ECB Accelerates Its Asset Purchases, Gold Needs Fed To Follow Suit

Sunshine Profits | Mar 16, 2021 01:01PM ET

The ECB accelerated its asset purchases, but unless the Fed follows suit, gold may continue its bearish trend.

On Thursday, March 11, the to accelerate its asset buying under the Pandemic Emergency Purchase Program:

Based on a joint assessment of financing conditions and the inflation outlook, the Governing Council expects purchases under the PEPP over the next quarter to be conducted at a significantly higher pace than during the first months of this year.

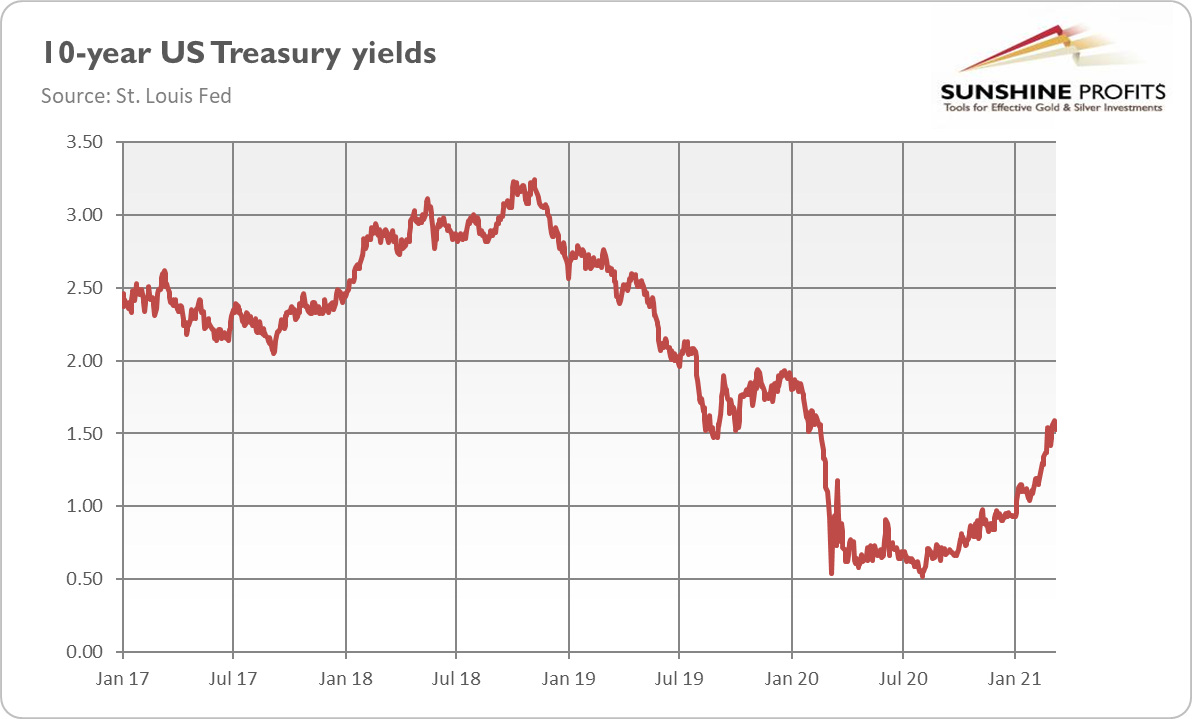

The decision came after a rise in the European Christine Lagarde was unafraid that increasing borrowing costs could hamper the economic recovery, so she decided to talk down the bond yields.

Indeed, the growth forecasts for the EU have deteriorated recently amid the persistence of the interest rates could additionally drag down the already fragile economic recovery:

Market interest rates have increased since the start of the year, which poses a risk to wider financing conditions. Banks use risk-free interest rates and sovereign bond yields as key references for determining credit conditions. If sizeable and persistent, increases in these market interest rates, when left unchecked, could translate into a premature tightening of financing conditions for all sectors of the economy. This is undesirable at a time when preserving favourable financing conditions still remains necessary to reduce uncertainty and bolster confidence, thereby, underpinning economic activity and safeguarding medium-term price stability.

