Eurozone Survey Indicators Look Extremely Weak

Sober Look | Oct 26, 2012 02:44AM ET

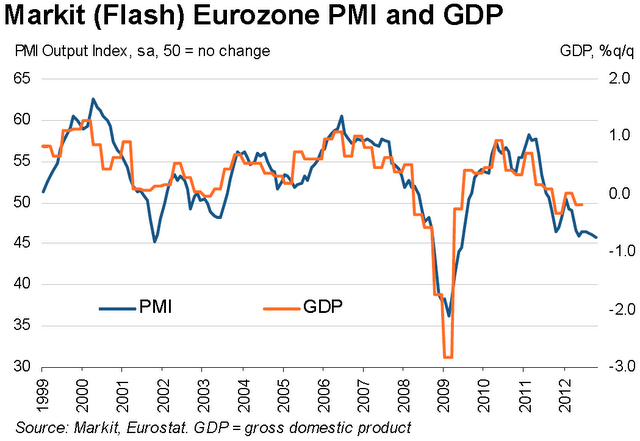

It is time once again to take a closer look at the latest Eurozone consumer sentiment and business conditions surveys. These measures tend to be leading indicators for the trajectory of corporate earnings and GDP growth. The first one is the Markit PMI.

Markit: - The Eurozone sank further into decline at the start of the fourth quarter, with the combined output of the manufacturing and service sectors dropping at the fastest rate since June 2009.

The Markit Eurozone PMI® Composite Output Index fell for a third successive month, down from 46.1 in September to 45.8 in October, according to the preliminary ‘flash’ reading based on around 85% of usual monthly replies. Output has fallen continually since September of last year with the exception of a marginal increase in January.

Output continued to fall in response to a further marked contraction in new orders. The rate of decline in new business eased slightly since September, which had seen the largest drop since June 2009.

It is interesting to see the PMI numbers diverging from the GDP - the so-called "soft data" - "hard data" divergence (chart below). It is possible that the actual business conditions are indeed better than the business survey would suggest - it has happened before. But in most cases the divergence was temporary and by the end of the year we should see which was closer to reality.

These weak business surveys are not just driven by the periphery nations. Germany's FT : - A poor week for the German economy will focus more eyes on the latest data from the eurozone heartland, the GfK consumer sentiment index released on Friday.

While stable numbers are expected from the German consumer, caution is the watchword after the surprise this week of the Ifo business confidence gauge hitting two-and-a-half-year lows and German PMI data declining for a sixth straight month. Could Germany become a bigger worry in the eurozone?

Trading in financial instruments and/or cryptocurrencies involves high risks including the risk of losing some, or all, of your investment amount, and may not be suitable for all investors. Prices of cryptocurrencies are extremely volatile and may be affected by external factors such as financial, regulatory or political events. Trading on margin increases the financial risks.

Before deciding to trade in financial instrument or cryptocurrencies you should be fully informed of the risks and costs associated with trading the financial markets, carefully consider your investment objectives, level of experience, and risk appetite, and seek professional advice where needed.

Fusion Media would like to remind you that the data contained in this website is not necessarily real-time nor accurate. The data and prices on the website are not necessarily provided by any market or exchange, but may be provided by market makers, and so prices may not be accurate and may differ from the actual price at any given market, meaning prices are indicative and not appropriate for trading purposes. Fusion Media and any provider of the data contained in this website will not accept liability for any loss or damage as a result of your trading, or your reliance on the information contained within this website.

It is prohibited to use, store, reproduce, display, modify, transmit or distribute the data contained in this website without the explicit prior written permission of Fusion Media and/or the data provider. All intellectual property rights are reserved by the providers and/or the exchange providing the data contained in this website.

Fusion Media may be compensated by the advertisers that appear on the website, based on your interaction with the advertisements or advertisers.