ECB's Credibility Problem Puts Eurozone at Risk

Tom Luongo | Aug 02, 2023 02:56AM ET

The ECB has a credibility problem. It didn’t last year. Last year it was the Fed with the credibility problem. Today, it’s Christine Lagarde, not Jerome Powell, who needs to justify her policy.

Powell needed nearly a year after he began raising rates to get a significant portion of the market to believe he was serious about raising rates. Today, they don’t believe him if he making the odd dovish coo.

I don’t blame the market for its previous skepticism, it was well-earned. But as I’ve pointed out many times, Powell’s incentives line up with his intentions, and that has translated directly into Fed policy.

Lagarde has done the same thing, except she forgot the whole ‘incentives’ part. She has clearly tried to force her intentions onto the market to affect her master’s policy.

So, she tried to outwait Powell, hoping that domestic US politics would force his hand into the ‘pivot’ that hasn’t come and won’t until something breaks.

That something in my mind is still the ECB. And the race is on as to whether deteriorating credit and economic conditions in the US will force Powell’s hand rather than Lagarde’s. The keys are oil prices and the Bank of Japan.

At last year’s July meeting, Powell raised rates another 75 basis points, and Lagarde responded by announcing the Transmission Protection Instrument (TPI), or Toilet Paper Initiative, as I like to call it.

The TPI was put in place to manage German/Italian credit spreads because last summer, they were blowing out very wide and threatening to take down the entire Euro-zone bond market. Powell’s studious application of “Rate Hikes of Unusual Size,” as Danielle Dimartino Booth put it to me in the podcast we did back in February, was the cause.

The TPI announcement was paired with statements about the end of the ECB’s current QE programs. But the TPI is just QE in another form, especially if coupled with the ECB and European-adjacent jurisdictions deploying reserves to manage the US yield curve.

But the TPI alone clearly isn’t enough. Eventually, shuffling underwater bonds from one pocket to another to massage credit spreads runs into the basic problem that Powell hasn’t stopped raising rates.

Running out of OPM

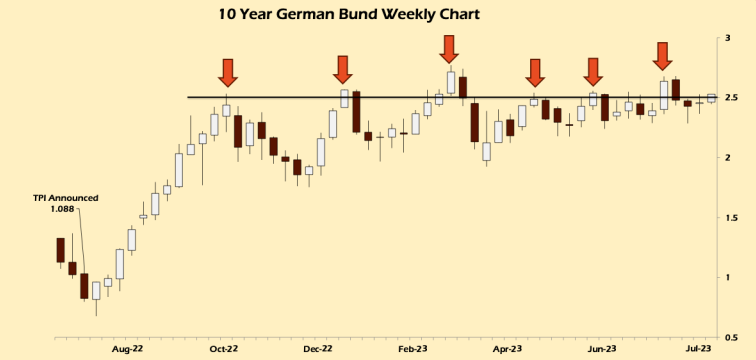

Eventually, as I pointed out in a recent article, policy limits are reached when rates themselves are the problem, not spreads. As a reminder, here’s the Germany 10-Year weekly chart and Lagarde’s defense of 2.5%

Oh, and inflation was “stickier” than Lagarde was fronting this time last year. She was still on the “transitory” talking point. For some reason, the markets believed her. Or, more specifically, wanted to believe her.

The euro-zone bond market is a cancer patient in Stage IV. Each time there is a major event, the rot within it metastasizes again, and a new alphabet program has to be invented — OMT, TARGET2, ESPP, TPI, ZOMG.

At this point, there is no internal solution save blowing up the entire fiction of individual central banks within the EU. Lagarde needs help from the outside to keep this patient alive.

She gets that regularly from both the Biden administration in general as well as Treasury Secretary Janet Yellen specifically.

In this month’s Gold Goats ‘n Guns newsletter, I laid out why I thought Yellen went to China to beg them to stop selling/start buying US Treasuries to keep a lid of global debt yields and the geopolitical implications for this.

