EUR/USD: Get Long Again, Next Target 1.1350

Growth Aces | Apr 30, 2015 07:12AM ET

GROWTHACES.COM Forex Trading Strategies

Taken Positions

USD/JPY: short at 119.35, target 117.20, stop-loss 120.20, risk factor **

EUR/GBP: long at 0.7170, target 0.7350, stop-loss 0.7110, risk factor ***

Pending Orders

EUR/USD: buy at 1.1040, if filled – target 1.1350, stop-loss 1.0925, risk factor *

GBP/USD: buy at 1.5270, if filled - target 1.5540, stop-loss 1.5170, risk factor *

USD/CAD: sell at 1.2110, if filled - target 1.1930, stop-loss 1.2205, risk factor **

AUD/USD: buy at 0.7870, if filled – target 0.8230, stop-loss 0.7790, risk factor **

NZD/USD: buy at 0.7560, if filled – target 0.7800, stop-loss 0.7450, risk factor **

EUR/JPY: buy at 131.30, if filled – target 134.50, stop-loss 130.20, risk factor *

EUR/CAD: buy at 1.3320, if filled – target 1.3610, stop-loss 1.3210, risk factor **

GBP/JPY: buy at 181.75, if filled - target 184.90, stop-loss 180.60, risk factor *

AUD/NZD: buy at 1.0320, if filled – target 1.0530, stop-loss 1.0220, risk factor ***

AUD/JPY: buy at 93.65, if filled - target 97.00, stop-loss 92.50, risk factor **

EUR/USD: Eurozone Bonds Reversing QE Gains

(buy at 1.1040)

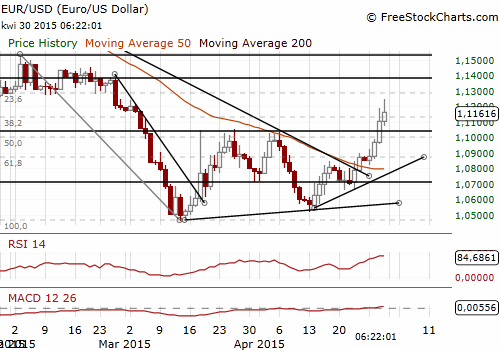

- The EUR/USD had rallied on Wednesday as the surprisingly soft US GDP data weighed on the USD. The Federal Reserve's post-meeting statement said the economic slowdown was probably transitory.

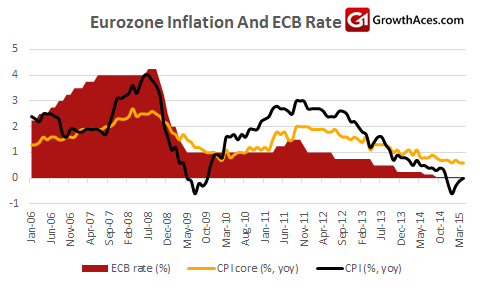

- The EUR/USD rally is continued today after eurozone bonds yields rose on easing deflation fears. The eurozone ended four months of deflation in April with consumer prices unchanged from year-ago levels. Core inflation, which excludes volatile energy and unprocessed food costs, was unchanged at 0.6% yoy. We expect inflation to rise gradually in the coming months. We will see stronger acceleration in CPI in the fourth quarter this year due to base effects.

- Eurozone unemployment rate amounted to 11.3% in March, unchanged from February.

- 10-year bond yields for Italy and Spain are now 25-30 bps higher than when ECB’s quantitative easing programme started. Bond yields in France, Belgium, Netherlands, Austria and Finland are already at the same levels when the QE started (or even slightly higher). 10-Year German Bund yields are getting closer to levels seen before the ECB started buying bonds. The spread between US Treasuries yields and German Bund yields has narrowed. This situation supports EUR/USD rises.

- A rise in bond yields may result from the lack of liquidity in government bonds now that the central bank has snapped up large portions of the stock of debt with its quantitative easing programme. However, bonds sell-off has a global character. U.S. Treasury yields also rose, with below-forecast economic growth data and no sign of an early rate hike from the Federal Reserve.

- German retail sales data support stronger EUR/USD and higher bond yields. Retail sales rose 3.5% yoy in March vs. median forecast for a 3.2% yoy rise.

- We are looking to buy EUR/USD at 1.1040. If the order is filled the target will be above 100-dma, currently at 1.1307, but below strong resistance level of 1.1380 (high on February 26).

Significant technical analysis' levels:

Resistance: 1.1248 (high Feb 27), 1.1280 (76.4% of 1.1534-1.0457), 1.1307 (100-dma)

Support: 1.1072 (session low Apr 30), 1.0960 (low Apr 29), 1.0924 (55-dma)

USD/JPY: BOJ Trimmed CPI Forecasts, As Expected

(stay short)

- The Bank of Japan kept unchanged its pledge to increase base money at an annual pace of JPY 80 trillion, disappointing some market players who had been looking for expanding monetary stimulus.

