EUR/USD To Continue Slips On Divergence With AQR Out Of The Way

Jeremy Cook | Oct 27, 2014 05:07AM ET

The weekend’s ‘stress tests’ on European banking assets has passed with little market fallout. Corroborating a leak on Friday afternoon, it was reported that 25 Eurozone banks had failed the criteria imposed upon them by the European Banking Authority. Nine of these banks – 36% – are Italian, three are Greek, three Cypriot, two from Belgium and Slovenia and then one each from Portugal, Austria, Ireland, France, Germany and Spain.

To pass the Asset-Quality Review – which looked at loans against the banks’ balance sheets – they needed to show common equity tier 1 of at least 8% of the bank’s risk weighted assets. In layman’s terms, 8% of a bank’s balance sheet risk needed to be capitalised within the bank. Those who had less than this, failed. While not a direct comparison – and more useful for showing how poor these stress tests can be – Lehman Brothers was ‘stress-tested’ four days before its eventual demise. It passed with an 11% tier 1 capital ratio. Obviously market conditions are a lot more tranquil than they were in 2008 but it goes to show that just because a box has been ticked, the risk has not dissipated significantly.

Euro is slightly higher on the announcement, as are the region’s stock markets this morning. Today’s German IFO release could easily see that optimism slip away. We know that the German economy continued to decline in September; PMIs for the month were awful. August’s reading was the lowest reading since April of last year and stood in direct contrast to the calming words of the Bundesbank which stated that “the general economic trend should stay positive despite the slowdown in the speed of expansion in the first half of 2014”. The first reading of Q3 German GDP is due November 14th.

UK GDP was shown to have grown by 0.7% in Q3 in Friday’s initial estimate. There’s no denying that the level of exuberance in the UK economy has slackened in the past four or five months and last week’s figure only backs up that sentiment. Of course, 0.7% growth is not in any way shoddy, but changes to the current landscape need to be seen for a move higher in the coming quarters.

Headwinds from the current slowing of output in Europe and China are obvious dangers to the UK’s growth picture, and with real wages staying determinedly negative at the moment, there are concerns about how much farther domestic demand levels can be pushed. Trade figures and wage settlements are now the barometers for not only the UK economy, but also any policy changes that the Monetary Policy Committee will be weighing up.

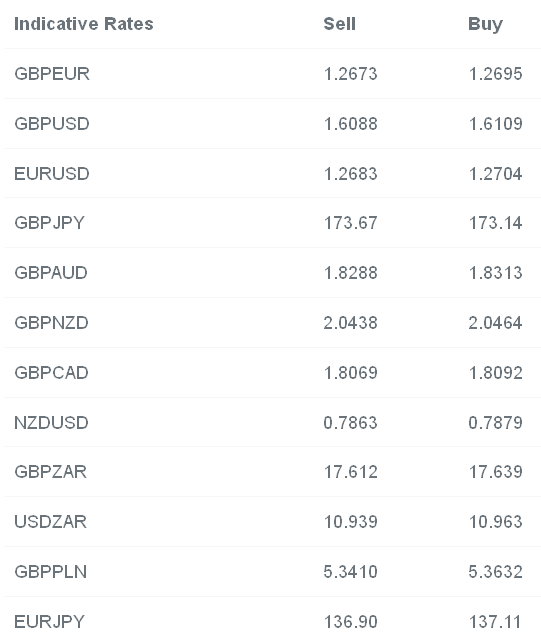

With the ‘stress tests’ out of the way, I am looking for EURUSD to test 1.25 again soon as the market refocuses on the marginal divergences in interest rate policy between the US and Eurozone with EURGBP also moving lower for similar reasons.

The highlights of the upcoming week are very much US and Eurozone focused. Wednesday’s Fed meeting is unlikely to cause too many ructions but may once again focus on the use of “considerable time” in the accompanying policy statement. I think that the phrase is kept within the statement so as to be removed in the December meeting – the next one that contains a post-decision press conference from Yellen. Context is everything in these markets it seems. This will also be the meeting that sees the Federal Reserve taper its asset purchase plan to nothing despite some hot-headed feeling earlier in the month that the end should be delayed in response to the recent spate of volatility.

Elsewhere, it is a week of Eurozone inflation numbers with the main preliminary number for the region due on Friday morning. It is expected to rise to 0.4% from the cyclical low of 0.3%.

Trading in financial instruments and/or cryptocurrencies involves high risks including the risk of losing some, or all, of your investment amount, and may not be suitable for all investors. Prices of cryptocurrencies are extremely volatile and may be affected by external factors such as financial, regulatory or political events. Trading on margin increases the financial risks.

Before deciding to trade in financial instrument or cryptocurrencies you should be fully informed of the risks and costs associated with trading the financial markets, carefully consider your investment objectives, level of experience, and risk appetite, and seek professional advice where needed.

Fusion Media would like to remind you that the data contained in this website is not necessarily real-time nor accurate. The data and prices on the website are not necessarily provided by any market or exchange, but may be provided by market makers, and so prices may not be accurate and may differ from the actual price at any given market, meaning prices are indicative and not appropriate for trading purposes. Fusion Media and any provider of the data contained in this website will not accept liability for any loss or damage as a result of your trading, or your reliance on the information contained within this website.

It is prohibited to use, store, reproduce, display, modify, transmit or distribute the data contained in this website without the explicit prior written permission of Fusion Media and/or the data provider. All intellectual property rights are reserved by the providers and/or the exchange providing the data contained in this website.

Fusion Media may be compensated by the advertisers that appear on the website, based on your interaction with the advertisements or advertisers.