EUR/USD: Bullish bias remains intact

Growth Aces | Mar 20, 2017 08:14AM ET

EUR/USD: Bullish bias remains intact

Macroeconomic overview

The USD has been on the retreat since the U.S. Federal Reserve raised interest rates on Wednesday but stopped short of predicting a sharper acceleration in monetary tightening over the next two years.

For currency markets, the meetings of Group of 20 financial leaders added up to a renewed expression of concern about the United States' global trade relations and by implication the Trump White House's concern over the strong dollar.

The post-meeting communique retained language on avoiding currency manipulation which has previously seemed aimed chiefly at Japan and China, but it omitted a call for free trade seen as opening the door to more overt efforts by Washington to shift the balance of its international relationships.

The Federal Reserve said on Friday manufacturing production rose 0.5% last month. January's output was revised up to show a 0.5% gain instead of the previously reported 0.2% increase.

Despite the increase in manufacturing output overall industrial production was unchanged in February because of a 5.7% weather-driven plunge in utilities generation. Industrial production fell 0.1% in January.

Manufacturing is regaining ground as the prolonged drag from lower oil prices, a strong dollar and an inventory overhang fades. The sector is also benefiting from a surge in sentiment amid promises by the Trump administration to pursue business-friendly policies, including tax cuts and deregulation.

Overall industrial capacity utilization fell 0.1 percentage point to 75.4%. It is 4.5 percentage points below its long-run average. Officials at the Fed tend to look at capacity use as a signal of how much "slack" remains in the economy and how much room there is for growth to accelerate before it becomes inflationary.

Technical analysis

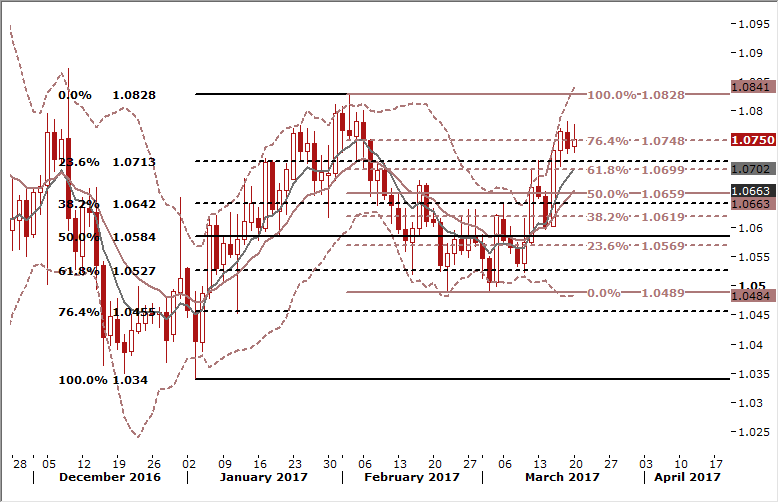

The EUR/USD is up on the day, but below Friday’s 1.0782 peak. A close above 76.4% fibo of February drop (1.0748) will keep bullish momentum intact. The next support is 1.0728 low on March 17.

Trading strategy

We stay long for 1.0820. There are no macroeconomic data scheduled for this week that could significantly change the market direction. Investors will be focused on speeches from Fed policymakers: Evans (today), Dudley (on Tuesday), Yellen and Kashkari (on Thursday).

USD/CAD: Loonie under pressure of falling oil prices

Macroeconomic overview

The CAD weakened slightly against the USD on Friday and remains near Friday’s close today, despite stronger-than-expected domestic manufacturing data.

Canadian manufacturing sales unexpectedly rose in January for the third month in a row, driven by a gain in sales of non-durable goods, including petroleum and coal products, data from Statistics Canada showed. The 0.6% gain beat expectations for a 0.2% decline, while sales volumes were also solid, rising 0.7%. The data supported prospects of the Bank of Canada dropping its cautious stance.

Falls of crude oil prices are worrying for CAD bulls. Oil prices fell more than 1% on Monday as investors made record cuts to bets on rising prices after strong drilling data from the United States fed concerns about the effectiveness of OPEC-led production cuts to curb a supply glut.

The prospect of higher output from Libya, which is exempt from the output cut deal, is adding further bearish sentiment. Libya's National Oil Corporation said it was confident of regaining control of two key oil ports, Es Sider and Ras Lanuf, which have a combined capacity to export 600,000 barrels per day.

