Epwin Group: Existing Guidance Maintained

Edison | May 31, 2018 01:44AM ET

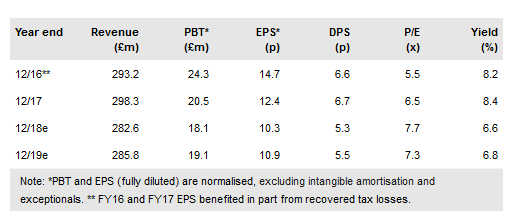

Epwin Group PLC (LON:EPWN): A short AGM update statement echoed previous management comments regarding market conditions and (unchanged) FY18 expectations. This suggests that the underlying trading environment is broadly stable and actions being taken to improve operational efficiency are proceeding to plan. The share price performance will be driven by delivery against these expectations and/or any indication of more robust market conditions, in our view. Ahead of such a catalyst, the prospective 6.6% dividend yield is a clear incentive to invest.

Taking positive actions in mixed markets

Management appears to be navigating mixed market conditions reasonably well – including selective price increases – in addition to progressing internal initiatives. Operational efficiency is a key focus for Epwin this year as two unexpected end customer issues that arose in FY17 flow through into FY18. Glass (sealed unit) operations were consolidated last year and further footprint actions are being taken in both profile extrusion and door fabrication. We believe that these actions were fully provided for in FY17 with expected completion during Q119. Elsewhere, Amicus (a 15-branch distribution business, acquired earlier this year) is bedding in and should make a modest profit contribution this year.

To read the entire report Please click on the pdf File Below:

Trading in financial instruments and/or cryptocurrencies involves high risks including the risk of losing some, or all, of your investment amount, and may not be suitable for all investors. Prices of cryptocurrencies are extremely volatile and may be affected by external factors such as financial, regulatory or political events. Trading on margin increases the financial risks.

Before deciding to trade in financial instrument or cryptocurrencies you should be fully informed of the risks and costs associated with trading the financial markets, carefully consider your investment objectives, level of experience, and risk appetite, and seek professional advice where needed.

Fusion Media would like to remind you that the data contained in this website is not necessarily real-time nor accurate. The data and prices on the website are not necessarily provided by any market or exchange, but may be provided by market makers, and so prices may not be accurate and may differ from the actual price at any given market, meaning prices are indicative and not appropriate for trading purposes. Fusion Media and any provider of the data contained in this website will not accept liability for any loss or damage as a result of your trading, or your reliance on the information contained within this website.

It is prohibited to use, store, reproduce, display, modify, transmit or distribute the data contained in this website without the explicit prior written permission of Fusion Media and/or the data provider. All intellectual property rights are reserved by the providers and/or the exchange providing the data contained in this website.

Fusion Media may be compensated by the advertisers that appear on the website, based on your interaction with the advertisements or advertisers.