Egdon Resources: Springs Road Exploration Well Results

Edison | Jun 27, 2019 07:02AM ET

Egdon Resources (LON:EGRE)and IGas have provided a summary of initial analysis of the core extracted from Springs Road-1 (SR-01), in which Egdon holds a 14.5% interest. The well was drilled as a vertical exploration well in the centre of the Gainsborough Trough Basin where Egdon holds 82,000 net acres. The Bowland Shale, the Millstone Grit and the Arundian Shale were encountered with 429m of hydrocarbon bearing shale (147m cored) within the Bowland. Core analysis is positive with key shale characteristics comparable to commercial shales found in North America. High clay content was viewed as a risk pre-drill but the company believes that average clay content of below 30% should ensure the rock can be effectively fracture stimulated.

Business description

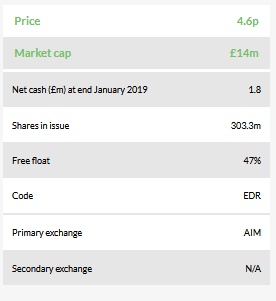

Egdon Resources is an AIM-listed onshore oil and gas exploration company. The group has conventional and unconventional assets in the UK.

SR-01 comparison to US shale gas play parameters. SR-01 total organic content of average 3% (ranging from 2-7%) is consistent with the averages of the top ten US shales which range from 0.9% to 5.3%. Thermal maturity at an average 464degC puts SR-01 shale in the wet gas to dry gas window. Total porosity of average 4% (range 2-9%) is comparable to US analogue shales which typically range from 4-7%. Gas content at an average 71scf/ton (range 24-131scf/ton) compares to a range of 15-350scf/ton typically seen in the US. Average clay content of 30% by weight (in The Carboniferous Bowland Shale gas study: geology and resource estimation – 2013, BGS states that clay content should be below 35% to facilitate fracture stimulation) is considered as low. From an operational perspective it is encouraging that SR-01 well costs came in 20% below budget; however well costs have not been released at this stage.

Operator IGas is to make a further announcement and technical presentation of these results in Q319.

Trading in financial instruments and/or cryptocurrencies involves high risks including the risk of losing some, or all, of your investment amount, and may not be suitable for all investors. Prices of cryptocurrencies are extremely volatile and may be affected by external factors such as financial, regulatory or political events. Trading on margin increases the financial risks.

Before deciding to trade in financial instrument or cryptocurrencies you should be fully informed of the risks and costs associated with trading the financial markets, carefully consider your investment objectives, level of experience, and risk appetite, and seek professional advice where needed.

Fusion Media would like to remind you that the data contained in this website is not necessarily real-time nor accurate. The data and prices on the website are not necessarily provided by any market or exchange, but may be provided by market makers, and so prices may not be accurate and may differ from the actual price at any given market, meaning prices are indicative and not appropriate for trading purposes. Fusion Media and any provider of the data contained in this website will not accept liability for any loss or damage as a result of your trading, or your reliance on the information contained within this website.

It is prohibited to use, store, reproduce, display, modify, transmit or distribute the data contained in this website without the explicit prior written permission of Fusion Media and/or the data provider. All intellectual property rights are reserved by the providers and/or the exchange providing the data contained in this website.

Fusion Media may be compensated by the advertisers that appear on the website, based on your interaction with the advertisements or advertisers.