Draghi Sets Up A New Tune For June

Jeremy Cook | May 09, 2014 05:31AM ET

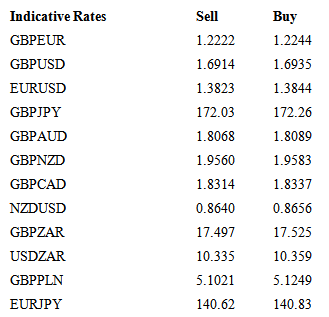

While no policy shifts occurred yesterday from either the Bank of England or the European Central Bank, to say it was an uneventful day would be incorrect. EUR/USD collapsed from a high of 1.3993 to the early 1.38s and GBPEUR came within 15 or so pips of its year-to-date highs as it was the ECB press conference that got traders interested.

Mario Draghi’s latest press conference ended with the European single currency in hard reverse. What made it do that? Initially the President’s press conference started out as a complete copy of his pronouncements in April; risks to the Eurozone economy remained to the downside, that inflation would remain subdued into the medium term and that the European Central Bank was ready to act swiftly if needed. So far, so similar.

The line however that engineered the euro’s decline was that the ECB “was comfortable acting in June if needs be”. This is the first time I can remember that we see some form of calendar date given by President Draghi and certainly heightens expectations that the ECB has got its act together. Whether this means that we will see some form of asset purchase plan from Frankfurt next month will remain to be seen but a cut in interest rates to 0.0% probably won’t be enough.

June’s meeting comes with fresh inflation and growth expectations and, despite the recent boost to inflation caused by Easter, should we see the longer-term inflation picture remain below the European Central Bank’s target of 2%, the likelihood of action will only increase.

Central bank policy has never been the clearest form of communication; last year’s ‘taper tantrum’ when the Federal Reserve hinted at tightening policy, and the frequent changes to the Bank of England and the Fed’s own forward guidance policies are evidence enough of this. Draghi has made a rod for his own back with these latest comments and, unless we see some form of positive inflation surprise at the end of this month, then monetary policy is likely to be cut and the euro should follow it lower.

All of this makes the Bank of England look very staid with policy once again held this month as the MPC continues to plough a furrow of inaction. The economy is pounding along at a decent rate, inflationary pressures seem to have subsided for now at least, the jobs market is improving well and the MPC will continue to adopt an approach of “Don’t move it! I’ve only just got the damn thing working…”

As we pointed out before the publication of the minutes of last month’s meeting, we expect policy to remain on hold for around 12 months from now but that does not mean that dissenting voices on a number of issues will not come to the fore earlier. The key risk to the ‘no change’ camp will be rising real wages. Wages matched inflation in April for the first time in 5 years and should this continue, the calls for a pre-Christmas rise will only grow louder.

Dollar was helped in its quest to push EUR/USD lower by a decent initial jobless claims number. Claims were 26,000 better than last week’s figures, which look to have been swelled by the Easter holidays. The improvement in the US jobs market is still seen as gradual but encouragement is always welcome for us USD bulls.

Chinese yuan has remained quiet overnight despite inflation falling to an 18 month low in April. Domestic demand seems to be the issue with falling commodity prices depressing industrial sector prospects. Lower inflation gives the Chinese authorities a broader remit for stimulatory action should they decide to increase support.

Today’s data calendar is chock full of UK data with trade balance and industrial/manufacturing releases out at 09.30. Export orders have remained strong according to PMI surveys while the strong pound and increasing investment numbers have allowed for stronger imports. The overall numbers may be a wash but we are looking for the trade balance to remain at around a £3bn deficit.

Manufacturing and industrial output numbers are expected to continue their recent good run and may convince more economy watchers that the recovery is stronger and better balanced than before. A strong number will see calls for UK Q1 GDP to be revised higher than the preliminary 0.8%.

Trading in financial instruments and/or cryptocurrencies involves high risks including the risk of losing some, or all, of your investment amount, and may not be suitable for all investors. Prices of cryptocurrencies are extremely volatile and may be affected by external factors such as financial, regulatory or political events. Trading on margin increases the financial risks.

Before deciding to trade in financial instrument or cryptocurrencies you should be fully informed of the risks and costs associated with trading the financial markets, carefully consider your investment objectives, level of experience, and risk appetite, and seek professional advice where needed.

Fusion Media would like to remind you that the data contained in this website is not necessarily real-time nor accurate. The data and prices on the website are not necessarily provided by any market or exchange, but may be provided by market makers, and so prices may not be accurate and may differ from the actual price at any given market, meaning prices are indicative and not appropriate for trading purposes. Fusion Media and any provider of the data contained in this website will not accept liability for any loss or damage as a result of your trading, or your reliance on the information contained within this website.

It is prohibited to use, store, reproduce, display, modify, transmit or distribute the data contained in this website without the explicit prior written permission of Fusion Media and/or the data provider. All intellectual property rights are reserved by the providers and/or the exchange providing the data contained in this website.

Fusion Media may be compensated by the advertisers that appear on the website, based on your interaction with the advertisements or advertisers.