Energy Sector Reaches Key Low Point

Chris Vermeulen | Sep 13, 2019 12:35PM ET

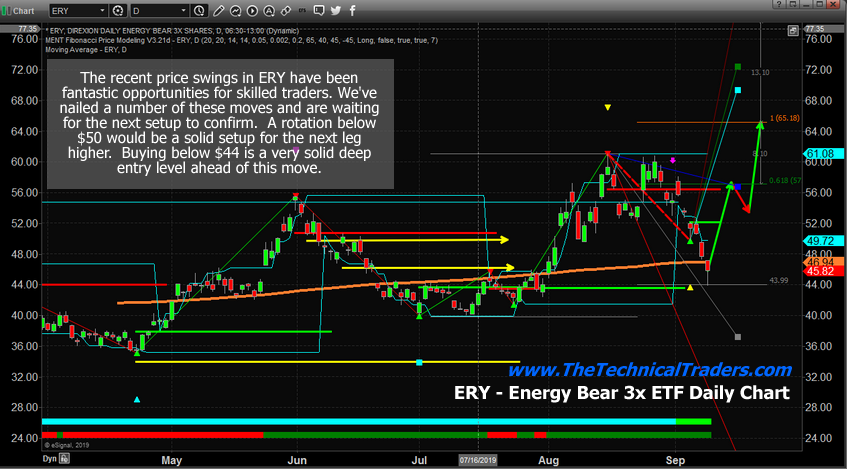

The Energy Sector ETF has been on fire recently with big price trends. We called a bottom/buy trigger in ERY in early July that resulted in a nearly +20% rally. Then, on August 29, we called for ERY to rotate lower, targeting the $46 to $47 level – setting up another price momentum base before another attempt to move higher. You can read that research post here.

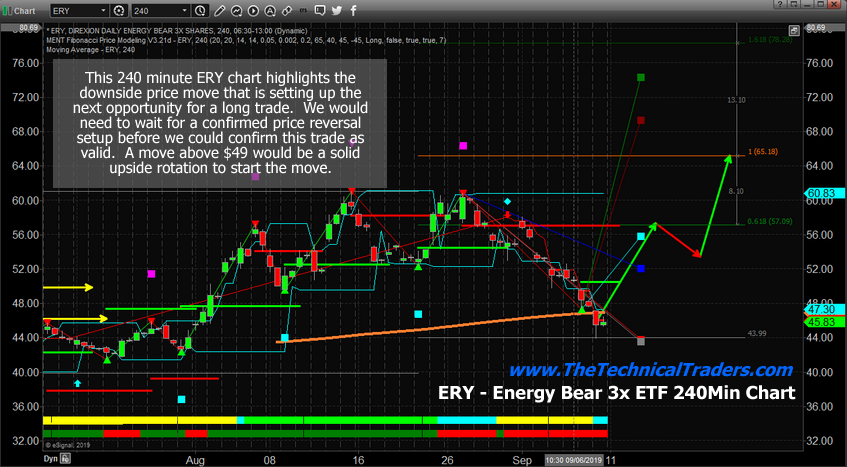

With crude oil pushing higher over the past few weeks and targeting levels just below the $59 price area, we believe the timing of this move in ERY is almost perfect. ERY rotated lower reaching the $44 price level on September 10. We believe this low price level will likely become the price bottom (or near a price bottom) for ERY and that a new upside price trend will set up over the next few days/weeks as a momentum base. It is very likely that an initial upside price move targeting $57 or $57 will conclude the first upside price leg (+20%). After that, the further upside target is another 18.5% higher near $65.25.

If you’ve been following our crude oil and Energy Sector research, you’ll already know the ERY trade setups have been very good in terms of price rotation, risk and opportunity. We believe the momentum base setup will likely take 4 to 6+ days to complete – giving skilled traders a great opportunity to identify entry locations.

Ultimately, the next upside price move should settle just below $57 on the initial move higher, then rotate downward a bit, then move higher towards the $65 price level. Traders should consider any deeper price rotation below $46 as a solid entry price level for this next move. Crude oil is already nearing price resistance and the energy sector may be poised for another big move higher.

A note of caution in regards to the ERY 3x ETF. Because this is a 3X ETF, skilled technical traders should be cautious in regards to risk factors. 3X ETFs can be fantastic for profits, but horrible for losses. If you are not prepared for volatility or don’t time your entry well, price rotation could result in some intermediate losses that may be tough to stomach. 3X ETFs are something that most novice traders should stay away from unless they fully understand the risks of these investments and how to properly size their trade positions.

Still, we believe the energy sector is setting up another great trade opportunity for skilled technical traders. Watch how this sets up below $46 and watch for deeper price moves below $45. Once the momentum base is set up, the upside price move should be very clean and fairly quick.

I have had a series of great trades this month. In fact, over the past 20 months, my ETF trading newsletter portfolio has generated over 100% return when compounded for members. And we locking in 5.1% profits on Tuesday with the Russell 2000 index and also XLU for a quick 1.43% profit as well.

As a technical analysis and trader since 1997, I have been through a few bull/bear market cycles. I believe I have a good pulse on the market and timing key turning points for both short-term swing trading and long-term investment capital. The opportunities are massive/life-changing if handled properly.

Trading in financial instruments and/or cryptocurrencies involves high risks including the risk of losing some, or all, of your investment amount, and may not be suitable for all investors. Prices of cryptocurrencies are extremely volatile and may be affected by external factors such as financial, regulatory or political events. Trading on margin increases the financial risks.

Before deciding to trade in financial instrument or cryptocurrencies you should be fully informed of the risks and costs associated with trading the financial markets, carefully consider your investment objectives, level of experience, and risk appetite, and seek professional advice where needed.

Fusion Media would like to remind you that the data contained in this website is not necessarily real-time nor accurate. The data and prices on the website are not necessarily provided by any market or exchange, but may be provided by market makers, and so prices may not be accurate and may differ from the actual price at any given market, meaning prices are indicative and not appropriate for trading purposes. Fusion Media and any provider of the data contained in this website will not accept liability for any loss or damage as a result of your trading, or your reliance on the information contained within this website.

It is prohibited to use, store, reproduce, display, modify, transmit or distribute the data contained in this website without the explicit prior written permission of Fusion Media and/or the data provider. All intellectual property rights are reserved by the providers and/or the exchange providing the data contained in this website.

Fusion Media may be compensated by the advertisers that appear on the website, based on your interaction with the advertisements or advertisers.