Equities Reverse Higher Again, ECB In Focus

JFD Team | Apr 22, 2021 04:11AM ET

Yesterday, the Bank of Canada sounded more positive, as it stated that economic growth in Q1 was considerably better than they have initially forecasted in January. After strong declines, seen on Monday and Tuesday, Wednesday was marked by “risk-on” trading. Today, we will get the ECB’s interest rate decision, which is not expected to end up with any fireworks.

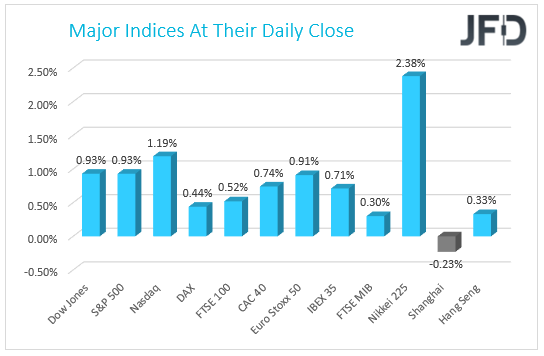

Markets Reverse Higher Again

After strong declines, seen on Monday and Tuesday, Wednesday was marked by “risk-on” trading. Most of the major indices managed to recover some of their losses, made in the beginning of the week. In the US, the recovery was led by a jump in the cyclical stocks, the ones of cruise operators and airlines.

Overall, the main sectors, which helped the market to regain some of the losses were financials, consumer cyclicals, industrials, technology and healthcare. One of the biggest losers in the US during Wednesday’s trading were NextEra Energy (NYSE:NEE), Oracle (NYSE:ORCL) and Netflix (NASDAQ:NFLX). The latter one delivered its 2021 Q1 financial results, which showed a decline in new user subscriptions. Other popular streaming companies, such as Disney (NYSE:DIS) and Roku (NASDAQ:ROKU), were in the red initially, but managed to get into positive territory by the end of the US trading session.

The decline in user subscribers is due to the fact that people are now hoping to have the restrictions to be lifted, allowing more free movement. But that doesn’t mean that it could be all down-hill from here for the streaming companies. There are still concerns that governments across the globe may continue with the lockdowns, especially due to new reports showing side-effects from some of the vaccines. And how bad this wouldn’t sound, but if people’s movement continues to be restricted, Netflix and other similar companies, might remain on the winning side from all this.

