EM Rundown: Inflation Jubilation Or Desolation?

Matthew Weller | Nov 10, 2014 03:28PM ET

Markets are off to a quiet start this week as traders try to gather their bearings after the whirlwind of top-tier economic data last week. The US dollar dipped early in Monday’s Asian and European sessions, though the world’s reserve currency recovered to trade generally higher as we went to press. Meanwhile, US equities are trading at all-time highs again (*yawn*), while global bond yields are ticking higher to reverse some of Friday’s losses.

The EMs

Shifting our attention to the emerging market sphere, EM FX traders are focused on the same economic factor as their developed-market brethren: inflation. Price pressures have been limited globally, helped along by falling commodity prices, and as long as inflation remains subdued, central bankers will remain on hold (or even in easing mode).

As my colleague Chris Tedder Monday, inflation figures in China, the world’s second-largest economy, were subdued. Consumer prices rose at just 1.6%, the slowest rate in five years, while producer prices actually contracted by 2.2%, suggesting that price pressures are unlikely to pick up any time soon. Despite this downbeat report, USD/CNH actually fell back to 6.12 Monday after testing its 50-day at 6.1400 on Friday. At this point, the pair looks likely to continue lower until the PBOC takes bold easing action or otherwise signals that the yuan is becoming to strong.

Across the world, traders also got a glance at the latest inflation figures out of Mexico, which showed that prices rose 0.55% m/m in October, roughly in line with expectations. Inflation ticked up to 4.3% on a trailing twelve month basis, signaling that Mexico may actually be one of the few regions where inflationary pressure could prompt central-bank action next year. Looking to the chart, USD/MXN is pressing against a key resistance level at 13.60, but as we noted last week , a break of that barrier could open the door for a rally toward 14 in time.

Source: FOREX.com

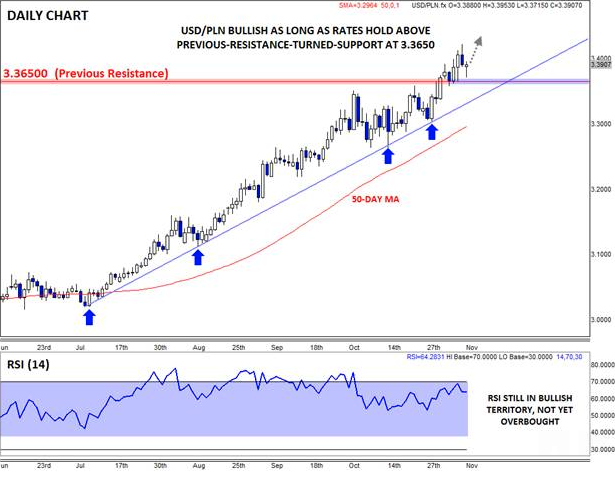

The last EM country facing a key inflation report this month is Poland. Traders will closely watch Thursday’s inflation figures from the European country, especially after the Poland’s central bank bucked market expectations by leaving interest rates unchanged at 2 % last year. In its meeting, the central bank cut its forecast for economic and growth and inflation and left the door open for future cuts. Expectations are centered around a flat (0.0%) inflation reading this week, which would leave the year-over-year rate at -0.3% and a miss of even this low hurdle could lead to more selling in the zloty. As long as USD/PLN remains above previous-resistance-turned-support at 3.3650, further gains are likely for the pair.

Source: FOREX.com

For more intraday analysis and market updates, follow us on twitter (@MWellerFX and @FOREXcom).

Trading in financial instruments and/or cryptocurrencies involves high risks including the risk of losing some, or all, of your investment amount, and may not be suitable for all investors. Prices of cryptocurrencies are extremely volatile and may be affected by external factors such as financial, regulatory or political events. Trading on margin increases the financial risks.

Before deciding to trade in financial instrument or cryptocurrencies you should be fully informed of the risks and costs associated with trading the financial markets, carefully consider your investment objectives, level of experience, and risk appetite, and seek professional advice where needed.

Fusion Media would like to remind you that the data contained in this website is not necessarily real-time nor accurate. The data and prices on the website are not necessarily provided by any market or exchange, but may be provided by market makers, and so prices may not be accurate and may differ from the actual price at any given market, meaning prices are indicative and not appropriate for trading purposes. Fusion Media and any provider of the data contained in this website will not accept liability for any loss or damage as a result of your trading, or your reliance on the information contained within this website.

It is prohibited to use, store, reproduce, display, modify, transmit or distribute the data contained in this website without the explicit prior written permission of Fusion Media and/or the data provider. All intellectual property rights are reserved by the providers and/or the exchange providing the data contained in this website.

Fusion Media may be compensated by the advertisers that appear on the website, based on your interaction with the advertisements or advertisers.