Euro Correction Expected After Break in Trend Line

Alpari | Feb 04, 2016 05:40AM ET

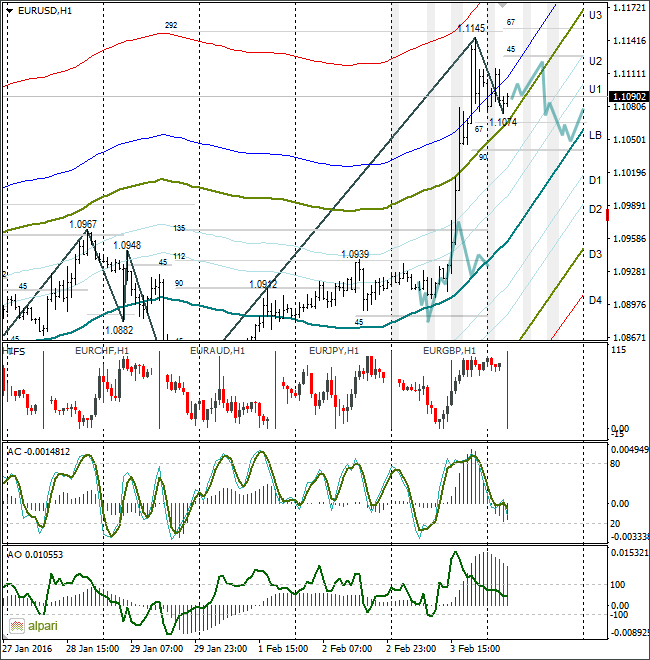

EUR/USD 1H

Yesterday’s Trading:

In mid-December the euro bulls didn’t manage to strengthen above 1.10. Now they are in jubilation on part of New York Fed chief Dudley who helped them pass the important technical levels and pop the stops off the sellers’ short positions.

All Dudley had to say was that a strong dollar is the Fed’s, the economy’s and US companies’ main problem, and then the speculators began selling US dollar.

At first the 1.0950 resistance was passed, then the main trend line which took its beginnings from the 1.1712 maximum and passed through 1.1045.

The dollar cheapened, despite strong private sector employment data from the US. The data came out better than expected with employment creation in January at 205k (forecasted: 200k, previous: 267k). The previous value was reassessed up from 257k. The official report is out on Friday.

US service PMI from Markit and ISM came out less than expected, and in doing so pushed the dollar down further. Now market participants are placing their bets on only 1 or 2 interest rate rises this year, instead of the 4 that they previously expected. The euro/dollar rose to 1.1145 and, according to recent quotes, is trading around 1.1084.

Main news of the day (EET):

- 10:00, ECB’s Draghi to speak;

- 11:00, ECB publishing its economic bulletin;

- 14:00, BoE interest rate decision (0.5%), minutes and asset purchasing program (£375 billion);

- 14:45, BoE governor Carney to speak;

- 15:30, US unemployment benefit applications;

- 17:00, PMI.

Market Expectations:

In the first half of Thursday, trader attention will be on the Bank of England minutes and the ECB economic bulletin. In the evening there will be data on unemployment benefit applications. On Friday will be the Non-Farm Payrolls.

Taking into account that the euro has been in the oversell zone and way off the channel for a few hours, today I think we’ll see a correction of the pair to the balance line at 1.1050/45. It is the NFP that makes me think that we will see a rebound today.

Technical Analysis:

- Intraday target maximum: 1.1120, minimum: 1.1050, close: 1.1080;

- Intraday volatility for last 10 weeks: 102 points (4 figures).

Today’s key event for the currency market is the Bank of England’s minutes. Expectations are for an 8-1 vote (keep – rise). Due to this, I expect the cross to fall in the second half of the day, putting pressure on the euro/dollar.

The price is now above the U3. The rate could return to 1.1120 from 1.1070. There is to be growth for partial profit fixation from long positions before the NFP. By the close of the European session I expect to have seen a fall to 1.1045/50. When the price meets the balance line on the hourly, the market will be balanced. Then traders will be waiting for the US labor market report.

EUR/GBP 1H

The fall was stronger due to UK stats, but on the whole my expectations rang true. A growth of the cross aided the euro/dollar to pass the 1.0950 resistance and the trend line at 1.1045. After the publication of the BoE’s minutes on Thursday, I expect to see a weakening of the euro against the pound. The fall of the cross will have a negative effect on the euro/dollar.

Daily

The euro/dollar has broken 2 trend lines and exceeded the December maximum from last year. Now the buyers have the road open to 1.1470. Today there should be a correctional phase. Let’s see what the market cooks up after the Bank of England has convened and the NFP is out.

Weekly

The euro/dollar has headed for the heavens. The closest target is 1.1240. If there’s no rebound, it means we’re off to 1.1494 (October 2015 maximum).

Trading in financial instruments and/or cryptocurrencies involves high risks including the risk of losing some, or all, of your investment amount, and may not be suitable for all investors. Prices of cryptocurrencies are extremely volatile and may be affected by external factors such as financial, regulatory or political events. Trading on margin increases the financial risks.

Before deciding to trade in financial instrument or cryptocurrencies you should be fully informed of the risks and costs associated with trading the financial markets, carefully consider your investment objectives, level of experience, and risk appetite, and seek professional advice where needed.

Fusion Media would like to remind you that the data contained in this website is not necessarily real-time nor accurate. The data and prices on the website are not necessarily provided by any market or exchange, but may be provided by market makers, and so prices may not be accurate and may differ from the actual price at any given market, meaning prices are indicative and not appropriate for trading purposes. Fusion Media and any provider of the data contained in this website will not accept liability for any loss or damage as a result of your trading, or your reliance on the information contained within this website.

It is prohibited to use, store, reproduce, display, modify, transmit or distribute the data contained in this website without the explicit prior written permission of Fusion Media and/or the data provider. All intellectual property rights are reserved by the providers and/or the exchange providing the data contained in this website.

Fusion Media may be compensated by the advertisers that appear on the website, based on your interaction with the advertisements or advertisers.