Euro Focused On Greece Jitters, USD May Extend Drop On CPI Data

Dailyfx | Jun 18, 2015 05:24AM ET

Talking Points:

- Greece Crisis in Focus as Eurozone Finance Ministers Meet in Luxembourg

- US Dollar Post-FOMC Selling Pressure May Be Amplified by Soft CPI Data

Greece returns to the spotlight in European trading hours as Eurozone finance ministers gather for a meeting in Luxembourg. The prospects for a deal look bleak after another day of heated rhetoric from both Athens and its creditors.

Traders may look to comments from German Chancellor Angela Merkel as she speaks before the Bundestag to see if the leader of the region’s largest economy will try to calm tempers or dig in hear heels. In the meantime, Greek Prime Minister Alexis Tsipras is due to visit Moscow and may likewise take to the wires (though nothing looks firmly scheduled at present).

Markets appear increasingly worried about an unfavorable outcome, although this has yet to meaningfully translate into euro weakness. Greece 10-Year bond yields advanced to levels unseen since April, reflecting building funding stress. Meanwhile, the 1-year CDS spread – a proxy for the perceived likelihood of default – jumps to a three-week high.

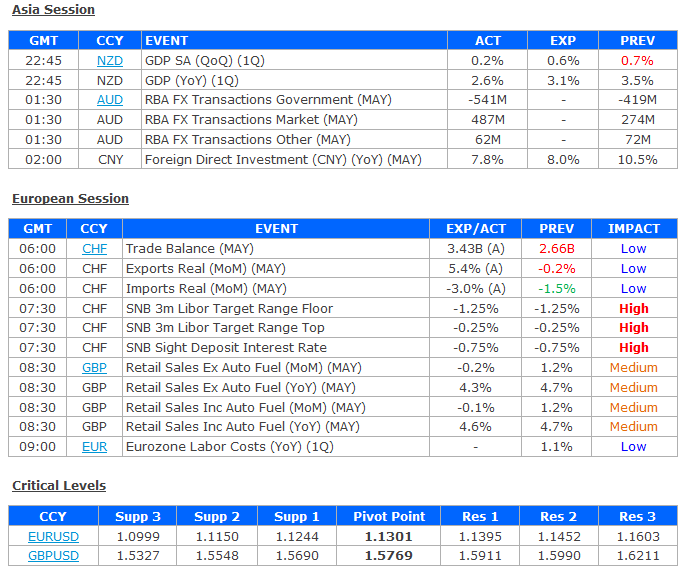

The Swiss National Bank is due to deliver its monetary policy announcement. Chairman Thomas Jordan and company are expected to keep the target 3-month Libor interest rate in the -0.25 to -1.25 percent range while interest on sight deposits remains at -0.75 percent.

Later in the day, May’s US CPI data will enter the spotlight. The core year-on-year inflation rate is expected to remain unchanged at 1.8 percent. Leading survey data suggests a pickup in input price inflation has yet to meaningfully translate into recovering output charges, setting the stage for a subdued outcome.

That may compound pressure on the US dollar as the benchmark currency continues to slide following the FOMC monetary policy announcement . While the central bank continued to call for at least one rate hike in 2015, the expected tightening trajectory over the coming years was revised to appear flatter than policymakers’ March assessment.

The New Zealand Dollar underperformed overnight following disappointing first-quarter GDP figures. Output expanded 0.2 percent, falling short of the 0.6 percent gain projected by economists. The Kiwi fell alongside front-end bond yields, suggesting the outcome served to amplify RBNZ interest rate cut speculation.

Original post

Trading in financial instruments and/or cryptocurrencies involves high risks including the risk of losing some, or all, of your investment amount, and may not be suitable for all investors. Prices of cryptocurrencies are extremely volatile and may be affected by external factors such as financial, regulatory or political events. Trading on margin increases the financial risks.

Before deciding to trade in financial instrument or cryptocurrencies you should be fully informed of the risks and costs associated with trading the financial markets, carefully consider your investment objectives, level of experience, and risk appetite, and seek professional advice where needed.

Fusion Media would like to remind you that the data contained in this website is not necessarily real-time nor accurate. The data and prices on the website are not necessarily provided by any market or exchange, but may be provided by market makers, and so prices may not be accurate and may differ from the actual price at any given market, meaning prices are indicative and not appropriate for trading purposes. Fusion Media and any provider of the data contained in this website will not accept liability for any loss or damage as a result of your trading, or your reliance on the information contained within this website.

It is prohibited to use, store, reproduce, display, modify, transmit or distribute the data contained in this website without the explicit prior written permission of Fusion Media and/or the data provider. All intellectual property rights are reserved by the providers and/or the exchange providing the data contained in this website.

Fusion Media may be compensated by the advertisers that appear on the website, based on your interaction with the advertisements or advertisers.