- The Bank of Japan trimmed its consumer price forecasts and pushed back the timeframe for its inflation target, predicting a recovering economy will gradually nudge prices higher. The board cut its core consumer inflation forecast for this fiscal year to 0.8% from 1.0%. Inflation is now expected to hit the 2% target around the half year from April to September 2016.

- BOJ Governor Haruhiko Kuroda told a news conference: “It is true that the timing for achieving 2% inflation has been delayed somewhat. But trend inflation is improving steadily and is expected to continue improving. As such, I do not think there is a need to ease policy further now. Having said that, there is no change to our stance that we will not hesitate to adjust policy on any signs of change in trend inflation.” Kuroda said that domestic demand remained firm and exports rose moderately.

- Many analysts still expect the BOJ to ease policy later this year as inflation slides further away from its ambitious target. In our opinion further policy easing is unlikely.

- Japan’s CPI data will be released today (23:30 GMT).

- Japanese industrial output fell 0.3% mom in March, declining for a second straight month. The fall was smaller than a median market forecast for a 2.3 % drop. Manufacturers surveyed by the Ministry of Economy, Trade and Industry expect output to rise 2.1% in April and decline 0.3% in May.

- The JPY appreciated slightly after the BOJ held off from expanding its monetary stimulus. The USD/JPY has been moving in relatively narrow range. However, layers of resistance continues to weigh heavily between recent 119.36 and 119.66 highs. We stay short.

Significant technical analysis' levels:

Resistance: 119.36 (high Apr 29), 119.44 (high Apr 27), 119.66 (high Apr 24)

Support: 118.50 (session low Apr 30), 118.33 (low Mar 26), 118.30 (low Feb 20)

NZD/USD: The RBNZ Leaves The Door Open For A Rate Cut

(buy at 0.7560)

- The Reserve Bank of New Zealand held its official cash rate at 3.5% for the sixth consecutive policy review, as expected.

- RBNZ Governor Graeme Wheeler said: “It would be appropriate to lower the official cash rate if demand weakens, and wage and price-setting outcomes settle at levels lower than is consistent with the inflation target.” A sharp slowdown in inflation due to falling oil prices pushed annual CPI down to 0.1% in the first quarter, its lowest in 15 years and pushing further below the RBNZ's inflation target around 2%.

- The inclusion of factors which may open the door to a possible rate cut in the statement suggested an incremental change in the RBNZ's neutral policy position seen in previous months which forecast a period of rate stability. Markets are pricing in 25 bps of easing in the next 12 months. The RBNZ’s longer term forecasts see inflation pressure picking up gradually, which may require rate rises later next year. In our opinion the next move will be a 25 bps hike in the middle of 2016.

- The NZD/USD fell sharply following a dovish central bank statement to a day’s low at 0.7576. Our long position hit its raised stop-loss level at 0.7630. However, our medium-term outlook on the NZD/USD is still bullish and we are going to buy at 0.7560.

Significant technical analysis' levels:

Resistance: 0.7685 (session high Apr 30), 0.7744 (high Apr 29), 7782 (high Jan 20)

Support: 0.7576 (session low Apr 30), 0.7544 (low Apr 24), 0.7538 (low Apr 23)

Source: Growth Aces Forex Trading Strategies

Trading in financial instruments and/or cryptocurrencies involves high risks including the risk of losing some, or all, of your investment amount, and may not be suitable for all investors. Prices of cryptocurrencies are extremely volatile and may be affected by external factors such as financial, regulatory or political events. Trading on margin increases the financial risks.

Before deciding to trade in financial instrument or cryptocurrencies you should be fully informed of the risks and costs associated with trading the financial markets, carefully consider your investment objectives, level of experience, and risk appetite, and seek professional advice where needed.

Fusion Media would like to remind you that the data contained in this website is not necessarily real-time nor accurate. The data and prices on the website are not necessarily provided by any market or exchange, but may be provided by market makers, and so prices may not be accurate and may differ from the actual price at any given market, meaning prices are indicative and not appropriate for trading purposes. Fusion Media and any provider of the data contained in this website will not accept liability for any loss or damage as a result of your trading, or your reliance on the information contained within this website.

It is prohibited to use, store, reproduce, display, modify, transmit or distribute the data contained in this website without the explicit prior written permission of Fusion Media and/or the data provider. All intellectual property rights are reserved by the providers and/or the exchange providing the data contained in this website.

Fusion Media may be compensated by the advertisers that appear on the website, based on your interaction with the advertisements or advertisers.