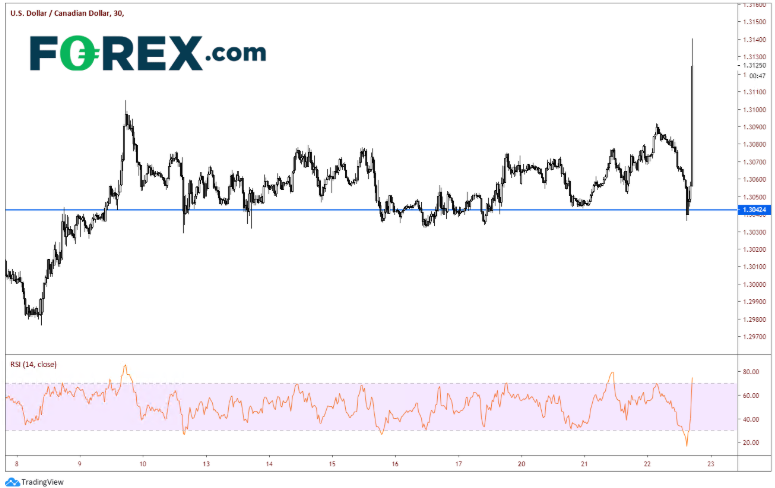

Dovish BoC Sends USD/CAD Soaring

Forex.com | Jan 22, 2020 01:04PM ET

The Bank of Canada met earlier today and left its benchmark interest rate unchanged at 1.75%, as expected. However, the dovish statement which accompanied the decision sent USD/CAD higher by nearly 100 pips as the Central Bank removed the description of interest rates as “appropriate”. The BOC also showed concerns about recent weak data and expressed concerns as to whether it was tied to the domestic economy or the world economy. In addition, they cut the near term GDP for 2020 to 1.6% from 1.8%, while raising the 2021 forecast to 2.0% from 1.8%.

Combine this with release of the poor CPI data this morning and is was a recipe for disaster for the Canadian Dollar. (CPI MoM for December was 0.0% vs 0.1% expected. Core CPI YoY was 1.7% vs 1.9% expected).

Upon release of the statement, USD/CAD pairs took off like a bat out of hell.

Source: All Charts Tradingview, FOREX.com

Previously the BOC had been quite neutral, one of the few Central Banks to remain so. USD/CAD had recently broken lower out of its long-term symmetrical triangle on a daily timeframe. With the move higher today, the pair is looking to test the underside of bottom trendline and the 200 Day Moving Average, which converge near 1.3220. A break above here would indicate a false breakdown and could lead to a test of the upper trendline near 1.3330.

On a 240-minute timeframe, the pair moved to the 50% retracement level from the highs on November 19th, 2019 to the lows on December 31st at 1.3142. Resistance crosses above at the 61.8% retracement level of the same time period near 1.3186. There is also horizontal resistance near 1.3230, which confluences with the previously mentioned 200-day moving average and the long-term trendline. Support now is at previous highs near 1.3100, as well as horizontal support near 1.3020, before returning to the December 31st lows at 1.2954.

On Friday Retail Sales for November will be released. 0.4% is expected for the headline vs -1.2% last. In addition, next week we will see GDP and PPI. The Bank of Canada doesn’t meet again until March 4th. If the data over the next 1 ½ months continues to remain weak, the BOC may be ready to cut rates (if not before then!).

Trading in financial instruments and/or cryptocurrencies involves high risks including the risk of losing some, or all, of your investment amount, and may not be suitable for all investors. Prices of cryptocurrencies are extremely volatile and may be affected by external factors such as financial, regulatory or political events. Trading on margin increases the financial risks.

Before deciding to trade in financial instrument or cryptocurrencies you should be fully informed of the risks and costs associated with trading the financial markets, carefully consider your investment objectives, level of experience, and risk appetite, and seek professional advice where needed.

Fusion Media would like to remind you that the data contained in this website is not necessarily real-time nor accurate. The data and prices on the website are not necessarily provided by any market or exchange, but may be provided by market makers, and so prices may not be accurate and may differ from the actual price at any given market, meaning prices are indicative and not appropriate for trading purposes. Fusion Media and any provider of the data contained in this website will not accept liability for any loss or damage as a result of your trading, or your reliance on the information contained within this website.

It is prohibited to use, store, reproduce, display, modify, transmit or distribute the data contained in this website without the explicit prior written permission of Fusion Media and/or the data provider. All intellectual property rights are reserved by the providers and/or the exchange providing the data contained in this website.

Fusion Media may be compensated by the advertisers that appear on the website, based on your interaction with the advertisements or advertisers.