Emini S&P 500: Back Into Trading Range/Digestion

Ricky Wen | Oct 23, 2019 02:38PM ET

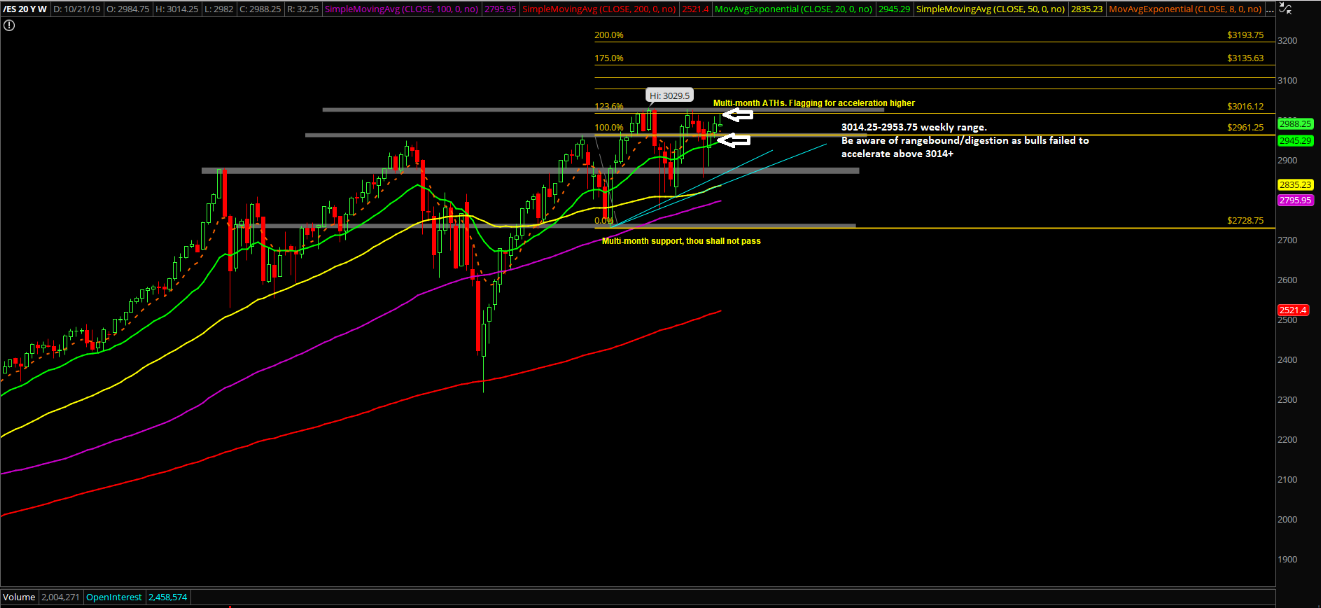

Tuesday’s session showcased a textbook rangebound grind and backtest as the price action could not break above the overnight 3014.25 high on the Emini S&P 500 (ES) to force a trend day.

Essentially, the market had to work out all the negative divergence on all four of the equity indices. As discussed in our trading room, it was prudent for short-term traders to bail and take profits in the morning given the numerous attempts that failed to break above 3014 indicating no immediate trend day setup. We had to bail immediately after the regular trading hours (RTH) open as bulls kept failing to break above the 3014.25 overnight high. It is what it is.