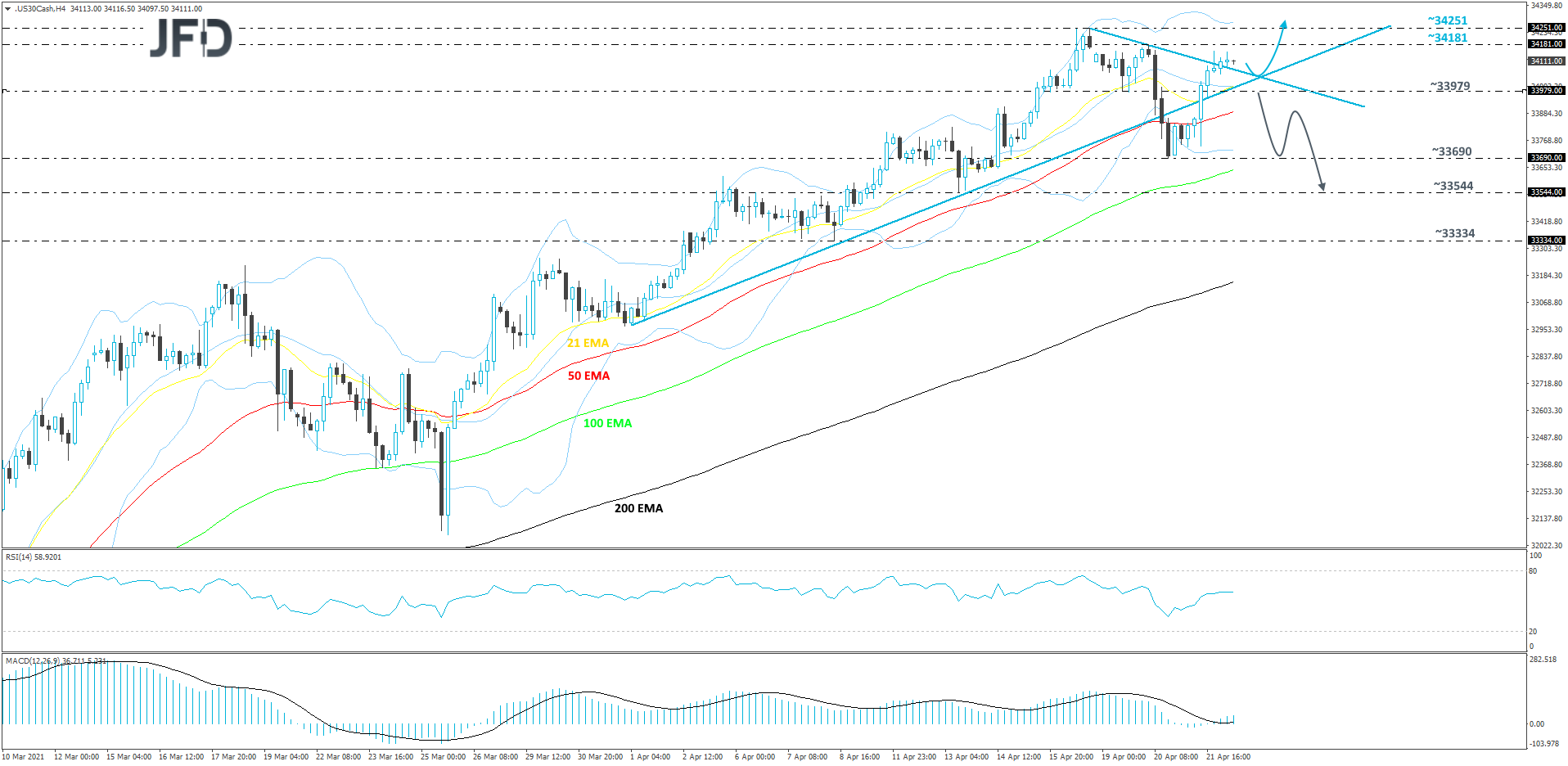

DJIA Technical Outlook

After yesterday’s strong reversal to the upside, the DJIA cash index had almost recovered all the losses made in the first half of the week. We can see that after finding support near the 33690 hurdle, the price drifted back above the short-term tentative upside support line taken from the low of April 1st. In addition to that, the cash index climbed back above a short-term tentative downside resistance line drawn from the high of Apr. 16. If DJIA continues to balance above both of those lines, we will remain positive, at least with the near-term outlook.

As mentioned above, if the index continues to trade above the previously discussed lines, this may attract more buyers into the game, possibly helping DJIA to move further north. The price may then test the 34181 obstacle, a break of which could set the stage for a push towards the 34251 zone, marked by the current all-time high. If the buyers are still feeling comfortable, they might overcome the current all-time high level, this way placing the index into the uncharted territory.

Alternatively, if the price breaks back below the aforementioned upside line and then drops through the 33979 hurdle, marked by the low of Apr. 19, that might once again temporarily spook the bulls from the field. DJIA could fall into the hands of more bears, resulting in a further slide towards the current low of this week, at 33690. If the selling continues, the next possible target may be at 33544, which is the low of Apr. 13.

Bank Of Canada Sounding Positive

On the currency front, the Canadian dollar was the biggest gainer among its major counterparts. The second and third best performers were NZD and AUD. The latter two were mainly driven by the recovery in the risk assets, such as equities. But the Canadian dollar attracted buying interest after the Bank of Canada came out with the interest rate decision and the monetary policy report. Certainly, there were no surprises in the regards to the interest rate decision, as it remained at the same level of +0.25%. But in relation to the Bank’s economic outlook, it sounded more positive, as it stated that economic growth in Q1 was considerably better than they have initially forecasted in January.

