ETF Sectors React To Budget Impasse

Pacific Park Financial Inc. | Sep 25, 2013 02:01PM ET

It has been five trading days since “no-taper” euphoria has passed. In that time, U.S. stock assets have been falling, though the declines have been modest. Most investors continue to believe that a last-minute deal will be struck and that a bearish retreat like the 2011 correction is improbable.

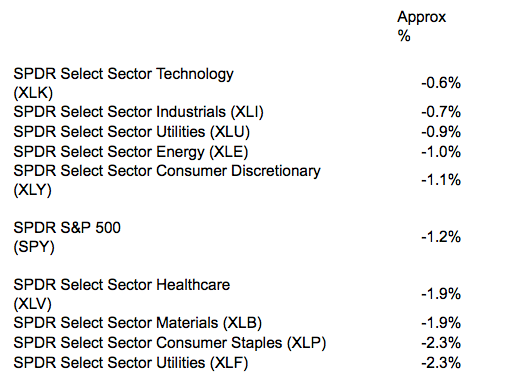

Nevertheless, different economic sectors appear to be responding differently to the current landscape. And while previous blueprints for budget uncertainty may have favored non-cyclical segments such as health care and consumer staples, old-school rules may not be applicable.

Granted, assets like SPDR Select Sector Materials (IJS ). I am also “overweight” tech at this time with funds like Vanguard Information Technology (VGT) or First Trust NASDAQ Tech Dividend (TDIV). That said, like Mr. Buffett, I have been patient for months with some cash on the sidelines. I would be willing to buy into meaningful market weakness. However, if long-term trends break and stop limit loss orders hit, clients may have even more cash to protect against catastrophic bear-market losses.

Trading in financial instruments and/or cryptocurrencies involves high risks including the risk of losing some, or all, of your investment amount, and may not be suitable for all investors. Prices of cryptocurrencies are extremely volatile and may be affected by external factors such as financial, regulatory or political events. Trading on margin increases the financial risks.

Before deciding to trade in financial instrument or cryptocurrencies you should be fully informed of the risks and costs associated with trading the financial markets, carefully consider your investment objectives, level of experience, and risk appetite, and seek professional advice where needed.

Fusion Media would like to remind you that the data contained in this website is not necessarily real-time nor accurate. The data and prices on the website are not necessarily provided by any market or exchange, but may be provided by market makers, and so prices may not be accurate and may differ from the actual price at any given market, meaning prices are indicative and not appropriate for trading purposes. Fusion Media and any provider of the data contained in this website will not accept liability for any loss or damage as a result of your trading, or your reliance on the information contained within this website.

It is prohibited to use, store, reproduce, display, modify, transmit or distribute the data contained in this website without the explicit prior written permission of Fusion Media and/or the data provider. All intellectual property rights are reserved by the providers and/or the exchange providing the data contained in this website.

Fusion Media may be compensated by the advertisers that appear on the website, based on your interaction with the advertisements or advertisers.