Eurozone Inflation Set To Hit A New Record High As Euro Tumbles

XM Group | Sep 28, 2022 11:14AM ET

ECB accelerates tightening, but does it matter?

At its latest gathering, the ECB raised interest rates by 75bps and pledged to continue raising them as it prioritizes the fight against inflation even as the whole economy looks to be headed towards a recession. At the press conference, ECB President Lagarde signaled that rate increments could continue for a few more meetings but specified that those meetings will probably be less than five, adding that 75bps hikes is not the norm and that future moves could be smaller.

Yet, the market has been leaning towards another 75bps hike at the October gathering, pushing the probability for such an action to around 95% after Lagarde said on Monday that a weak euro has aided to the build-up of inflationary pressures. But does it really matter for the euro by how much the ECB will hike? Even after the prior meeting, when officials delivered the largest increase in this Bank’s history, the euro continued falling. This implies that euro traders are more worried that the Bank will assist in pushing the Euro-area economy deeper into recession than trusting it to tame inflation.

In any case, with demand for energy having the potential to increase during winter months, inflation could accelerate again, even if there is a downside surprise this week.

One-way ride for the euro

A downside surprise could mean that the ECB may not need to act as aggressively as currently expected and may force the euro to extend its tumble without correcting higher. On the other hand, a new inflation record could validate speculation of a more forceful ECB and thereby allow a rebound. Nonetheless, with traders fearful of higher interest rates hurting even more the already injured economy, the currency may soon resume its prevailing downtrend.

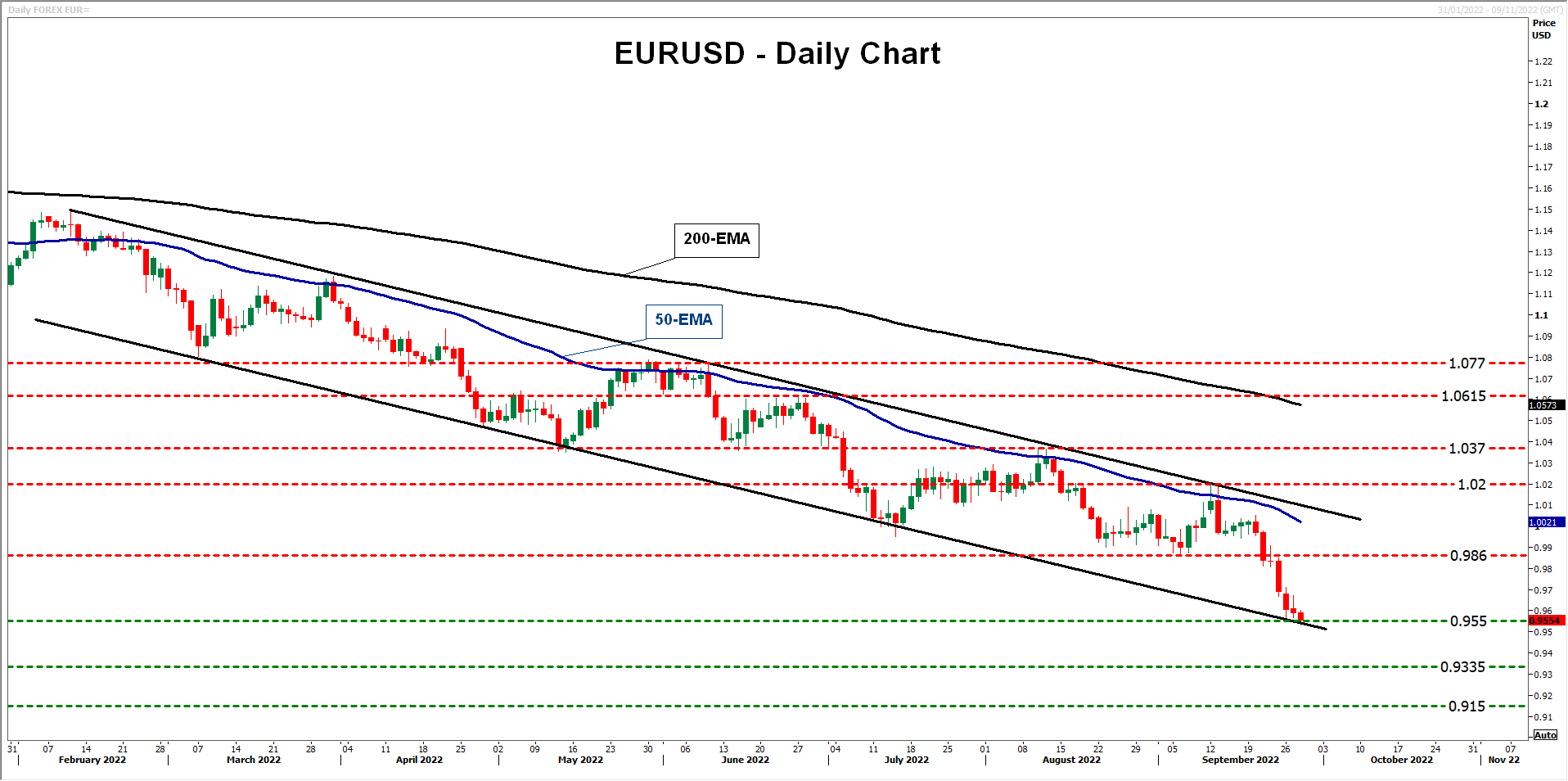

Euro/dollar could rebound from near the crossroads of the 0.9550 barrier and the lower bound of the downward sloping channel that’s been containing the price action since January 28. That said, the bears could take charge again from around the 0.9860 zone and push for another test at 0.9550, which if broken may stretch the downtrend towards the 0.9335 territory, defined as a support by the low of June 6, 2002.

The bullish case could be put on the table upon a break above 1.0200 accompanied by data suggesting that the ECB’s actions are having the desired effect on inflation, as well as that the economy is withstanding the pressure of higher rates. Such a recovery could confirm the upside exit out of the channel and may initially target the 1.0370 barrier, marked by the high of August 10, where another break could set the stage for the peak of June 27, at 1.0615.

Trading in financial instruments and/or cryptocurrencies involves high risks including the risk of losing some, or all, of your investment amount, and may not be suitable for all investors. Prices of cryptocurrencies are extremely volatile and may be affected by external factors such as financial, regulatory or political events. Trading on margin increases the financial risks.

Before deciding to trade in financial instrument or cryptocurrencies you should be fully informed of the risks and costs associated with trading the financial markets, carefully consider your investment objectives, level of experience, and risk appetite, and seek professional advice where needed.

Fusion Media would like to remind you that the data contained in this website is not necessarily real-time nor accurate. The data and prices on the website are not necessarily provided by any market or exchange, but may be provided by market makers, and so prices may not be accurate and may differ from the actual price at any given market, meaning prices are indicative and not appropriate for trading purposes. Fusion Media and any provider of the data contained in this website will not accept liability for any loss or damage as a result of your trading, or your reliance on the information contained within this website.

It is prohibited to use, store, reproduce, display, modify, transmit or distribute the data contained in this website without the explicit prior written permission of Fusion Media and/or the data provider. All intellectual property rights are reserved by the providers and/or the exchange providing the data contained in this website.

Fusion Media may be compensated by the advertisers that appear on the website, based on your interaction with the advertisements or advertisers.