Businesses and households managed to adjust to all the imposed restrictions, which helped keep the economy running. This is why the Bank said it will lower its bond purchases from CAD 4bln to CAD 3bln as of Apr. 26. Also, the GDP growth forecast for 2021 was revised higher, going from 4% to 6.5%. That said, the growth forecast for 2022 was lowered from 4.8% to 3.7%. The overall positive tone from the BoC gave CAD a significant advantage over its top counterparts, especially CHF and JPY. The Canadian dollar may continue strengthening today as well, just as a follow up to yesterday’s positivity from the BoC. However, we will closely monitor oil prices, because if those slide further in the near-term, this might have a negative effect on CAD.

NZD/CAD Technical Ooulook

NZD/CAD continues to drift lower, after hitting resistance near the 0.9082 barrier yesterday. Also, the pair managed to break below a short-term tentative upside support line taken from the low of Apr. 13. The pair might drift a bit further south, however, we would still class this move as a temporary correction, if another short-term upside line, taken from the low of Apr. 1, stays intact.

A further slide could bring the rate closer to the 0.8953 obstacle, marked by an intraday swing low of Apr. 16, which may temporarily provide a hold-up. However, if the bears continue to dictate the rules, NZD/CAD could fall to the next possible support area, at 0.8912. That area is marked by the low of Apr. 16.

On the other hand, if the pair reverses back above the 0.9015 barrier, marked by yesterday’s intraday swing high, that may open the door for a move up again. NZD/CAD might travel to the 0.9060 obstacle, or to the 0.9082 level. That level is the current highest point of April.

ECB In The Spotlight

Today, we will get the ECB’s interest rate decision, which is not expected to end up with any fireworks. The current rate is set at 0.0% and it is expected to stay at the same level for a while. As mentioned in our weekly report, delivered on Monday:

“At its latest meeting, this Bank decided to accelerate its Pandemic Emergency Purchase Program in order to stop any unwarranted rise in bond yields. Although other major central banks share the view that the latest rise in bond yields around the globe just represents a healthy economic recovery, that’s not the case for the ECB. Rising bond yields in Europe have partly spilled over from US markets reacting to President Biden’s massive fiscal stimulus.

That said, PMIs since then suggested that the Euro-area economy is on a recovery mode, while inflation rose. Although several Eurozone nations are still in lockdowns, and despite ECB President Lagarde noting that any rise in inflation is likely to be temporary, the minutes of the last meeting revealed that officials discussed the idea of reducing the pace of PEPP purchases in the future. Thus, it would be interesting to see whether they will signal something like that at this meeting, or whether they will stay ready to ease further if deemed necessary. With government bond yields around the globe pulling back recently, we would see the former case as the more likely one, and if indeed this is the case, the euro is likely to continue strengthening.”

As For The Rest Of Today's Events

The other events on the economic calendar, which is worthwhile to be mentioned, are the US jobless claims, both initial and continuing. Although the initial ones are believed to have increased slightly from 576k to 617k, the continuing ones are expected to decline, going from 3731k to 3667k.

Also, we will receive the US existing homes sales number for the month of March, which is believed to have declined slightly from 6.22mln to 6.19mln.

Trading in financial instruments and/or cryptocurrencies involves high risks including the risk of losing some, or all, of your investment amount, and may not be suitable for all investors. Prices of cryptocurrencies are extremely volatile and may be affected by external factors such as financial, regulatory or political events. Trading on margin increases the financial risks.

Before deciding to trade in financial instrument or cryptocurrencies you should be fully informed of the risks and costs associated with trading the financial markets, carefully consider your investment objectives, level of experience, and risk appetite, and seek professional advice where needed.

Fusion Media would like to remind you that the data contained in this website is not necessarily real-time nor accurate. The data and prices on the website are not necessarily provided by any market or exchange, but may be provided by market makers, and so prices may not be accurate and may differ from the actual price at any given market, meaning prices are indicative and not appropriate for trading purposes. Fusion Media and any provider of the data contained in this website will not accept liability for any loss or damage as a result of your trading, or your reliance on the information contained within this website.

It is prohibited to use, store, reproduce, display, modify, transmit or distribute the data contained in this website without the explicit prior written permission of Fusion Media and/or the data provider. All intellectual property rights are reserved by the providers and/or the exchange providing the data contained in this website.

Fusion Media may be compensated by the advertisers that appear on the website, based on your interaction with the advertisements or advertisers.