ECB Capping Rates On PIIGS? Wait Till Traders Call Its Bluff

EconMatters | Aug 20, 2012 01:28AM ET

The big buzz about the debt-embattled Euro Zone on an otherwise quiet Sunday came from German news magazine Der Spiegel that ECB is considering measures to cap the borrowing costs of the crisis-central PIIGS countries. According to Argentine to slowly dig themselves out of the hole. However, this is not the case for the Euro Zone.

This sugar-pill proposal of "unlimited bond purchases," if implemented, will most likely relieve the rate pressure in the short term, but the rudimentary issue is that the Euro Zone is nowhere near making these PIIGS countries to really commit to getting spending under control.

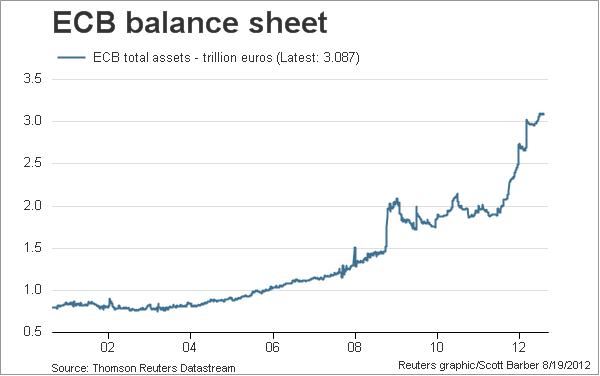

Now, ECB's balance sheet has ballooned to 3.087 trillion euros, or USD $3.8 trillion (See Chart Above), so the more important question is how much longer can ECB keep this bond buying spree?

Eventually traders and bond vigilantes will call ECB's bluff dragging down the entire Euro Zone, and here are some likely events that would follow:

- The problematic nations could continue piling on debt with ECB as the "sugar daddy."

- ECB would continue wasting good money (ultimately from the European taxpayers) on bad "solutions," instead putting into promoting GDP growth.

- Even if PIIGS countries come to agreements on austerity measures, that would still take a decade before any meaningful signs of recovery.

- Europe would be pushed deeper into a recession or even a depression.

Since the Euro Zone is bound by a single currency, the member countries in the zone sink or swim together. Market fears of the bloc's difficulties have prompted Moody's to threaten cutting the hard working and earning Germany's AAA sovereign credit rating.

For now, the Euro Zone will try to stay together for as long as they can. Kicking the can down the road is one thing world politicians love to do until it blows up in their faces, and that's when everything hits the fan-- fast and furious.

Trading in financial instruments and/or cryptocurrencies involves high risks including the risk of losing some, or all, of your investment amount, and may not be suitable for all investors. Prices of cryptocurrencies are extremely volatile and may be affected by external factors such as financial, regulatory or political events. Trading on margin increases the financial risks.

Before deciding to trade in financial instrument or cryptocurrencies you should be fully informed of the risks and costs associated with trading the financial markets, carefully consider your investment objectives, level of experience, and risk appetite, and seek professional advice where needed.

Fusion Media would like to remind you that the data contained in this website is not necessarily real-time nor accurate. The data and prices on the website are not necessarily provided by any market or exchange, but may be provided by market makers, and so prices may not be accurate and may differ from the actual price at any given market, meaning prices are indicative and not appropriate for trading purposes. Fusion Media and any provider of the data contained in this website will not accept liability for any loss or damage as a result of your trading, or your reliance on the information contained within this website.

It is prohibited to use, store, reproduce, display, modify, transmit or distribute the data contained in this website without the explicit prior written permission of Fusion Media and/or the data provider. All intellectual property rights are reserved by the providers and/or the exchange providing the data contained in this website.

Fusion Media may be compensated by the advertisers that appear on the website, based on your interaction with the advertisements or advertisers.