ECB Meeting Unlikely To Be A Game Changer

Danske Markets | Jun 06, 2019 03:48AM ET

Market movers today

Focus in markets remains on US trade talks - with short-term emphasis on Mexico, see latest here - and speculation of central bank easing for most notably the Fed.

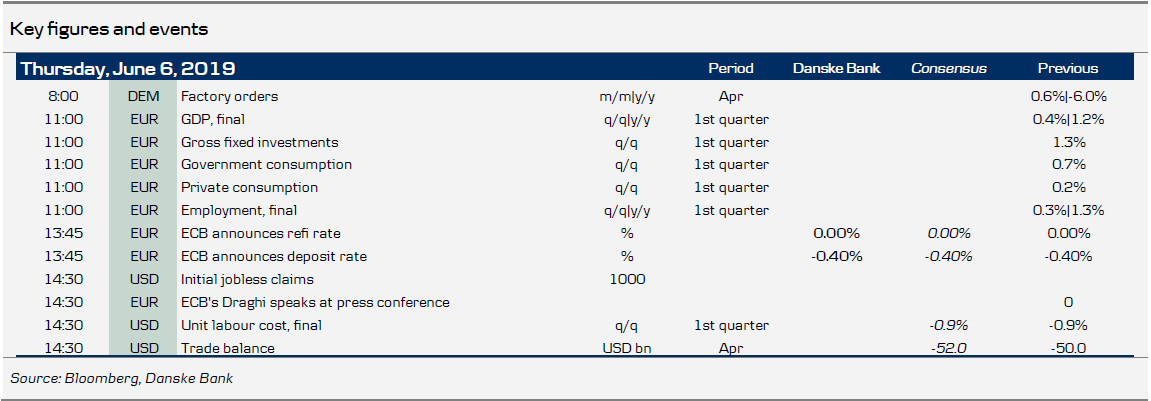

Today's highlight is the ECB meeting, with a policy statement to be released at 13:45 CEST and a press conference at 14:30 CEST. We expect the ECB to maintain its easing bias, with no new additional stimulus measures announced. The update of the staff projections is unlikely to change much for inflation, but we see a downside risk to the 2020-21 growth forecast from its already low level. We will also get more information on the TLTRO3 terms, which we expect to be favourable in light of the ongoing struggles of the economy. See our full preview here .

We will also get euro area GDP details for Q1 . We will closely monitor the domestic demand drivers and see how they fared; private consumption and fixed investments were probably strong judging from the German figures already released.

In the US , we get the jobless claims , which will attract attention ahead of tomorrow's NFP number amid contradicting labour market signals yesterday (see below). We expect initial jobless claims to come in at the low end.

Selected market news

Yesterday's US ADP (NASDAQ:ADP) report for May fell well short of market expectations with a monthly private job growth of only 24K - the weakest report since March 2010. Over the past years the ADP report has been a less-than-stellar predictor of the nonfarm release even if the moving average version has proven a better fit, see chart - showed a strong rise to 58.1, spreading doubt as to the reliability of the weak ADP signal. Rates markets subsequently reversed most of the US fixed income rally.

Brent crude temporarily dropped below USD60/bbl yesterday as the EIA's weekly inventory report showed a historically large increase in total US petroleum stocks. This raises concerns about waning US demand at a time when trade concerns have resurfaced. On the other hand, the latest price drop increases the likelihood of OPEC+ extending its output curbs.

The general election in Denmark gave a majority to the parties that support a new government under Social Democratic leadership. There still need to be negotiations and the shape of a new government is not a done deal. We do not expect any market impact. A new government does not mean a fundamental shift in economic policy, Denmark's EU membership is not in question, and any thoughts of joining the euro are far away.

Real Estate Norway house prices showed a monthly rise in national house prices in May of 0.5% s.a. This was a little stronger than expected and shows that rising disposable income growth is more than countering the housing headwinds from rising supplies, higher nominal rates, tight regulation, lower migration and lower population growth. We expect continued moderate house price growth in the coming months.

