Dollar Strength: Ongoing Headwind For Emerging Market Equities

Blog of HORAN Capital Advisors | Oct 07, 2015 12:45AM ET

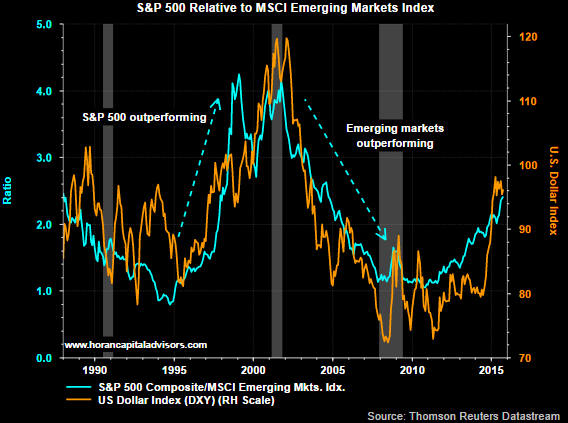

Since mid 2011 emerging market equities began to underperform the U.S. equity market (S&P 500 Index). Earlier this year we noted in a post, Emerging Markets Not Out Of The Woods Yet, the headwind a stronger U.S. dollar can have on emerging market equity performance.

The updated chart below continues to show the accelerated strengthening of the dollar (orange line) and the underperformance of the MSCI Emerging Markets Index relative to the S&P 500 Index.

|

| From The Blog of HORAN Capital Advisors |

The U.S. dollar tends to move in an average cycle of about eight years and this cycle is about four years old. A number of factors can contribute to a stronger dollar. One factor is a higher interest rate trend in the U.S. and the Fed's desire to raise rates continues to place an upward bias on the dollar.

Investors seem to be taking note of the headwind facing the emerging markets as ETF fund outflows have accelerated. Yesterday, in a Bloomberg report , it was noted:

- Outflows from U.S. exchange-traded funds that invest in emerging markets more than doubled last week, with redemptions exceeding $12 billion in the third quarter.

- Withdrawals from emerging-market ETFs that invest across developing nations as well as those that target specific countries totaled $566.1 million compared with outflows of $262.1 million in the previous week.

- The losses marked the 13th time in 14 weeks that investors withdrew money from emerging market ETFs and left the funds down $12.4 billion for the quarter, the most since the first quarter of 2014, when outflows reached $12.7 billion. For September, emerging market ETFs suffered $1.9 billion of withdrawals.

As difficult as it can be to predict currency moves, getting the directional call correct will likely be a factor that influences emerging market returns over the next several years. A stronger Dollar will serve as a headwind and a weaker one could be a positive for emerging market equities.

Trading in financial instruments and/or cryptocurrencies involves high risks including the risk of losing some, or all, of your investment amount, and may not be suitable for all investors. Prices of cryptocurrencies are extremely volatile and may be affected by external factors such as financial, regulatory or political events. Trading on margin increases the financial risks.

Before deciding to trade in financial instrument or cryptocurrencies you should be fully informed of the risks and costs associated with trading the financial markets, carefully consider your investment objectives, level of experience, and risk appetite, and seek professional advice where needed.

Fusion Media would like to remind you that the data contained in this website is not necessarily real-time nor accurate. The data and prices on the website are not necessarily provided by any market or exchange, but may be provided by market makers, and so prices may not be accurate and may differ from the actual price at any given market, meaning prices are indicative and not appropriate for trading purposes. Fusion Media and any provider of the data contained in this website will not accept liability for any loss or damage as a result of your trading, or your reliance on the information contained within this website.

It is prohibited to use, store, reproduce, display, modify, transmit or distribute the data contained in this website without the explicit prior written permission of Fusion Media and/or the data provider. All intellectual property rights are reserved by the providers and/or the exchange providing the data contained in this website.

Fusion Media may be compensated by the advertisers that appear on the website, based on your interaction with the advertisements or advertisers.