This morning Zerohedge reports that Yellen has already issued more than $500 billion in new debt and will sell more than $1 trillion in Q3 and another $722 billion in Q4. From the Treasury Marketable Borrowing Estimates report:

- During the July – September 2023 quarter, Treasury expects to borrow $1.007 trillion in privately-held net marketable debt, assuming an end-of-September cash balance of $650 billion. The borrowing estimate is $274 billion higher than announced in May 2023, primarily due to the lower beginning-of-quarter cash balance ($148 billion) and higher end-of-quarter cash balance ($50 billion), as well as projections of lower receipts and higher outlays ($83 billion).

- During the October – December 2023 quarter, Treasury expects to borrow $852 billion in privately-held net marketable debt, assuming an end-of-December cash balance of $750 billion.

With this much borrowing, I expect Yellen can and will support Lagarde by structuring Treasury sales to over-supply high-yielding short-term debt and under-supply long-term debt. It’s a subtle form of yield curve control designed to keep the 2/10 inversion high and the bid under the long end of the curve strong.

Clearly, if you can keep long US yields well bid, you help the ECB hold the line on German debt. But will it be enough?

The problem for these two Keynesians is that Powell has them right where he wants them. Despite all of the whining, US economic data looks better than EU data by a wide margin, and the summer is nearly over, meaning higher oil prices.

Powell raised by 25 basis points as expected. So too, did the ECB, also expected. Powell’s post-statement comments were also abundantly clear, he doesn’t believe inflation has been whipped. He is rightly saying that commodity inflation has a second wave coming, confirming the analysis of myself and Francis Hunt in a banger interview on Palisades Gold Radio (as I outlined in a recent private blog post for Patrons).

In fact, Powell said explicitly he doesn’t see inflation coming down to the 2% target until the middle of 2025.

That knocked markets for a loop. The US yield curve since then blew out to the upside, and it is normalizing in the critical 1-3 year area of the curve, creating a decided trend on a weekly basis rather than the tug-of-war that had been going on.

Normalization is happening. It’s slow and methodical, but it’s happening.

Bank of Japan: Alive or Dead

This is after the Bank of Japan moved markets on Friday with their announcement they will ‘tweak’ their Yield Curve Control policy. Like Lagarde last July raising interest rates and announcing the eventual end of other QE programs (tightening) while announcing the TPI (MOAR QE), the BoJ talked out of both sides of its mouth with this change.

It’s kinda like Schrödinger’s Yield Curve Control at this point. Will they intervene at 0.5% or 1.0% on the ten year JGB? Who knows. Open the box and find out. They intervened almost immediately at 0.6% on the 10-year.

The reality is that the BoJ has to end the policy, but like all trapped institutions, are trying to maintain both credibility AND flexibility. This is exactly what Lagarde tried so hard to do over the past year and failed at miserably.

Ueda at the BoJ will fail as well, unless he keeps markets on their toes.

She’s raising rates because she has to follow Powell and hold to basic investment demands, the market chases real yield.

If she doesn’t follow Powell from here then the capital flow out of Europe goes from a small stream in the backyard to a biblical flood as the markets call bullshit on the entirety of the ECB’s mission. At that point she wouldn’t be able to defend EITHER credit spreads or the euro.

So, clearly Lagarde’s behavior is predictable at this point.

The Bank of Japan, however, is in a better position to play this game because Japan’s fundamentals are slightly stronger than Europe’s. Their Achilles’ heel is oil prices, as both are massive net energy importers. But Japan, unlike Europe, didn’t start a war with Russia over Ukraine. While Japan may still be playing games diplomatically with the Russians over the Kuril Islands, Russia understands the real pain points for Japan.

Don’t be surprised if, now, post-NATO Summit, Russia doesn’t reach out again to try and settle things. This could be a big tell that Washington is finally backing down on World War III if it allows Japan to talk honestly with Russia about the end of World War II.

All of the macro arguments for Japan that have been out there for years are now here – big debt problem, aging population, demand destruction, etc. But they haven’t cut themselves off from the energy they need. More Russian oil is flowing east today than ever before, and that will expand.

Russia would love to make another friend off its eastern coast.

