Emini: August Buy Climax Should Reverse Down More

Al Brooks | Sep 08, 2020 10:16AM ET

Pre-Open Market Analysis

Emini futures sold off Friday on the open, but reversed up from a parabolic wedge sell climax for the rest of the day, erasing more than half of Friday’s selloff.

The selloff dipped below the bottom of the streak of 7 consecutive bull days and reversed up, which I have been saying was the 1st target for the bears.

Because Friday reversed up, it is a buy signal bar for today. But with its big bear body, it is a weak buy signal.

There will probably be sellers above its high, especially around 3500. Traders expect a 2nd leg down, maybe to the bottom of the streak of 9 consecutive bull bars, which is around 3200. Less likely, to the start of the 2 month tight bull channel, which was around 3,000

Did the selloff end on Friday? That is unlikely. But if the bulls get 2 or 3 big bull bars this week, traders will begin to wonder if the bull trend is resuming.

Last week traded above the high of the prior week and then below its low. It was therefore an outside down week in a buy climax on the weekly chart. Since it closed in the middle third of the bar, it is a weak sell signal bar for this week.

However, traders should expect lower prices and the bears will try to trigger the sell signal by getting this week to trade below last week’s low.

Overnight Emini Globex Trading

The Emini futures is down 44 points in the Globex session. It will therefore open with a big gap down.

When there is a big gap down, the Emini is far below the average price. One measure is the 20 bar EMA. Unless there are strong bear bars on the open, many bears will not sell on the open. They are only willing to sell far below the average price if the bars are very bearish.

Most of the time, a big gap down leads to a trading range open. The bears look for a wedge rally or a double top in the 1st hour or two to around the EMA and they then sell, hoping for the high of the day. The bulls look for a wedge bottom or a double bottom to buy for a swing up. There are often several minor legs before there is a good enough setup for a swing up or down.

There is sometimes a strong trend up or down that begins within the first few bars after a big gap down. Traders typically want to see consecutive strong bear trend bars before they are willing to sell, but they will often buy above a single big bear bar.

The bears want a close far below last week’s low. They want traders to conclude that the Emini will work lower for several weeks.

The bulls will buy around last week’s low. They want a double bottom with Thursday’s selloff. If they get a strong reversal up, traders will suspect that the selloff had ended.

At the moment, the bear case on the daily and weekly charts is more likely. Traders will continue to sell rallies until the bulls create s very strong reversal up. Friday’s rally was not enough.

