EUR/AUD Short-Term Elliott Wave Analysis: Cycles Remain Bearish

Elliott Wave Forecast | Apr 14, 2015 08:07PM ET

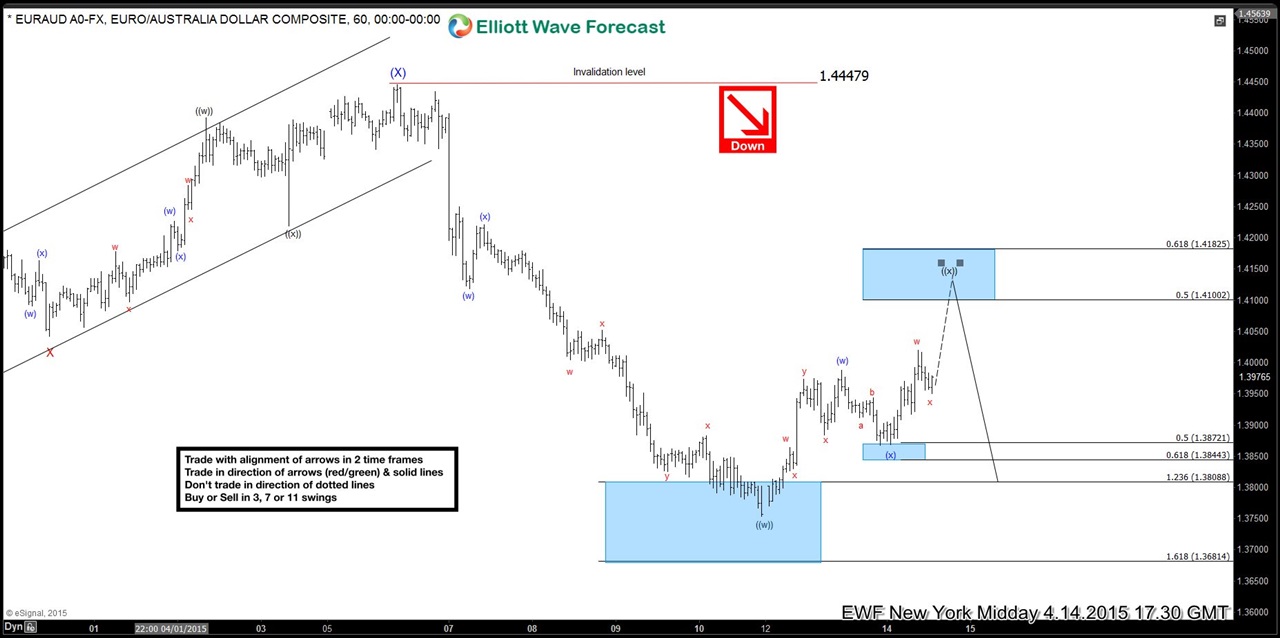

Preferred Elliott wave view suggests EUR/AUD cycles remain bearish against 6th April high (1.4447). Decline from 1.4447 – 1.3753 was a double three Elliott wave structure i.e. (w)-(x)-(y) when wave (w) completed at 1.4118, wave (x) completed at 1.4221 and wave (y) completed at 1.3753 making a higher degree wave ((w)). Pair is currently in wave ((x)) bounce correcting the decline from 1.4447 peak.

Wave ((x)) is also expected to unfold as a (w)-(x)-(y) structure when wave (w) completed at 1.3987, wave (x) completed at 1.3867 and wave (y) higher is now in progress and expected to reach 50 – 61.8 fib Fibonacci retracement zone of wave ((w)) between 1.4100 – 1.4182 before sellers appear and decline resumes. Red arrow indicates trend is down and move up is shown with a dashed line so we are not interested in buy the pair and expect the bounce to find sellers in 7 or 11 swings as far as pivot at 1.4447 high remains intact. Only a break of pivot at 1.4447 high would open another extension higher.

Trading in financial instruments and/or cryptocurrencies involves high risks including the risk of losing some, or all, of your investment amount, and may not be suitable for all investors. Prices of cryptocurrencies are extremely volatile and may be affected by external factors such as financial, regulatory or political events. Trading on margin increases the financial risks.

Before deciding to trade in financial instrument or cryptocurrencies you should be fully informed of the risks and costs associated with trading the financial markets, carefully consider your investment objectives, level of experience, and risk appetite, and seek professional advice where needed.

Fusion Media would like to remind you that the data contained in this website is not necessarily real-time nor accurate. The data and prices on the website are not necessarily provided by any market or exchange, but may be provided by market makers, and so prices may not be accurate and may differ from the actual price at any given market, meaning prices are indicative and not appropriate for trading purposes. Fusion Media and any provider of the data contained in this website will not accept liability for any loss or damage as a result of your trading, or your reliance on the information contained within this website.

It is prohibited to use, store, reproduce, display, modify, transmit or distribute the data contained in this website without the explicit prior written permission of Fusion Media and/or the data provider. All intellectual property rights are reserved by the providers and/or the exchange providing the data contained in this website.

Fusion Media may be compensated by the advertisers that appear on the website, based on your interaction with the advertisements or advertisers.