Dow Breaks Out; Russell Adds To Gains; NASDAQ 100 In Focus

Declan Fallon | Oct 03, 2017 12:14AM ET

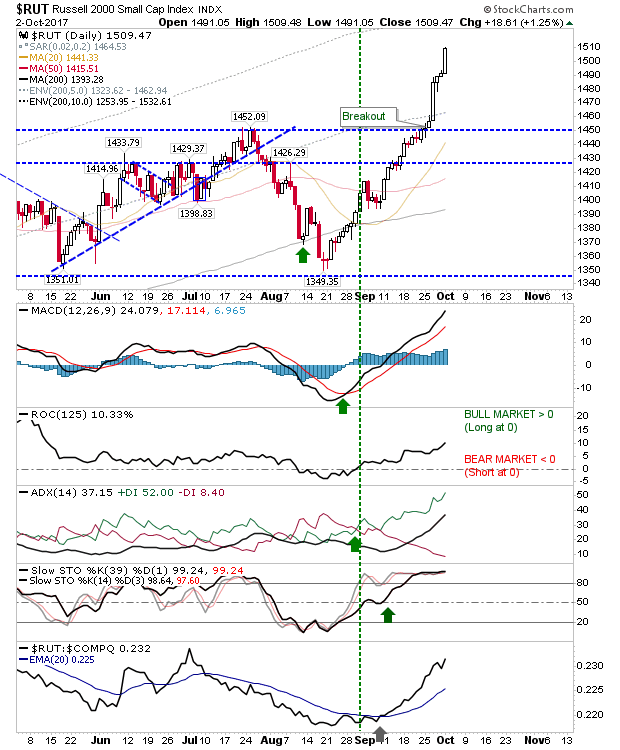

The Dow followed in the footsteps of other indices by mounting a breakout but it was the Russell 2000 which stole the limelight yesterday.

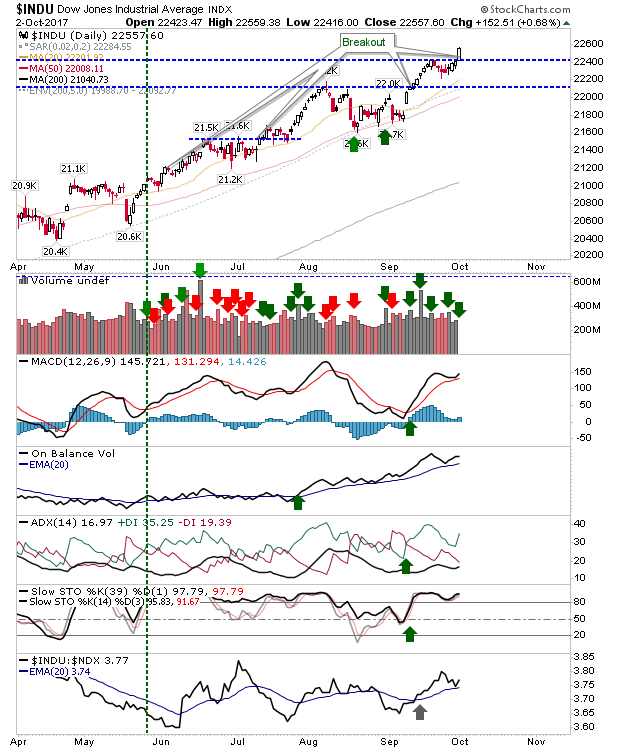

Starting with the Dow, it made a straightforward break to new highs on higher volume accumulation. Technicals remain in good shape.

But yesterday was also a day where there was an acceleration in the gains of the Russell 2000; this is a rally which has gone from the lows of 1,344 in August, to 1,509 at the start of October and doesn't look like it will be stopping anytime soon. Historic extremes for this index don't kick in until the Russell 2000 gets to 1,560. Small Cap strength is important marker of economic strength and offers an opportunity for money rotation into Large Cap indices down the road (when bulls tire of chasing gains in the Russell 2000).

We are still watching for a breakout in the NASDAQ 100. Yesterday came close to clearing 6,000 - a move likely to coincide with a new MACD trigger 'buy'

Finally, the S&P 500 remains on course to test channel resistance. Technicals remain firm.

For today, keep an eye on the NASDAQ 100. This is the index offering something for bulls.

Trading in financial instruments and/or cryptocurrencies involves high risks including the risk of losing some, or all, of your investment amount, and may not be suitable for all investors. Prices of cryptocurrencies are extremely volatile and may be affected by external factors such as financial, regulatory or political events. Trading on margin increases the financial risks.

Before deciding to trade in financial instrument or cryptocurrencies you should be fully informed of the risks and costs associated with trading the financial markets, carefully consider your investment objectives, level of experience, and risk appetite, and seek professional advice where needed.

Fusion Media would like to remind you that the data contained in this website is not necessarily real-time nor accurate. The data and prices on the website are not necessarily provided by any market or exchange, but may be provided by market makers, and so prices may not be accurate and may differ from the actual price at any given market, meaning prices are indicative and not appropriate for trading purposes. Fusion Media and any provider of the data contained in this website will not accept liability for any loss or damage as a result of your trading, or your reliance on the information contained within this website.

It is prohibited to use, store, reproduce, display, modify, transmit or distribute the data contained in this website without the explicit prior written permission of Fusion Media and/or the data provider. All intellectual property rights are reserved by the providers and/or the exchange providing the data contained in this website.

Fusion Media may be compensated by the advertisers that appear on the website, based on your interaction with the advertisements or advertisers.