Don’t Get Boxed In: Containerboard Sees Drop In Prices

Wall Street Daily | Jan 31, 2016 01:33AM ET

You know that major commodities have taken a huge hit, but did you know that prices of everyday commodities, such as the material that goes into making the lowly cardboard box, have also cratered?

As a result, the stocks of the companies that make these materials were bludgeoned this week.

For instance, International Paper Company (N:IP), the world’s largest paper producer, has seen its share prices fall the most in six years.

Inventories Mount

Given stronger-than-expected December box shipments and the increased demand for packaging enhanced by online shopping , you’d think that containerboard prices would be stable or rising. But this hasn’t been the case.

Currently, there’s too much supply relative to demand – and supply is increasing, too.

Sound familiar? This is what happened to crude oil and other commodities, as well. And since it takes energy to make most commodities, lower energy prices naturally beget lower commodity prices.

According to Pulp and Paper Products Council’s publication, Pulp & Paper Week, prices for containerboard are estimated to fall as much as $20 per ton from December levels.

In the most recent report, Pulp & Paper Week revealed that global pulp deliveries increased by 9.3% to 4.29 million tonnes in December, up from 3.92 million tonnes in November. Shipments were also 5.6% higher than the same period a year ago, due to increased deliveries of bleached softwood kraft pulp and bleached hardwood kraft pulp.

Meanwhile, global producer inventories stood at 35 days of supply in December.

The strength of the U.S. dollar has also been a major hit to the industry, weakening the competitiveness of exports and hurting demand for packaging materials in the United States.

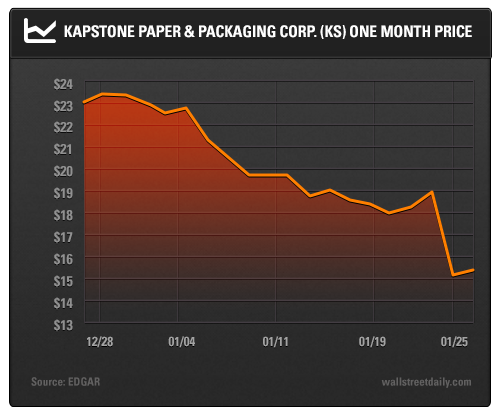

Other stocks that have seen their prices fall in recent days include Packaging Corporation of America (N:PKG), KapStone Paper and Packaging (N:KS), Kimberly-Clark Corporation (N:KMB), and Weyerhaeuser Company (N:WY).

Winners and Losers

The upside to the containerboard decline is that some industries will benefit from cheaper cardboard box prices.

Corrugated raw material is used by everyone from delivery businesses such as the United Parcel Service Inc (N:UPS) and FedEx Corporation (N:FDX) to home and office supply companies like The Home Depot Inc (N:HD) and Staples Inc (O:SPLS).

And who can forget everyone’s favorite box from Domino`s Pizza Group Plc (N:DPZ)!

So don’t get boxed into thinking this is all bad news. Rather, trade your longs and shorts wisely.

Good Investing,

Trading in financial instruments and/or cryptocurrencies involves high risks including the risk of losing some, or all, of your investment amount, and may not be suitable for all investors. Prices of cryptocurrencies are extremely volatile and may be affected by external factors such as financial, regulatory or political events. Trading on margin increases the financial risks.

Before deciding to trade in financial instrument or cryptocurrencies you should be fully informed of the risks and costs associated with trading the financial markets, carefully consider your investment objectives, level of experience, and risk appetite, and seek professional advice where needed.

Fusion Media would like to remind you that the data contained in this website is not necessarily real-time nor accurate. The data and prices on the website are not necessarily provided by any market or exchange, but may be provided by market makers, and so prices may not be accurate and may differ from the actual price at any given market, meaning prices are indicative and not appropriate for trading purposes. Fusion Media and any provider of the data contained in this website will not accept liability for any loss or damage as a result of your trading, or your reliance on the information contained within this website.

It is prohibited to use, store, reproduce, display, modify, transmit or distribute the data contained in this website without the explicit prior written permission of Fusion Media and/or the data provider. All intellectual property rights are reserved by the providers and/or the exchange providing the data contained in this website.

Fusion Media may be compensated by the advertisers that appear on the website, based on your interaction with the advertisements or advertisers.