Fixed income markets

Today’s big question is whether Draghi, like Powell, will make a dovish turn and open up for more QE or rate cuts at today’s ECB meeting. In that respect, remember the ECB is already on an ‘easing bias’. But still it might be difficult to live up to dovish market expectations. We expect that the best the market can hope for is some favourable TLTRO modalities, potentially with an incentive structure to the level seen for the current deposit rate of -40bp. For more see our ECB cheat sheet and our ECB preview. We see short-end rates markets suffering initially, although we expect the low for longer/hunt for carry narrative to continue also after today. However, equity markets might suffer initially, which should add support to Bunds and push 10Y yields even lower.

The periphery including Italy, continued to perform yesterday and today Spain is set to sell a modest EUR2-3bn in the 3Y and 5Y benchmark bonds. Hence, there is modest SPGB risk coming to the market, which should support the auction. The drop in 10Y French yields to just 15bp has also fuelled speculation that Japanese investors will increasingly move to Spain. France will today tap the 8Y, 10Y, 17Y and 30Y bonds. Hence, there is a lot of French duration coming to the market. We continue to recommend 10Y Spain vs France.

FX markets

More dovish hints from the Fed and a weak ADP employment report temporarily sent EUR/USD up to 1.13 yesterday before the cross more than erased gains on the nonmanufacturing ISM. The market will likely need a significant dovish shift from the ECB today to be inclined to sell EUR/USD, i.e. rate cuts and/or QE on the table. We think the ECB will have a hard time living up to market expectations as it becomes clear that the Fed is one step ahead of ECB in the dovish shift. Hence, we do not look for the ECB to derail recent positive EUR/USD momentum.

Over a volatile day, USD/JPY ended slightly higher and thus joined in on the rally also seen in equities. We remain on the sidelines in buying this rally and expect declining oil prices to set the dominant theme for continued JPY strength. Our short-term forecast is 108 and we continue to see downside on this.

The NOK has come under renewed pressure from the drop in oil prices and hence yesterday our NOK/SEK trading recommendation hit our stop-profit level of 1.0825 (PnL +3.1% incl. carry). In the short term, the bearish oil sentiment in oil markets is testing our views of both a lower AUD/NOK and lower USD/NOK – but strategically we still like the trades on both the Norwegian macro case and in an environment where the Fed fully opens for rate cuts.

More specifically on Oceania FX, the AUD and NZD either weakened or gave back some gains in the end as commodities remain on a weak footing; not least the broad dollar strengthening late in the US session. Domestic data has been a bit better in these countries but against still-weak risk sentiment we do not expect to see a major rally in these crosses.

Trading in financial instruments and/or cryptocurrencies involves high risks including the risk of losing some, or all, of your investment amount, and may not be suitable for all investors. Prices of cryptocurrencies are extremely volatile and may be affected by external factors such as financial, regulatory or political events. Trading on margin increases the financial risks.

Before deciding to trade in financial instrument or cryptocurrencies you should be fully informed of the risks and costs associated with trading the financial markets, carefully consider your investment objectives, level of experience, and risk appetite, and seek professional advice where needed.

Fusion Media would like to remind you that the data contained in this website is not necessarily real-time nor accurate. The data and prices on the website are not necessarily provided by any market or exchange, but may be provided by market makers, and so prices may not be accurate and may differ from the actual price at any given market, meaning prices are indicative and not appropriate for trading purposes. Fusion Media and any provider of the data contained in this website will not accept liability for any loss or damage as a result of your trading, or your reliance on the information contained within this website.

It is prohibited to use, store, reproduce, display, modify, transmit or distribute the data contained in this website without the explicit prior written permission of Fusion Media and/or the data provider. All intellectual property rights are reserved by the providers and/or the exchange providing the data contained in this website.

Fusion Media may be compensated by the advertisers that appear on the website, based on your interaction with the advertisements or advertisers.