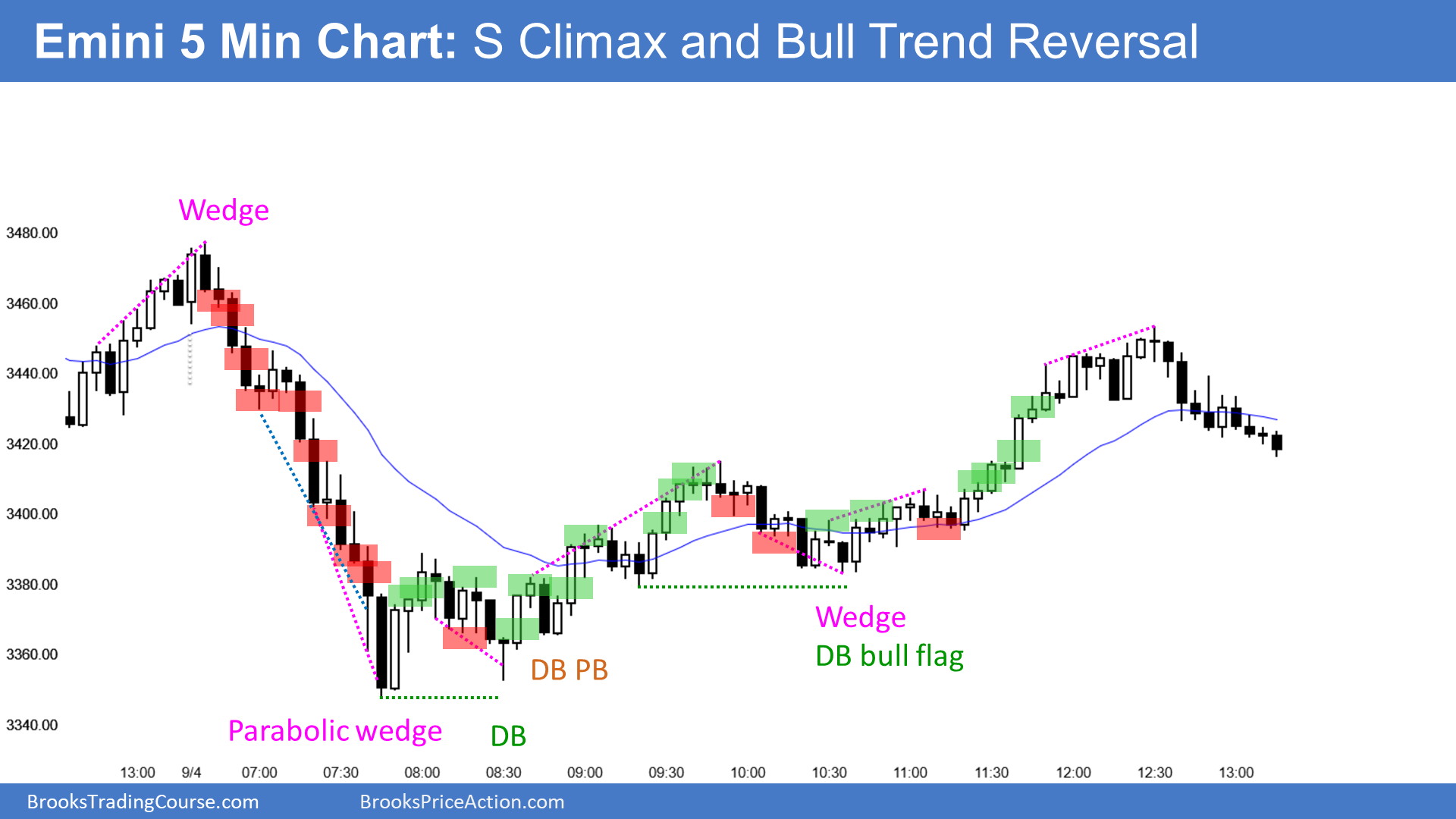

Last Friday’s setups

Here are several reasonable stop entry setups from last Friday. I show each buy entry with a green rectangle and each sell entry with a red rectangle. I rarely also show limit order entries and entries on the close of bars. I do not want the lines to be distracting. If they are longer, I make them dotted. But, they have to be visible, so I make the shorter ones solid. Buyers of the Brooks Trading Course and Encyclopedia of Chart Patterns have access to a much more detailed explanation of the swing trades for each day (see Online Course/BTC Daily Setups).

My goal with these charts is to present an Always In perspective. If a trader was trying to be Always In or nearly Always In a position all day, and he was not currently in the market, these entries would be logical times for him to enter.

If the risk is too big for your account, you should wait for trades with less risk or trade an alternative market like the Micro Emini.

Trading in financial instruments and/or cryptocurrencies involves high risks including the risk of losing some, or all, of your investment amount, and may not be suitable for all investors. Prices of cryptocurrencies are extremely volatile and may be affected by external factors such as financial, regulatory or political events. Trading on margin increases the financial risks.

Before deciding to trade in financial instrument or cryptocurrencies you should be fully informed of the risks and costs associated with trading the financial markets, carefully consider your investment objectives, level of experience, and risk appetite, and seek professional advice where needed.

Fusion Media would like to remind you that the data contained in this website is not necessarily real-time nor accurate. The data and prices on the website are not necessarily provided by any market or exchange, but may be provided by market makers, and so prices may not be accurate and may differ from the actual price at any given market, meaning prices are indicative and not appropriate for trading purposes. Fusion Media and any provider of the data contained in this website will not accept liability for any loss or damage as a result of your trading, or your reliance on the information contained within this website.

It is prohibited to use, store, reproduce, display, modify, transmit or distribute the data contained in this website without the explicit prior written permission of Fusion Media and/or the data provider. All intellectual property rights are reserved by the providers and/or the exchange providing the data contained in this website.

Fusion Media may be compensated by the advertisers that appear on the website, based on your interaction with the advertisements or advertisers.