Implications For Gold

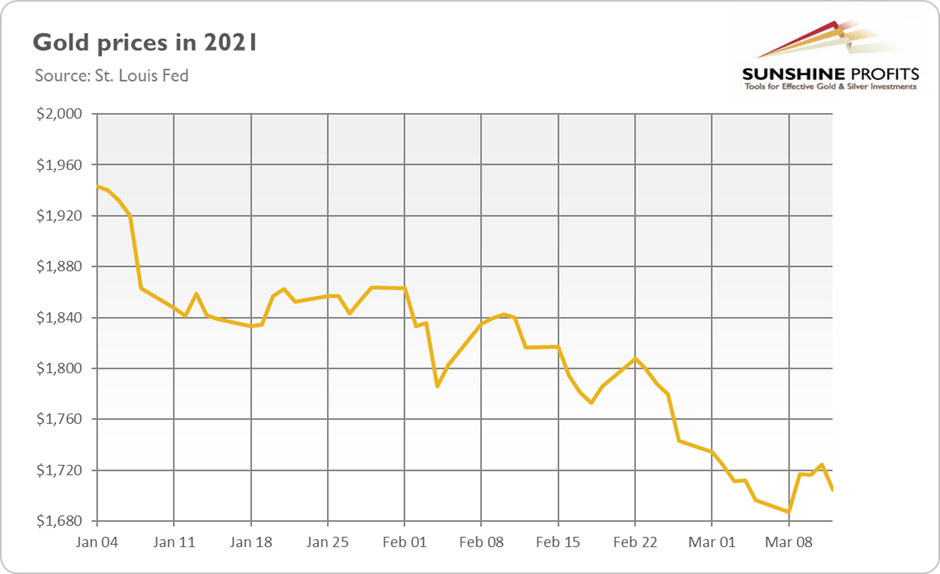

What does this all mean for gold prices? Well, the ECB’s move should prove rather negative for the price of gold, at least initially. This is because the loosening of the European monetary policy could weaken both the euro and gold against the U.S. dollar. Indeed, as the chart below shows, although the price of gold increased on Thursday, it declined one day later.

Moreover, the acceleration in the ECB’s greenback at the expense of the yellow metal.

On the other hand, the fact that the ECB has intervened in the markets – announcing acceleration in the pace of its asset-buying program, after a certain rebound in the bond yields – could turn out to be positive for gold prices, at least in the long run. This is because it shows how fragile the modern economies are and how dependent they have become on cheap borrowing guaranteed by the central banks.

As I noticed earlier in the past, we are in the yield curve control.

So far, only the ECB has intervened in the markets, but other central banks could follow suit. This week, the bearish trend .

Trading in financial instruments and/or cryptocurrencies involves high risks including the risk of losing some, or all, of your investment amount, and may not be suitable for all investors. Prices of cryptocurrencies are extremely volatile and may be affected by external factors such as financial, regulatory or political events. Trading on margin increases the financial risks.

Before deciding to trade in financial instrument or cryptocurrencies you should be fully informed of the risks and costs associated with trading the financial markets, carefully consider your investment objectives, level of experience, and risk appetite, and seek professional advice where needed.

Fusion Media would like to remind you that the data contained in this website is not necessarily real-time nor accurate. The data and prices on the website are not necessarily provided by any market or exchange, but may be provided by market makers, and so prices may not be accurate and may differ from the actual price at any given market, meaning prices are indicative and not appropriate for trading purposes. Fusion Media and any provider of the data contained in this website will not accept liability for any loss or damage as a result of your trading, or your reliance on the information contained within this website.

It is prohibited to use, store, reproduce, display, modify, transmit or distribute the data contained in this website without the explicit prior written permission of Fusion Media and/or the data provider. All intellectual property rights are reserved by the providers and/or the exchange providing the data contained in this website.

Fusion Media may be compensated by the advertisers that appear on the website, based on your interaction with the advertisements or advertisers.