Dow 20,000 Only A Matter Of Time: No Pain, No Gain

EconMatters | Feb 23, 2013 01:26AM ET

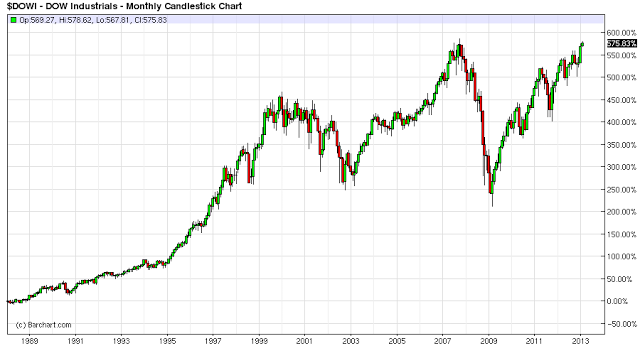

We are 200 points from breaking a new high in the Dow Industrials, which got me looking back at assets over the last 25 years in relation to the value of the US Dollar Index, and the overall money supply.

25 years in Markets

Some of the best performing assets are the stock market, gasoline with bonds and housing putting in steady gains. Of course, as with all assets you get a whole lot more bang for your buck if you happen to time the market correctly. And assets like Stocks, Housing and Gasoline all have crash periods where Dow components go bankrupt and are replaced, homeowners lose their homes and in the financial crash any Gasoline investor would have been forced out of the market.

Need to be Invested

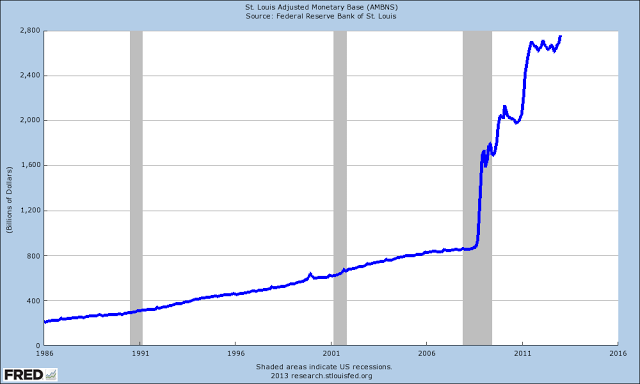

But make no mistake, the long-term trend is that you want to be invested in something that appreciates in value. You can get out of it if you need to as in liquid, and it is going to be attractive to other investors over the long haul. But you have to be invested to take advantage of the trend of the growing money supply, currency in circulation and the printing press phenomenon that ultimately underlies all asset values.

Your Grandpa was on to something

Whether it is the price of a car, a new house, gasoline, a movie ticket or a good stock there is going to be more money created each year chasing these assets in the system. This represents the phenomenon of “when I was a kid a coke cost a nickel”, or you could buy a home or a vehicle in the 1950`s for prices that are unrecognizable today.

Dow 20,000 only a matter of time

Looking back at history of markets, if we take the Dow Industrials, there is no doubt we are going to blow past Dow 15,000, 16,000, 17,000 and so on based upon currency creation effects alone. The fact that markets are liquid, capital will flow in and out, and there will be major pullbacks. Those who fail to get market time will be crushed occasionally,but make no mistake - Dow 20,000 is a foregone conclusion.

If we filter out the noise which is considerable at times, the unmistakable point is that most assets appreciate over time. The last 25 years show quite clearly in Gold, Lean Hogs, Real Estate, Stocks and Energy the benefit of being invested, especially in relation to the ever-present growing money supply in the economy.

I would say that if the economy cooperates even modestly over the next three years, the Dow 20,000 milestone will be reached. How soon we get there will depend upon other variables for sure, but watch how the market performs once we break through the 14,200 level, and start putting in new highs in the other indexes. The pace can really take off once markets are in unchartered territory, and we can start taking 1000 point monthly clips that will leave you speechless.

And of course Dow 20,000 isn`t going to happen without some pain along the way, but make no mistake it will happen, and it is closer than you think! We are on the verge of taking that next leg up in the Dow, in fact, we should set a new high pretty soon; enjoy the ride as this breakout has been a long time coming.

Trading in financial instruments and/or cryptocurrencies involves high risks including the risk of losing some, or all, of your investment amount, and may not be suitable for all investors. Prices of cryptocurrencies are extremely volatile and may be affected by external factors such as financial, regulatory or political events. Trading on margin increases the financial risks.

Before deciding to trade in financial instrument or cryptocurrencies you should be fully informed of the risks and costs associated with trading the financial markets, carefully consider your investment objectives, level of experience, and risk appetite, and seek professional advice where needed.

Fusion Media would like to remind you that the data contained in this website is not necessarily real-time nor accurate. The data and prices on the website are not necessarily provided by any market or exchange, but may be provided by market makers, and so prices may not be accurate and may differ from the actual price at any given market, meaning prices are indicative and not appropriate for trading purposes. Fusion Media and any provider of the data contained in this website will not accept liability for any loss or damage as a result of your trading, or your reliance on the information contained within this website.

It is prohibited to use, store, reproduce, display, modify, transmit or distribute the data contained in this website without the explicit prior written permission of Fusion Media and/or the data provider. All intellectual property rights are reserved by the providers and/or the exchange providing the data contained in this website.

Fusion Media may be compensated by the advertisers that appear on the website, based on your interaction with the advertisements or advertisers.