ERY Rallies Over 35%, Another Setup Ahead

Chris Vermeulen | Oct 07, 2019 12:35AM ET

Sometimes, it pays to be lucky and skilled when deploying technical analysis and price theory. We caught an early move in ERY back in June 2019 for a nice profit.

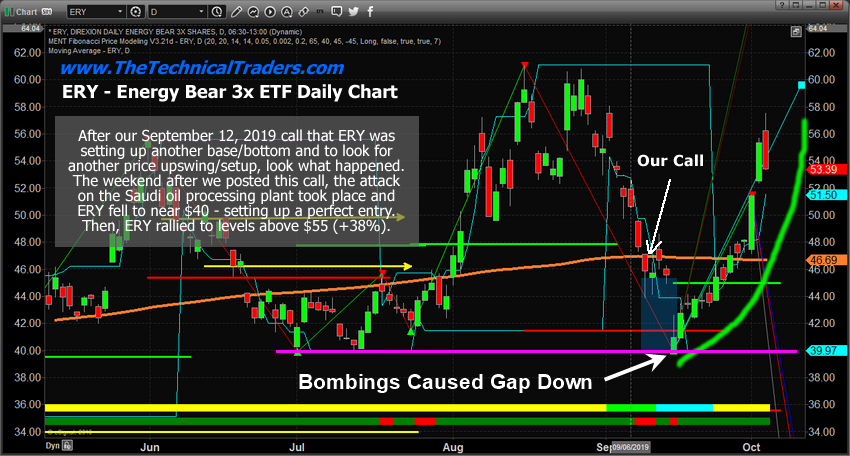

Then watched as price fell back towards the $44 price level – expecting another base/bottom setup to form. On September 12, 2019, we issued a research post suggesting to our followers that ERY is reaching a key low point and that traders should start looking for the next move.

We had no idea that Yemen would launch a drone attack on Saudi Arabia crippling their oil production capacity within 5 days of that research post. All we knew was that ERY was moving back towards a historical low price level that would present another opportunity for skilled traders – an opportunity for profits.

At that time, we believed any price level near of below $45 would qualify as a solid entry point and warned our followers to “watch for any deeper price moves below $45” for key entry levels. 5 days later, a very deep price level printed (near $40) after the attack on the Saudi oil plant. What happened next?

September 12, 2019: ENERGY SECTOR REACHES KEY LOW POINT – START LOOKING FOR THE NEXT MOVE

Daily ERY – Energy Sector ETF Chart

The first real opportunity for a deeper price move below $45 happened on the following Monday after the attack near $40. This constituted a very deep price decline and provided multiple days of opportunity for entry below $44.

Nearly 3 weeks later, the ERY price rallied to levels above $56 reaching a solid +35% gain. As we stated, sometimes it pays to be lucky and skilled when trading. We hope some of you were able to follow our research and catch a part of this move?

Concluding Thoughts:

Get ready for the next big move in ERY, folks. If our research is correct, another setup will happen before the end of October with another basing level below $45 and another attempt at a rally in ERY with upside targets settling near $55 or higher. It’s just a matter of time before this new basing/bottom setup takes place. We’ll keep you informed when we believe the timing is right to look for new entry points.

As a technical analysis and trader since 1997, I have been through a few bull/bear market cycles. I believe I have a good pulse on the market and timing key turning points for both short-term swing trading and long-term investment capital. The opportunities are massive/life-changing if handled properly.

Trading in financial instruments and/or cryptocurrencies involves high risks including the risk of losing some, or all, of your investment amount, and may not be suitable for all investors. Prices of cryptocurrencies are extremely volatile and may be affected by external factors such as financial, regulatory or political events. Trading on margin increases the financial risks.

Before deciding to trade in financial instrument or cryptocurrencies you should be fully informed of the risks and costs associated with trading the financial markets, carefully consider your investment objectives, level of experience, and risk appetite, and seek professional advice where needed.

Fusion Media would like to remind you that the data contained in this website is not necessarily real-time nor accurate. The data and prices on the website are not necessarily provided by any market or exchange, but may be provided by market makers, and so prices may not be accurate and may differ from the actual price at any given market, meaning prices are indicative and not appropriate for trading purposes. Fusion Media and any provider of the data contained in this website will not accept liability for any loss or damage as a result of your trading, or your reliance on the information contained within this website.

It is prohibited to use, store, reproduce, display, modify, transmit or distribute the data contained in this website without the explicit prior written permission of Fusion Media and/or the data provider. All intellectual property rights are reserved by the providers and/or the exchange providing the data contained in this website.

Fusion Media may be compensated by the advertisers that appear on the website, based on your interaction with the advertisements or advertisers.