Reacting to the oil glut, financial oil traders cut their net long U.S. crude futures and options positions in the week to March 14, the third consecutive reduction, the U.S. Commodity Futures Trading Commission said on Friday.

Technical analysis

The loonie recoverved against the USD on less-hawkish Fed last week and the USD/CAD fall was stopped near 38.2% fibo level of January-March rise. The CAD has been fluctuating slightly above this level, but still below 7-day exponential moving average, which is negatively aligned now. A further drop is likely in the coming days.

Trading strategy

We stay short for 1.3150.

TRADING STRATEGIES SUMMARY:

FOREX - MAJOR PAIRS:

FOREX - MAJOR CROSSES:

PRECIOUS METALS:

It is usually reasonable to divide your portfolio into two parts: the core investment part and the satellite speculative part. The core part is the one you would want to make profit with in the long term thanks to the long-term trend in price changes. Such an approach is a clear investment as you are bound to keep your position opened for a considerable amount of time in order to realize the profit. The speculative part is quite the contrary. You would open a speculative position with short-term gains in your mind and with the awareness that even though potentially more profitable than investments, speculation is also way more risky.

In typical circumstances investments should account for 60-90% of your portfolio, the rest being speculative positions. This way, you may enjoy a possibly higher rate of return than in the case of putting all of your money into investment positions and at the same time you may not have to be afraid of severe losses in the short-term.

How to read these tables?

1. Support/Resistance - three closest important support/resistance levels

2. Position/Trading Idea:

BUY/SELL - It means we are looking to open LONG/SHORT position at the Entry Price. If the order is filled we will set the suggested Target and Stop-loss level.

LONG/SHORT - It means we have already taken this position at the Entry Price and expect the rate to go up/down to the Target level.

3. Stop-Loss/Profit Locked In - Sometimes we move the stop-loss level above (in case of LONG) or below (in case of SHORT) the Entry price. This means that we have locked in profit on this position.

4. Risk Factor - green "*" means high level of confidence (low level of uncertainty), grey "**" means medium level of confidence, red "***" means low level of confidence (high level of uncertainty)

5. Position Size (forex)- position size suggested for a USD 10,000 trading account in mini lots. You can calculate your position size as follows: (your account size in USD / USD 10,000) * (our position size). You should always round the result down. For example, if the result was 2.671, your position size should be 2 mini lots. This would be a great tool for your risk management!

Position size (precious metals) - position size suggested for a USD 10,000 trading account in units. You can calculate your position size as follows: (your account size in USD / USD 10,000) * (our position size).

6. Profit/Loss on recently closed position (forex) - is the amount of pips we have earned/lost on recently closed position. The amount in USD is calculated on the assumption of suggested position size for USD 10,000 trading account.

Profit/Loss on recently closed position (precious metals) - is profit/loss we have earned/lost per unit on recently closed position. The amount in USD is calculated on the assumption of suggested position size for USD 10,000 trading account.

Source: GrowthAces.com - your daily forex trading strategies newsletter

Trading in financial instruments and/or cryptocurrencies involves high risks including the risk of losing some, or all, of your investment amount, and may not be suitable for all investors. Prices of cryptocurrencies are extremely volatile and may be affected by external factors such as financial, regulatory or political events. Trading on margin increases the financial risks.

Before deciding to trade in financial instrument or cryptocurrencies you should be fully informed of the risks and costs associated with trading the financial markets, carefully consider your investment objectives, level of experience, and risk appetite, and seek professional advice where needed.

Fusion Media would like to remind you that the data contained in this website is not necessarily real-time nor accurate. The data and prices on the website are not necessarily provided by any market or exchange, but may be provided by market makers, and so prices may not be accurate and may differ from the actual price at any given market, meaning prices are indicative and not appropriate for trading purposes. Fusion Media and any provider of the data contained in this website will not accept liability for any loss or damage as a result of your trading, or your reliance on the information contained within this website.

It is prohibited to use, store, reproduce, display, modify, transmit or distribute the data contained in this website without the explicit prior written permission of Fusion Media and/or the data provider. All intellectual property rights are reserved by the providers and/or the exchange providing the data contained in this website.

Fusion Media may be compensated by the advertisers that appear on the website, based on your interaction with the advertisements or advertisers.