Dollar Rallies, Gold Corrects Then Resumes Climb

Peter Krauth | Sep 23, 2020 12:17AM ET

After taking it on the chin for the last six months, the U.S. dollar now looks set to rally. Gold, on the other hand, is being dented, having recently traded back below $1,900.

Meanwhile, the dollar is already up nearly 1.5% since the start of September. That’s a big deal for the world’s reserve currency.

But if you consider what’s happened to the dollar since March, this could be the start of something bigger. In my recent articles, I’ve been telling you to watch for a relief rally in the dollar over the near-term.

I also said that could weigh on gold, generating some temporary weakness which would create an excellent opportunity to buy.

Well, it looks like we’re entering that period now, suggesting it will soon be time to put cash to work in the gold space.

Dollar Looks to Break Out

This recent 1.5% gain for the dollar has been a stealth rally so far. I suspect that’s because it’s small compared to the massive drop in the U.S. Dollar Index over the past six months.

In March the USDX peaked above 103 as COVID lockdowns went into full swing. By late August it had dropped 10.7%, scraping the 92 level. That’s a massive drop for any currency in such a short time, but it’s a very big deal for the world’s reserve currency.

I’m not saying it wasn’t deserved, especially given the trillions being printed to stimulate. But that also doesn’t mean it hasn’t become oversold in the near term.

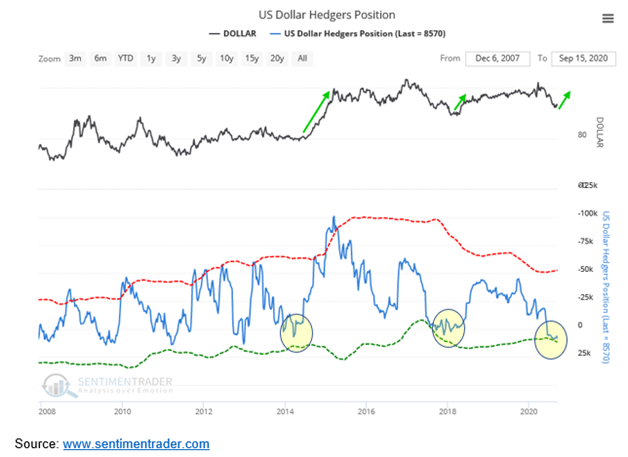

From the following chart, we see that “smart money” dollar hedgers have not been this bullish on the dollar since 2012.

The last few times dollar hedgers were similarly bullish, the dollar went on to generate noticeablerallies.And I think we could be in for a similar outcome this time as well.

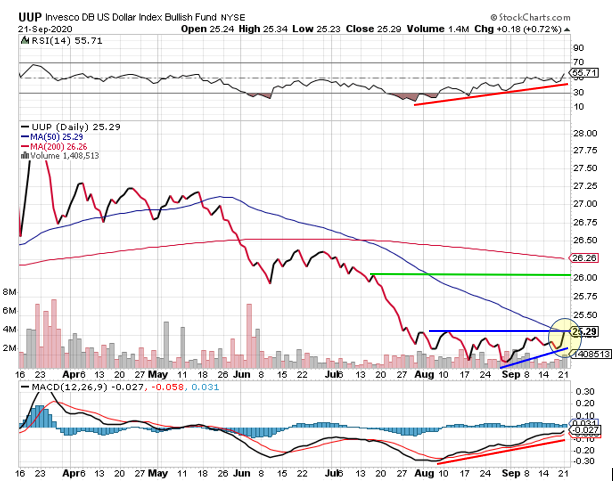

A quick analysis of the USDX price, using the Invesco DB US Dollar Index Bullish Fund (NYSE:UUP) as a proxy, provides some technical basis.

While UUP continued to trend downwards through late August, The RSI and MACD momentum indicators showed positive divergence as they had already started rising in late July or early August (red lines). The price action since late August has formed a bullish ascending triangle (blue lines).

The August 11 closing high was $25.31. If UUP closes above that level, it will be the first time since mid-May above its 50-day moving average while setting a new recent high. Should UUP be able to maintain that for a couple of days, then odds are we have anupside breakout.

My first target would be just above $26, which corresponds to about 96.25 on the USDX. That would be about a 3% gain over a couple of weeks, which is likely to weigh on gold.

It’s also worth noting a recent Reuters article highlighting the dollar’s tendency to rally around the time of U.S. elections. According to Ben Randol, G10 FX and rates strategist at BofA Global Research, since 1980 the USDX rose 7 of 10 times between the start of September and early December, gaining an average of 2.5%.

Gold Enters Weak Period

Looking at gold we see clear weakness has started in the last couple of trading days.

Gold has just traded back below its 50-day moving average, a move being confirmed by both the RSI and MACD which have also turned lower.

The first downside target level is likely to be near $1,800, which lines up with the rising support (green) line. The next support would be in the $1,750 - $1,760 range.

Examining gold stocks, the VanEck Vectors Gold Miners ETF (NYSE:GDX) appears to be confirming renewed weakness as well.

The RSI and MACD have both turned lower, confirming renewed weakness, with the GDX trading below its 50-day moving average for the first time since mid-June, a bearish signal.

If this persists, my first target would be $37, followed by the $33 - $34 range which lines up with the 200-day moving average.

There is also gold’s seasonality to consider as well. While not the strongest indicator, taken together with others, it can bolster the case for gold’s near-term direction.

Once again, we see that we’re heading into a period of typical seasonal weakness for gold.

If we consider gold’s bullish years since 2001, the metal has tended to find a bottom in mid-October.

So what’s gold likely to do next?

I’m not in the habit of agreeing with the proverbial “banksters”—even former ones. Still I must admit Lloyd Blankfein, former chair and CEO at Goldman Sachs, is right about gold.

He recently told the CME Group:

“It has been so long since these metals have played a role in financial markets as a store of value…But if there was ever a time where they would, it would be now.”

And Goldman itself is also firmly bullish on gold, saying in July their target is $2,300 per ounce within 12 months.

Remember, we still have a worsening COVID situation potentially leading to a 2nd wave and renewed lockdowns, as well as a likely chaotic U.S. election just 6 weeks away.

In my view, once this correction/consolidation is over, we’ll resume bull market action, taking gold to a new all-time high near $2,200 before the year is out.

For now, the gold bull market is just taking a breather. But it’s certainly far from over.

Trading in financial instruments and/or cryptocurrencies involves high risks including the risk of losing some, or all, of your investment amount, and may not be suitable for all investors. Prices of cryptocurrencies are extremely volatile and may be affected by external factors such as financial, regulatory or political events. Trading on margin increases the financial risks.

Before deciding to trade in financial instrument or cryptocurrencies you should be fully informed of the risks and costs associated with trading the financial markets, carefully consider your investment objectives, level of experience, and risk appetite, and seek professional advice where needed.

Fusion Media would like to remind you that the data contained in this website is not necessarily real-time nor accurate. The data and prices on the website are not necessarily provided by any market or exchange, but may be provided by market makers, and so prices may not be accurate and may differ from the actual price at any given market, meaning prices are indicative and not appropriate for trading purposes. Fusion Media and any provider of the data contained in this website will not accept liability for any loss or damage as a result of your trading, or your reliance on the information contained within this website.

It is prohibited to use, store, reproduce, display, modify, transmit or distribute the data contained in this website without the explicit prior written permission of Fusion Media and/or the data provider. All intellectual property rights are reserved by the providers and/or the exchange providing the data contained in this website.

Fusion Media may be compensated by the advertisers that appear on the website, based on your interaction with the advertisements or advertisers.