10 currencies. The reasons are a slowdown in the US GDP growth and a slower pace of the Fed monetary normalization. The FOMC has indicated three rate hikes in its projections; the same opinion is shared by Reuters 54 experts out of 102 ones. At the same time, the number of those who expect two monetary restrictions next year is increasing; and the derivative market during the recent week has reduced the odds for this scenario to 35%, from 57%. The probability of recession during the next two years, on the contrary, has increased to 35%, from 30%. Experts suggest that the US GDP rate should slow down to 2.7% in the fourth quarter, to 2%-2.5% during 2019, and to 1.8% in 2020.

Dynamics of the US recession probability

Source: Reuters.

Therefore, the greenback middle- and long-term prospects are still bearish; but, in the short run, its advantages are still strong. Besides, the opponent's weakness alone is not sufficient to restore the EUR/USD bullish trend. The euro needs its own drivers. It is hard to find any, as the economy is not expanding so fast, Austria and the Netherlands require decisive action by the EU against Italy, and Brexit problems are not settled down.

Dollar, on the contrary, is going to be supported by higher inflation rate (according to a new study from San Francisco Fed, the U.S. is at full employment) and the escalating of the US-China trade battle. It is too early to give up on the dollar; the European Commission decision on Italy on November 21 may crash the euro rates like a house of cards. On the other hand, the EUR/USD will hardly dive too deep. The bulls’ inability to hold the euro above $1.14 will be the sign of their weakness.

Trading in financial instruments and/or cryptocurrencies involves high risks including the risk of losing some, or all, of your investment amount, and may not be suitable for all investors. Prices of cryptocurrencies are extremely volatile and may be affected by external factors such as financial, regulatory or political events. Trading on margin increases the financial risks.

Before deciding to trade in financial instrument or cryptocurrencies you should be fully informed of the risks and costs associated with trading the financial markets, carefully consider your investment objectives, level of experience, and risk appetite, and seek professional advice where needed.

Fusion Media would like to remind you that the data contained in this website is not necessarily real-time nor accurate. The data and prices on the website are not necessarily provided by any market or exchange, but may be provided by market makers, and so prices may not be accurate and may differ from the actual price at any given market, meaning prices are indicative and not appropriate for trading purposes. Fusion Media and any provider of the data contained in this website will not accept liability for any loss or damage as a result of your trading, or your reliance on the information contained within this website.

It is prohibited to use, store, reproduce, display, modify, transmit or distribute the data contained in this website without the explicit prior written permission of Fusion Media and/or the data provider. All intellectual property rights are reserved by the providers and/or the exchange providing the data contained in this website.

Fusion Media may be compensated by the advertisers that appear on the website, based on your interaction with the advertisements or advertisers.