Enough Consolidation Already!

Monica Kingsley | Apr 29, 2021 03:23PM ET

Stocks are readying another push higher, and not just on the heels of the still accommodative Fed. The Fed won't simply remove the punch bowl, it will keep repeating the transitory inflation mantra ad nauseam. The ingredients are in place for a continued upswing in stocks and commodities.

Look for nominal yields to continue rising. My hunch is that it won't be enough to turn the dollar around. We're about to experience continuously declining dollar.

And the emerging markets are embracing the unfolding currency moves. They are rising with more vigor than the Russell 2000 lately. Little wonder, for they are farther from their prior highs than the small caps. When it comes to S&P 500 sectors, yesterday brought us a rare rotation out of tech, while the heavyweights still eked out minor gains. That rotation is a telling sign of a risk on sentiment.

The key more in the gold sector was in the miners, whose continued resilience is a good omen.

What‘s not to love about this reflation before inflation starts to bite noticeably more? Forget about those pesky commodities and my incessant bullish calls within the sector too.

Let‘s move right into the charts (all courtesy of www.stockcharts.com ).

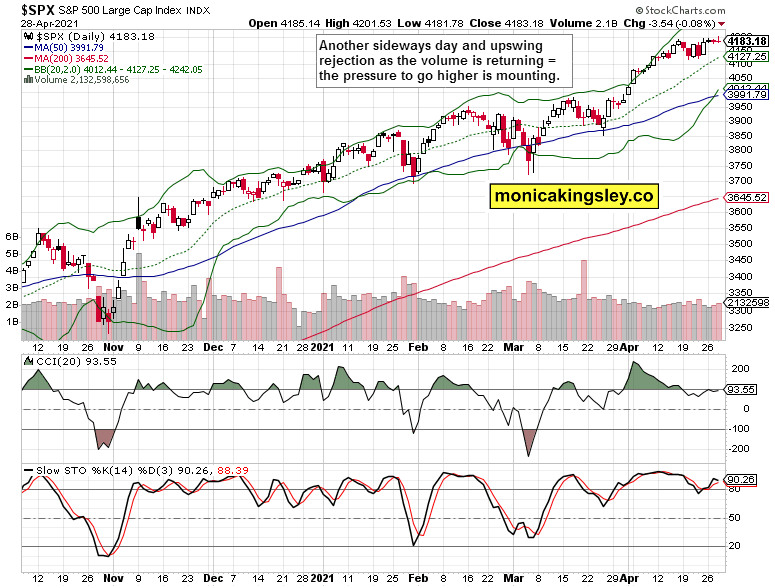

S&P 500 Outlook

Stocks are merely gathering strength before another upswing. Enough consolidation already, seems to be the rallying cry here.

Credit Markets

A strong sign of risk-on returning here – high-yield corporate bonds (iShares iBoxx $ High Yield Corporate Bond ETF (NYSE:HYG) clearly outperformed investment grade ones (iShares iBoxx $ Investment Grade Corporate Bond ETF (NYSE:LQD), and these mirror the long-dated Treasuries performance.

Technology And Financials

Another proof of risk-on is in both the technology performance disregarding FANG holding ground, and in the Dow Jones Industrial Average weakness. Value stocks and cyclicals such as financials (Financial Select Sector SPDR® Fund (NYSE:XLF) ETF) are having a field day, and as will be apparent from today‘s oil analysis, energy (Energy Select Sector SPDR® Fund (NYSE:XLE) ETF) is a great pick as well.

Summary

The S&P 500 keeps pushing for new all-time highs, and remain well positioned to close there any day now, especially since the credit markets favor risk on, and the defensives underperformance concurs.

Gold and miners are ready for another upswing, and the commodities performance, inflation expectations and nominal yields trajectory favor that. The inability of the sellers to push prices below $1,760 speaks volumes.

Trading in financial instruments and/or cryptocurrencies involves high risks including the risk of losing some, or all, of your investment amount, and may not be suitable for all investors. Prices of cryptocurrencies are extremely volatile and may be affected by external factors such as financial, regulatory or political events. Trading on margin increases the financial risks.

Before deciding to trade in financial instrument or cryptocurrencies you should be fully informed of the risks and costs associated with trading the financial markets, carefully consider your investment objectives, level of experience, and risk appetite, and seek professional advice where needed.

Fusion Media would like to remind you that the data contained in this website is not necessarily real-time nor accurate. The data and prices on the website are not necessarily provided by any market or exchange, but may be provided by market makers, and so prices may not be accurate and may differ from the actual price at any given market, meaning prices are indicative and not appropriate for trading purposes. Fusion Media and any provider of the data contained in this website will not accept liability for any loss or damage as a result of your trading, or your reliance on the information contained within this website.

It is prohibited to use, store, reproduce, display, modify, transmit or distribute the data contained in this website without the explicit prior written permission of Fusion Media and/or the data provider. All intellectual property rights are reserved by the providers and/or the exchange providing the data contained in this website.

Fusion Media may be compensated by the advertisers that appear on the website, based on your interaction with the advertisements or advertisers.