EUR/USD: Euro Steady Ahead Of FOMC Statement

MarketPulse | Apr 27, 2016 06:21AM ET

EUR/USD is steady on Wednesday. The pair has gained close to 100 points this week, and is trading at the 1.13 line in the European session. In economic news, German Consumer Climate improved to 9.7 points, beating the estimate. Today’s highlight is the FOMC Statement, with the Fed expected to maintain the benchmark interest rate. As well, the US releases Pending Home Sales.

German key releases are closely watched by the markets, as Germany is the largest economy in the Eurozone. German Consumer Climate climbed to 9.7 points in April, above the estimate of 9.5 points. This marked the indicator’s highest level since August 2015, and points to stronger consumer confidence, which usually translates into increased consumer spending. We’ll get a look at German CPI and Retail Sales later in the week.

Last week, the ECB remained on the sidelines at its April policy meeting, leaving the benchmark interest rate at a record low of zero. The spotlight shifts to the Federal Reserve on Wednesday, which will release a policy statement. The Fed is widely expected to maintain interest rates at the current level of 0.25%. The markets will be carefully monitoring the tone of the policy statement. Janet Yellen has sounded cautious about the health of the US economy, and if the Fed continues on this path and sends out a dovish message, the dollar could soften against its major rivals.

The US economy continues to expand, but there are some weak spots, including the manufacturing sector. Core Durable Goods dropped 0.2%, well off the estimate of a 0.6% gain. This marked the fourth decline in five months. Durable Goods Orders was stronger at 0.8%, but also missed expectations, as the estimate stood at 1.9%. Recent manufacturing reports, such as the Philly Fed Mfg. Index have also been soft, as the industry has been hard-hit by weak global demand and a downturn in the US oil industry due to low crude prices.

EUR/USD Fundamentals

Wednesday (April 27)

- 6:00 German Import Prices. Estimate 0.3%. Actual 0.7%

- 6:00 GfK German Consumer Climate. Estimate 9.5. Actual 9.7

- 8:00 Eurozone M3 Money Supply. Estimate 5.0%. Actual 5.0%

- 8:00 Eurozone Private Loans. Estimate 1.7%. Actual 1.6%

- Tentative – German 30-Year Bond Auction

- 12:30 US Goods Trade Balance. Estimate -62.5B

- 14:00 US Pending Home Sales. 0.3%

- 14:30 US Crude Oil Inventories. Estimate 1.4M

- 18:00 US FOMC Statement

- 18:00 US Federal Funds Rate. Estimate

*Key events are in bold

*All release times are GMT

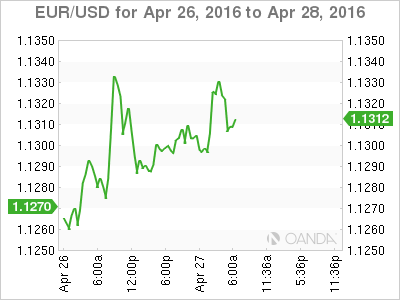

EUR/USD for Wednesday, April 27, 2016

EUR/USD April 27 at 10:00 GMT

Open: 1.1296 Low: 1.1291 High: 1.1333 Close: 1.1306

EUR/USD Technical

| S1 | S2 | S1 | R1 | R2 | R3 |

| 1.1087 | 1.1172 | 1.1278 | 1.1378 | 1.1495 | 1.1609 |

- EUR/USD was flat in the Asian session. The pair has shown some choppiness in the European trade

- 1.1278 is providing weak support

- There is resistance at 1.1378

Further levels in both directions:

- Below: 1.1278, 1.1172, 1.1087 and 1.0989

- Above: 1.1378, 1.1495 and 1.1609

- Current range: 1.1278 to 1.1378

OANDA’s Open Positions Ratio

EUR/USD ratio shows short positions with a strong majority (61%). This is indicative of strong trader bias towards EUR/USD reversing directions and moving lower.

Original post

Trading in financial instruments and/or cryptocurrencies involves high risks including the risk of losing some, or all, of your investment amount, and may not be suitable for all investors. Prices of cryptocurrencies are extremely volatile and may be affected by external factors such as financial, regulatory or political events. Trading on margin increases the financial risks.

Before deciding to trade in financial instrument or cryptocurrencies you should be fully informed of the risks and costs associated with trading the financial markets, carefully consider your investment objectives, level of experience, and risk appetite, and seek professional advice where needed.

Fusion Media would like to remind you that the data contained in this website is not necessarily real-time nor accurate. The data and prices on the website are not necessarily provided by any market or exchange, but may be provided by market makers, and so prices may not be accurate and may differ from the actual price at any given market, meaning prices are indicative and not appropriate for trading purposes. Fusion Media and any provider of the data contained in this website will not accept liability for any loss or damage as a result of your trading, or your reliance on the information contained within this website.

It is prohibited to use, store, reproduce, display, modify, transmit or distribute the data contained in this website without the explicit prior written permission of Fusion Media and/or the data provider. All intellectual property rights are reserved by the providers and/or the exchange providing the data contained in this website.

Fusion Media may be compensated by the advertisers that appear on the website, based on your interaction with the advertisements or advertisers.