The yen will need to strengthen here to hold inflation in check if the BoJ is serious about letting rates rise. It’s in the Fed’s best interests to remove cover from the EU, so Powell won’t oppose this.

Once that happens, Lagarde will lose the last of her cover through the one-way bets of the carry trades.

This is likely why Ueda gave us uncertainty over YCC policy last week. A little uncertainty means traders need to start paying attention as opposed to assuming nothing’s changed.

Lagarde is predictable. Powell already shocked markets, now he has their attention.

Everyone is now all-in on “Credibility” at the central banks. The age of the coordinated policy is over. If there is one central bank with a lower credibility quotient than the pre-Resting Hawk Face Powell, it’s the BoJ.

Greasing the Inflation Skids

The one thing that helped out Lagarde more than anything else has been the fall in oil prices. Biden drained the SPR into a US production peak, grasping for a time the title of Producer of the Marginal Barrel of Crude Oil from Russia.

The stronger euro helped along by this has now clearly lost this support with Brent breaking back towards $85 per barrel. Japan has allowed a weaker yen to cover this cost for most of the last year as well. But, now that trade should reverse because low oil prices were a lie. And now the euro and the yen need the same thing, strength to keep inflation under control and prevent capital flight.

Today oil is clearly on the move to the upside. According to the latest EIA data, US production has completely flatlined, below 12.4 million bbls/day. This was expected with the fall off in the Baker-Hughes Rig count this year.

The big tell is that US exports are falling fast.

US Imports are rising as well. This all signals US oil consumption is rising despite the credit crunch on the horizon.

This has led to the tightening of the Brent/WTI spread to ~$3.60/bbl, down from $4.90/bbl just a few weeks ago and a return of $4.00/gallon gasoline here in Florida. So, any help that came on the inflation front from the US flooding the market with oil this year is done, dusted, buried and the shovel thrown away, for everyone.

Gasoline prices jumped out of the technical box the other day as well.

This is why Powell doesn’t see inflation coming down until 2025. Commodity prices are going higher because of a loss of confidence in governments getting their acts together. Securing supplies of tangible assets for future production will dominate markets just like it did coming out of the COVID-19 lockdowns.

CPI inflation lags moves in gasoline. by about six months.

Inflation is coming back hard this fall. Credit asset liquidations are just starting. Major policy changes like the BoJ’s reveal mispricing in fundamental markets. Old assumptions die, new theses take shape and a new tranche of players realize they are on the wrong side of the trade in a big, big way.

Capital is getting ready for a seismic shift coming around Labor Day here in the US.

Yellen is getting ready to flood the markets with USTs, Spending on Capitol Hill isn’t falling anytime soon, which means Powell has all the cover he needs to do whatever he wants to do.

Biden is in trouble and likely will be impeached by October, and Hungary is making noises that will change the EU forever. More on this next time.

Check and mate, Chrissy.

Original Post

Trading in financial instruments and/or cryptocurrencies involves high risks including the risk of losing some, or all, of your investment amount, and may not be suitable for all investors. Prices of cryptocurrencies are extremely volatile and may be affected by external factors such as financial, regulatory or political events. Trading on margin increases the financial risks.

Before deciding to trade in financial instrument or cryptocurrencies you should be fully informed of the risks and costs associated with trading the financial markets, carefully consider your investment objectives, level of experience, and risk appetite, and seek professional advice where needed.

Fusion Media would like to remind you that the data contained in this website is not necessarily real-time nor accurate. The data and prices on the website are not necessarily provided by any market or exchange, but may be provided by market makers, and so prices may not be accurate and may differ from the actual price at any given market, meaning prices are indicative and not appropriate for trading purposes. Fusion Media and any provider of the data contained in this website will not accept liability for any loss or damage as a result of your trading, or your reliance on the information contained within this website.

It is prohibited to use, store, reproduce, display, modify, transmit or distribute the data contained in this website without the explicit prior written permission of Fusion Media and/or the data provider. All intellectual property rights are reserved by the providers and/or the exchange providing the data contained in this website.

Fusion Media may be compensated by the advertisers that appear on the website, based on your interaction with the advertisements or advertisers.