Euro And Cable: Uptrends Prevail But Inflation Angst Could Be The Game Changer

MaiMarFX | May 17, 2021 05:02AM ET

The US dollar ended last week lower against other peers after US retail sales stalled in April following a sharp advance in the prior month. Regardless of the greenback’s most recent decline, inflation fears will be front and center in the market and investors will scrutinize the minutes from the Federal Open Market Committee’s latest meeting (Wednesday) for any hints of a timeline for reducing stimulus.

While market participants are bracing themselves for a sooner rather than later shift in the Fed’s monetary policy, Cleveland Fed President Loretta Mester said in a Bloomberg interview on Friday that the Fed’s policy is in a good place right now. “This is not the time to be adjusting anything on policy. It really is a time for watchful waiting, seeing how the recovery evolves” Mester said.

Aside from the FOMC minutes, it could be an interesting week for the pound sterling as the U.K. is due to release data on employment, retail sales and inflation.

Notwithstanding the fundamental backdrop, we will focus on the technical picture in the currency pairs.

GBP/USD

The trend is our friend and based on the prevailing uptrend in this pair we will focus on a higher target at around 1.4220 with a potential extension of gains towards the February high at 1.4243. A current support is however intact at 1.40 and if the cable dips below that crucial barrier, a lower target could come in at 1.3950 – the lower boundary of the latest uptrend channel.

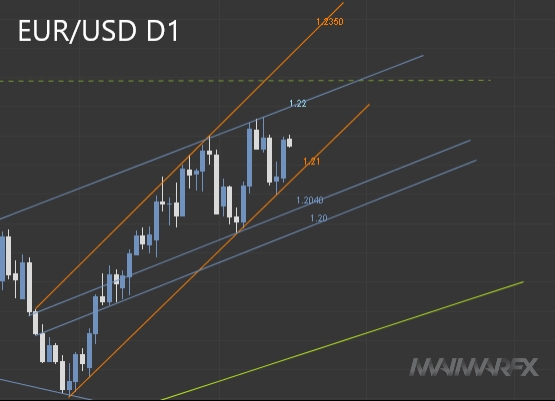

EUR/USD

While the overall uptrend for EUR/USD is obvious, we will pay attention to short-term price barriers within the bullish trend. On the upside we see a next hurdle at 1.22 and if this level is significantly breached to the upside, we may see another leg up towards 1.23 and 1.2350. On the downside, if the euro breaks below 1.2080, we expect more losses towards 1.2040 and 1.20.

DAX

Volatility was notably higher in recent days with the index surging from a low near its current support at 14800 to a high of 15500 – the upper boundary of the index’s recent sideways range. Breaking above 15520, the DAX could resume its uptrend towards a higher target of 16000.

We went long this morning at 15430 and were able to take profit at 15470 in a quick trade.

Disclaimer:All trading ideas and expressions of opinion made in the articles are the personal opinion and assumption of MaiMarFX traders. They are not meant to be a solicitation or recommendation to buy or sell a specific financial instrument.

Trading in financial instruments and/or cryptocurrencies involves high risks including the risk of losing some, or all, of your investment amount, and may not be suitable for all investors. Prices of cryptocurrencies are extremely volatile and may be affected by external factors such as financial, regulatory or political events. Trading on margin increases the financial risks.

Before deciding to trade in financial instrument or cryptocurrencies you should be fully informed of the risks and costs associated with trading the financial markets, carefully consider your investment objectives, level of experience, and risk appetite, and seek professional advice where needed.

Fusion Media would like to remind you that the data contained in this website is not necessarily real-time nor accurate. The data and prices on the website are not necessarily provided by any market or exchange, but may be provided by market makers, and so prices may not be accurate and may differ from the actual price at any given market, meaning prices are indicative and not appropriate for trading purposes. Fusion Media and any provider of the data contained in this website will not accept liability for any loss or damage as a result of your trading, or your reliance on the information contained within this website.

It is prohibited to use, store, reproduce, display, modify, transmit or distribute the data contained in this website without the explicit prior written permission of Fusion Media and/or the data provider. All intellectual property rights are reserved by the providers and/or the exchange providing the data contained in this website.

Fusion Media may be compensated by the advertisers that appear on the website, based on your interaction with the advertisements or advertisers.