Dollar's Softer Tone Deepens

MarketPulse | Apr 17, 2018 06:19AM ET

Tuesday April 17: Five things the markets are talking about

Despite geopolitical concerns lingering in the background, investor focus is back on corporate earnings and on a number of Fed speakers this week.

Overnight, China data showed that their economy expanded in line in Q1 (GDP q/q: +1.4% vs. +1.4%e), March retail sales came in stronger than expected (y/y +10.1% vs. +9.7%e), while industrial production missed estimates (+6% vs. +6.3%e).

The greenback remains under pressure, falling to its lowest level in two months against G7 countries, after President Trump accused Russia and China of devaluing their currencies, contradicting an assessment from the Treasury Department.

Global sovereign yields continue to edge a tad higher and West Texas crude futures drifted higher toward $67 a barrel.

On Tap: The next NY Fed head, John Williams, speaks on “the economic outlook” in Madrid today (09:15 EDT), while Fed Governor Randal Quarles is to speak in Washington. President Trump will meet Japan’s PM Abe and expect N. Korea and trade to be discussed.

1. Stocks mixed results

In Japan, the Nikkei ended little changed overnight as the market turned a tad cautious ahead of today’s Trump/Abe meeting in Mar-a-Largo. The Nikkei share average ended up +0.1% after trading in negative territory for most of the session, while the broader Topix fell -0.4%.

Down-under, Aussie shares closed flat on Tuesday, as gains in material and telecom stocks were offset by financials. In S. Korea, the KOSPI closed lower, falling -0.2%.

In China, stocks fell further overnight amid concerns over trade tensions between China and the US, and as investors’ pondered China’s GDP data for Q1. The CSI 300 index fell -1.5%, while the Shanghai Composite Index lost -1.4%. In Hong Kong, the Hang Seng Index closed lower by -0.8%.

In Europe, regional indices trade higher across the board following on from yesterday’s stronger US trade and stronger futures this morning. The FTSE is underperforming on the overall strength of sterling over the past few sessions.

US stocks are set to open in the black (+0.3%).

Indices: STOXX 600 +0.3% at 378.7, FTSE flat at 7199, DAX +0.7% at 12472, CAC 40 +0.3% at 5329, IBEX 35 +0.4% at 9807, FTSE MIB +0.6% at 23467, SMI +0.4% at 8764, S&P 500 Futures +0.3%

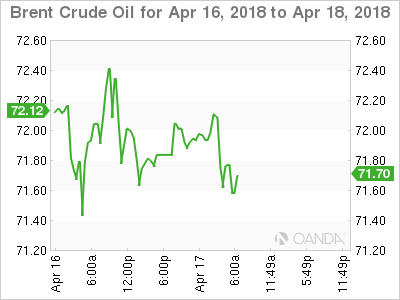

2. Oil prices rise amid risk of supply disruptions, gold stronger

Oil prices are better bid amid worries there could be a high risk of disruptions to supply, especially in the Middle East.

Brent crude oil futures are at +$71.75 per barrel, up +33c cents, or +0.5%, from yesterday’s close. US West Texas Intermediate (WTI) crude futures are up +36c, or +0.5%, at +$66.58 a barrel.

Traders remain concerned about a potentially spreading conflict in the Middle East, renewed US sanctions against Iran and falling output as a result of political and economic crisis in Venezuela.

Note: Oil markets have generally been well supported this year, with Brent up by around +16% from it’s 2018-low in February, due to healthy demand, supported by OPEC’s supply cuts aimed at tightening the market.

Gold prices rise as the dollar slips to its lowest in nearly three-weeks. The metal is also supported by festering worries over US/China trade tensions. Spot gold has gained +0.2% to +$1,347.81 an ounce, while US gold futures are steady at +$1,350.60 an ounce.

3. Yields continue to back up

Sovereign bond prices have edge lower again, lifting yields overnight, as the market shrugs off coordinated missile attacks in Syria.

Also supporting higher US yields is the FOMC minutes last week showing officials leaning towards a slightly faster pace of tightening at their March meeting as their growth outlook and confidence in hitting inflation targets strengthened.

Yields on both German 10-Year and United States 10-Year government bonds are both at their highest level in four-weeks.

In Japan, government bond prices remain mixed ahead of today’s closely watched meeting between PM Abe and Trump.

The yield on US 10-year notes increased +1 bps to +2.84%. In Germany, the 10-year Bund yield climbed +1 bps to +0.53%, while in UK the 10-Year Gilt yield gained +1 bps to +1.463%, the highest in three-weeks.

4. Dollar softer tone deepens

The ‘mighty’ USD continues to remain soft against the G10 trading pairs.

EUR/USD (€1.2379) briefly probed new three-week highs above the psychological €1.24 level before consolidating. The techies see key resistance seen at €1.2470 and break above could ignite upside momentum.

GBP/USD (£1.4320) probed its highest level since the Brexit as it tested the £1.4375 area. However, the pound's sound gains evaporate after February earnings data missed expectations. The Bank of England (BoE) is expected to raise interest rates in May. Dealers noted that UK CPI pressures might have peaked, but the upcoming inflation report is expected to support.

5. UK jobless rate lowest since 1975

Data in the U.K this morning showed that the unemployment rate declined in February to its lowest level in more than 40 years, while wage growth strengthened.

The jobless rate declined to +4.2% in the three months through February, compared with +4.3% in the three months through January.

Digging deeper, the fall was driven by a rise in employment, while the number of people not seeking work registered a small decline.

Wage growth ex-bonuses accelerated to an annual +2.8% during the three-month period, the fastest rate of growth in three years, driven by higher pay settlements in construction and manufacturing.

Note: This data would suggest that the BoE should remains on track to hike rates in May.

Original Post

Trading in financial instruments and/or cryptocurrencies involves high risks including the risk of losing some, or all, of your investment amount, and may not be suitable for all investors. Prices of cryptocurrencies are extremely volatile and may be affected by external factors such as financial, regulatory or political events. Trading on margin increases the financial risks.

Before deciding to trade in financial instrument or cryptocurrencies you should be fully informed of the risks and costs associated with trading the financial markets, carefully consider your investment objectives, level of experience, and risk appetite, and seek professional advice where needed.

Fusion Media would like to remind you that the data contained in this website is not necessarily real-time nor accurate. The data and prices on the website are not necessarily provided by any market or exchange, but may be provided by market makers, and so prices may not be accurate and may differ from the actual price at any given market, meaning prices are indicative and not appropriate for trading purposes. Fusion Media and any provider of the data contained in this website will not accept liability for any loss or damage as a result of your trading, or your reliance on the information contained within this website.

It is prohibited to use, store, reproduce, display, modify, transmit or distribute the data contained in this website without the explicit prior written permission of Fusion Media and/or the data provider. All intellectual property rights are reserved by the providers and/or the exchange providing the data contained in this website.

Fusion Media may be compensated by the advertisers that appear on the website, based on your interaction with the advertisements or advertisers.