EUR/CHF Trapped Within Range

JFD Team | Aug 24, 2018 07:18AM ET

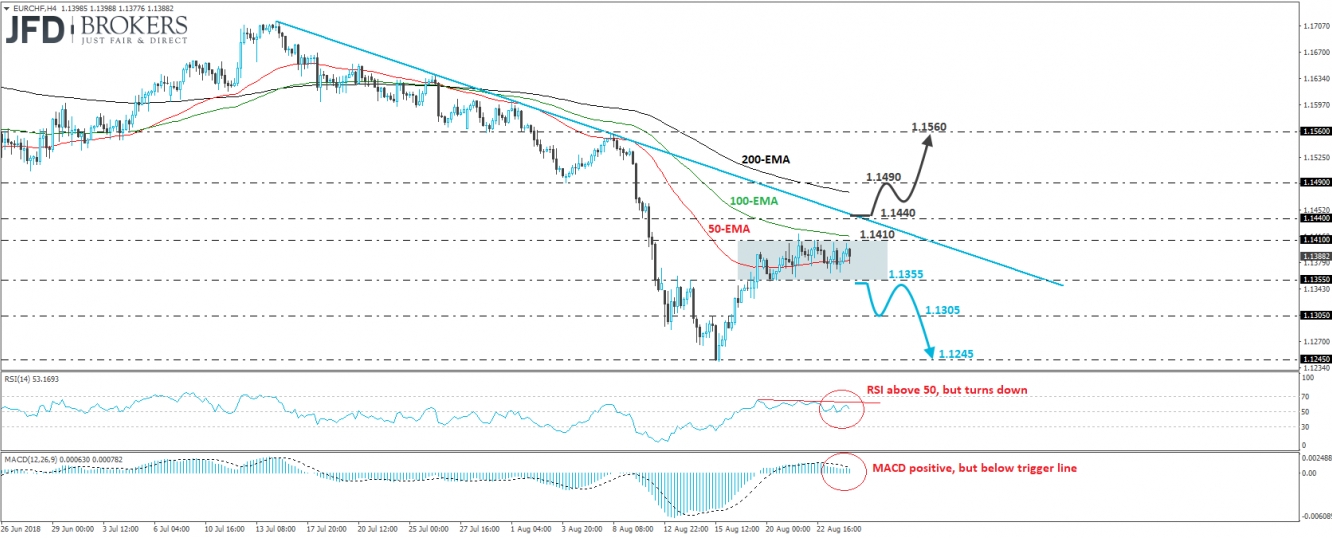

EUR/CHF has been trading in a sideways manner since the 17th of August, oscillating between 1.1355 and 1.1410. This keeps the short-term picture somewhat neutral for now but bearing in mind that the price action is still below the downtrend line drawn from the peak of the 16th of July, we see more chances for the pair to exit the range to the downside rather than to the upside.

A clear dip below 1.1355 could confirm the case and is possible to set the stage for our next support level of 1.1305, defined by the inside swing peak of the 15th of August. Now, if the bears prove strong enough to overcome that level as well, then we may experience more downside extensions, perhaps towards the low of that day, at around 1.1245.

Looking at our short-term oscillators, we see that the RSI, although above 50, stays below its respective downside resistance line and points down, while the MACD, even though within its positive territory, lies below its trigger line and looks to be heading towards zero. These indicators support somewhat the case for the bears to attempt a dip below 1.1355.

On the upside, even if the pair exits the short-term range through its upper bound, it could still meet strong resistance near the aforementioned downtrend line and then fall again. Thus, we would prefer to see a decisive move above that line and the 1.1440 level before we assume that the bulls have taken the driver’s seat. In such a case, we would expect a recovery towards the 1.1490 key resistance zone, the break of which could carry more bullish implications, perhaps opening the path for the 1.1560 obstacle, marked by the peak of the 8th of August.

Trading in financial instruments and/or cryptocurrencies involves high risks including the risk of losing some, or all, of your investment amount, and may not be suitable for all investors. Prices of cryptocurrencies are extremely volatile and may be affected by external factors such as financial, regulatory or political events. Trading on margin increases the financial risks.

Before deciding to trade in financial instrument or cryptocurrencies you should be fully informed of the risks and costs associated with trading the financial markets, carefully consider your investment objectives, level of experience, and risk appetite, and seek professional advice where needed.

Fusion Media would like to remind you that the data contained in this website is not necessarily real-time nor accurate. The data and prices on the website are not necessarily provided by any market or exchange, but may be provided by market makers, and so prices may not be accurate and may differ from the actual price at any given market, meaning prices are indicative and not appropriate for trading purposes. Fusion Media and any provider of the data contained in this website will not accept liability for any loss or damage as a result of your trading, or your reliance on the information contained within this website.

It is prohibited to use, store, reproduce, display, modify, transmit or distribute the data contained in this website without the explicit prior written permission of Fusion Media and/or the data provider. All intellectual property rights are reserved by the providers and/or the exchange providing the data contained in this website.

Fusion Media may be compensated by the advertisers that appear on the website, based on your interaction with the advertisements or advertisers.