Euro Dips Below 1.10, Markets Eye U.S. Housing Report

MarketPulse | Feb 24, 2016 05:46AM ET

After starting the week with sharp losses, the euro has been shown limited movement. EUR/USD is trading at 1.0990 in Wednesday’s European session. It’s a quiet day on the release front, with only one Eurozone event, the German 30-Year bond auction. In the US, today’s key release is New Home Sales. On Thursday, the US releases two key events – Core Durable Goods Orders and Unemployment Claims.

German business confidence has taken a hit in February, as the Ifo Business Climate index, a well-respected report, dropped to 105.7 points, short of the estimate of 107.0 points. This figure was the weakest reading since December 2014, and underscores deep concern about the state of the economy. The Chinese slowdown is a key reason for pessimism in the business community, as the Asian giant is Germany’s fifth largest export markets, so weaker Chinese demand has taken a toll on German exports. Recent German manufacturing reports were short of expectations, and a weaker German economy, the largest in Europe, would be bad news for the Eurozone. If Eurozone growth and inflation numbers do not improve, it will be increasingly difficult for the ECB to remain on the sidelines. Will Mario Draghi and Co. make a move at the March policy meeting? Possible monetary moves include adopting negative interest rates (a step recently taken by the BoJ) as well as increasing the current quantitative easing scheme, which currently involves purchasing assets at 60 billion euros/mth. Either of these moves would likely shake up the currency markets and weaken the euro.

The US economy has softened in the early part of 2016, and the American consumer has become less optimistic about the economy as a result. This was underscored by CB Consumer Confidence, which slid to 92.2 points in January, well off the forecast of 97.4 points. This marked a three-month low for the key indicator. Weaker consumer confidence could well translate into a decrease in consumer spending, a key driver of economic growth. Meanwhile, the US manufacturing sector continues to struggle. Recent manufacturing reports have pointed to contraction in the sector, and this was again the case with the Richmond Manufacturing report, which slipped to -4 points in February, short of the forecast of +2 points. This was the indicator’s worst reading since September 2015. On Thursday, we’ll get a look at Core Durable Goods Orders, a key manufacturing indicator. The markets are braced for a small gain of 0.2%, and a reading that misses the estimate could have a sharp impact on the currency markets.

Wednesday (Feb. 24)

- Tentative – German 30-year Bond Auction

- 9:45 US Flash Services PMI. Estimate 53.4 points

- 10:00 US New Home Sales. Estimate 522K

- 10:30 US Crude Oil Inventories. Estimate 2.0M

- 19:00 US FOMC James Bullard Speaks

Upcoming Key Events

Thursday (Feb. 25)

- 8:30 US Core Durable Goods Orders. Estimate 0.2%

- 8:30 US Unemployment Claims. 271K

*Key events are in bold

*All release times are EST

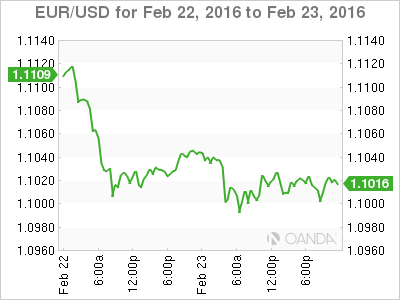

EUR/USD for Wednesday, February 24, 2016

EUR/USD February 24 at 4:40 EST

Open: 1.1023 Low: 1.0991 High: 1.1027 Close: 1.0984

EUR/USD Technical

| S1 | S2 | S1 | R1 | R2 | R3 |

| 1.0708 | 1.0847 | 1.0941 | 1.1087 | 1.1172 | 1.1278 |

- EUR/USD was flat in the Asian session and has posted slight losses in European trade

- There is resistance at 1.1087

- 10941 is providing weak support

- Current range: 1.0941 to 1.1087

Further levels in both directions:

- Below: 1.0941, 1.0847 and 1.0708

- Above: 1.1087, 1.1172, 1.1278 and 1.1349

OANDA’s Open Positions Ratio

EUR/USD ratio is showing little movement, consistent with the lack of significant activity from EUR/USD. Short positions retain a strong majority of positions (57%). This points to trader bias towards the euro continuing to soften.

Original post

Trading in financial instruments and/or cryptocurrencies involves high risks including the risk of losing some, or all, of your investment amount, and may not be suitable for all investors. Prices of cryptocurrencies are extremely volatile and may be affected by external factors such as financial, regulatory or political events. Trading on margin increases the financial risks.

Before deciding to trade in financial instrument or cryptocurrencies you should be fully informed of the risks and costs associated with trading the financial markets, carefully consider your investment objectives, level of experience, and risk appetite, and seek professional advice where needed.

Fusion Media would like to remind you that the data contained in this website is not necessarily real-time nor accurate. The data and prices on the website are not necessarily provided by any market or exchange, but may be provided by market makers, and so prices may not be accurate and may differ from the actual price at any given market, meaning prices are indicative and not appropriate for trading purposes. Fusion Media and any provider of the data contained in this website will not accept liability for any loss or damage as a result of your trading, or your reliance on the information contained within this website.

It is prohibited to use, store, reproduce, display, modify, transmit or distribute the data contained in this website without the explicit prior written permission of Fusion Media and/or the data provider. All intellectual property rights are reserved by the providers and/or the exchange providing the data contained in this website.

Fusion Media may be compensated by the advertisers that appear on the website, based on your interaction with the advertisements or advertisers.