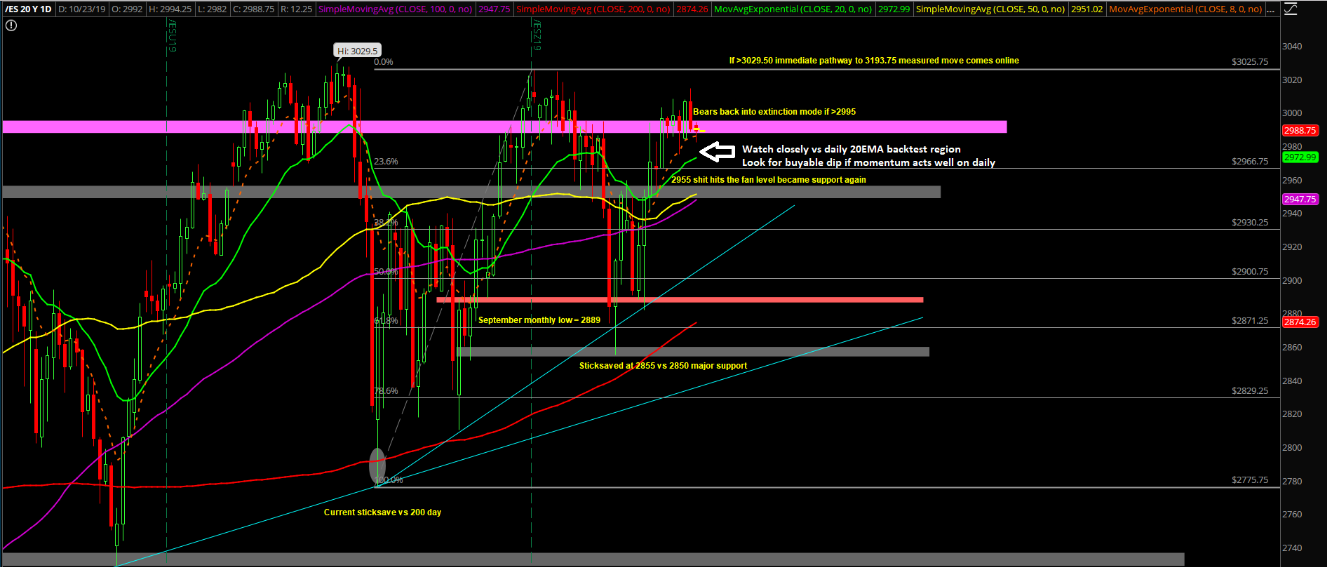

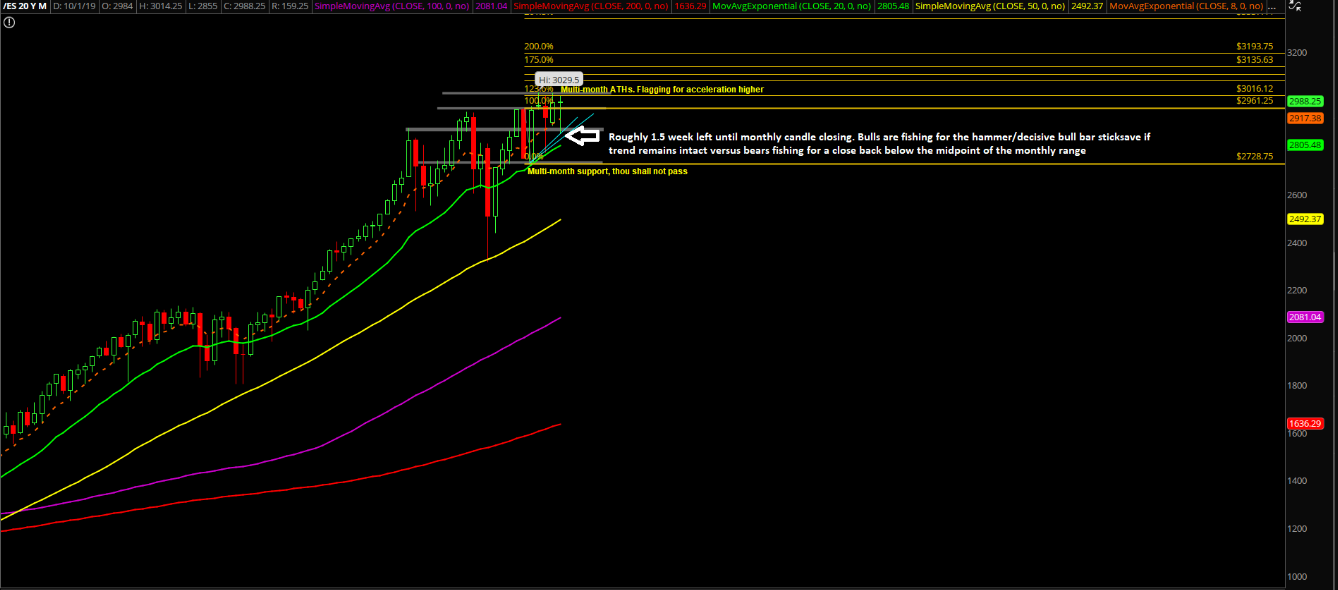

The main takeaway is the market continues doing the daily 8EMA grind and now the range could be expanded into 3014.25-2953.75 derived from Tuesday’s high and last week’s low. The immediate trend continuation setup into all-time highs (ATH's) has obviously been delayed/rejected given what occurred today with the backtest into support. The primary thing to focus on now would be the incoming backtest vs. the trending daily 20EMA 2970s -- that also matches with Friday’s low of 2975.

What’s Next?

Tuesday closed at 2988.25 on the ES, showcasing a rejection/bearish candlestick that closed just below the midpoint of Monday’s range. Price action is below the immediate trending supports signifying the immediate acceleration setup has been rejected or have been put on hold. Key points:

Trading in financial instruments and/or cryptocurrencies involves high risks including the risk of losing some, or all, of your investment amount, and may not be suitable for all investors. Prices of cryptocurrencies are extremely volatile and may be affected by external factors such as financial, regulatory or political events. Trading on margin increases the financial risks.

Before deciding to trade in financial instrument or cryptocurrencies you should be fully informed of the risks and costs associated with trading the financial markets, carefully consider your investment objectives, level of experience, and risk appetite, and seek professional advice where needed.

Fusion Media would like to remind you that the data contained in this website is not necessarily real-time nor accurate. The data and prices on the website are not necessarily provided by any market or exchange, but may be provided by market makers, and so prices may not be accurate and may differ from the actual price at any given market, meaning prices are indicative and not appropriate for trading purposes. Fusion Media and any provider of the data contained in this website will not accept liability for any loss or damage as a result of your trading, or your reliance on the information contained within this website.

It is prohibited to use, store, reproduce, display, modify, transmit or distribute the data contained in this website without the explicit prior written permission of Fusion Media and/or the data provider. All intellectual property rights are reserved by the providers and/or the exchange providing the data contained in this website.

Fusion Media may be compensated by the advertisers that appear on the website, based on your interaction with the advertisements or advertisers.