Dollar Looks To Fed Speakers For Direction; Eurozone And Canada Release CPI Data

XM Group | Feb 23, 2018 04:09AM ET

Here are the latest developments in global markets:

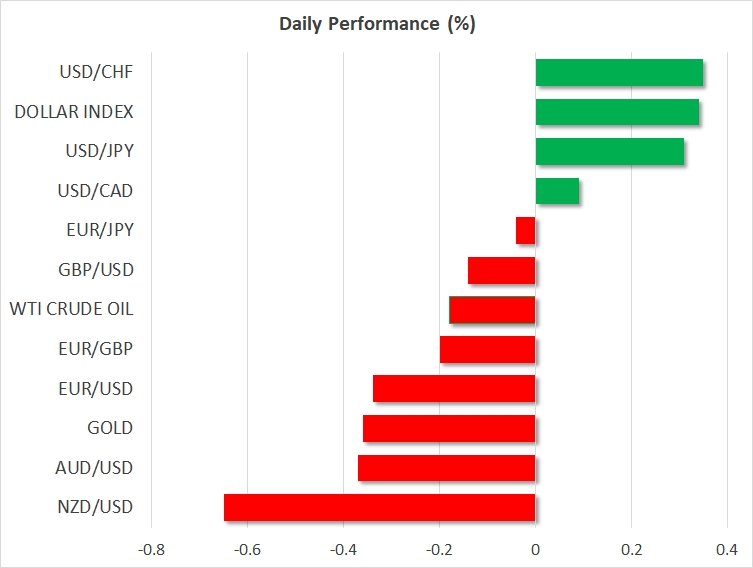

· FOREX: The dollar index was nearly 0.4% higher on Friday, recouping some of the losses it posted earlier on Thursday. Kiwi/dollar was a notable mover as well, tumbling 0.6% despite stronger-than-expected data out of New Zealand overnight.

· STOCKS: US markets were mixed on Thursday, providing yet another sign that investors’ risk sentiment remains quite fragile still. The Dow Jones closed 0.7% higher, but the S&P 500 was barely in the green, rising a mere 0.1%, while the NASDAQ Composite fell 0.1%, recording its fourth straight day of declines, albeit the benchmark’s losses were not sizable. That said, futures tracking the Dow, S&P, and NASDAQ 100 are all safely in positive territory at the moment, signaling that these indices may open higher today. In Asia, markets were a sea of green. Japan’s Nikkei 225 and TOPIX closed up 0.7% and 0.8% respectively, while in Hong Kong, the Hang Seng was higher by 1.0%. Meanwhile in Europe, futures of all the major indices were flashing green.

· COMMODITIES: In energy markets, oil prices were lower on Friday with both WTI and Brent crude declining 0.2%, giving back some of the gains they posted on Thursday after the weekly EIA inventory data showed a surprising drawdown in inventories. Today, oil traders will look to the release of the Baker Hughes oil rig count, in order to gauge whether the increase in US production continues unabated. In precious metals, gold was down almost 0.4%, last seen near the $1327 per ounce handle. Considering the absence of any major news lately on the geopolitical front to drive the yellow metal, its latest moves appear to be dictated solely by movements in the US dollar.

Major movers: Dollar whipsaws ahead of Fed speakers; ECB minutes pave the way for language shift

The US dollar climbed on Friday, regaining some of the ground it lost earlier on Thursday. Price action in the world’s reserve currency has been particularly choppy ever since the FOMC minutes were released on Wednesday, something that may be a reflection of investors’ indecisiveness regarding the outlook for US monetary policy. While the minutes were quite upbeat and heightened speculation that the Committee could deliver four quarter-point rate hikes this year, FOMC policymakers quickly stepped in to calm markets down yesterday.

St. Louis Fed President James Bullard (non-voter) pushed back against rate-hike expectations, noting that four hikes seem “like a lot” to him, and that for this to happen, “everything would have to go just right”. Although Bullard is a notorious dove on policy, other more neutral policymakers like Dallas Fed President Robert Kaplan (non-voter) also appeared quite cautious, indicating that his view of three hikes in 2018 could change, but only if economic data exceed his forecasts.

Without any major data on the US economic calendar today, the dollar will be looking for directional clues in the speeches of another four FOMC members, three of which hold voting rights this year. New York Fed President William Dudley (voter), Boston Fed President Eric Rosengren (non-voter), Cleveland Fed President Loretta Mester (voter) and San Francisco Fed President John Williams (voter) will all be delivering remarks. Investors will be looking for their outlook on policy in light of the latest acceleration in wages, as they try to gauge whether the Fed could upgrade its rate projections at the March meeting to signal four hikes in 2018.

The ECB minutes released yesterday confirmed some members wanted to alter the forward guidance around QE as early as at the January meeting. This enhances the case that the Bank may change its language in a more hawkish direction at the upcoming gathering in March. Euro/dollar spiked higher at the release, but quickly gave back its gains to trade lower in the following minutes.

Elsewhere, the Canadian dollar briefly stumbled yesterday, after the nation’s retail sales for December disappointed. The core print fell by 1.8%, missing its forecast for a rise by 0.3%, and likely generating speculation that the economy may have ended 2017 on a soft note. As for the antipodean currencies, kiwi/dollar was more than 0.6% lower today, even though New Zealand’s retail sales for the fourth quarter were surprisingly strong. Aussie/dollar fell 0.4%, pressured by the rebound in the greenback.

Day ahead: Eurozone and Canadian inflation due; Brexit developments eyed

Inflation figures out of the eurozone and Canada will perhaps be attracting most attention out of today’s economic calendar.

Krona pairs will be in focus as the Swedish central bank’s official record from its latest meeting will be made public at 0830 GMT.

The eurozone’s final inflation figures for January are scheduled for release at 1000 GMT. Headline CPI is expected to be confirmed at 1.3% y/y, this reflecting a slowdown relative to December. Month-on-month, headline inflation is forecast to have contracted by 0.9%. Core CPI, the inflation measure that is calculated after excluding volatile items, will also be watched. It should be kept in mind that prices in the euro area often decline in January, so one might be justified not to place too much emphasis – at least in terms of ECB policymaking – on Friday’s numbers.

Canadian inflation numbers for the month of January are due at 1330 GMT. On an annual basis, headline CPI is projected to have grown by 1.4%, easing from December’s 1.9%. The Bank of Canada has a target for annual inflation of 2% with a 1% band around it (i.e. a 1-3% target band). Core inflation as well as the measures of inflation utilized by the BoC in its policymaking – common, median and trimmed CPI – will be generating interest as well. Loonie pairs will be watched, with an upside surprise in the readings anticipated to boost the Canadian dollar as market participants are likely to push closer in time their expectations for additional monetary policy tightening by the BoC.

Deliberations between UK PM Theresa May and her cabinet on arriving at the type of post-Brexit trade deal the nation wants with the EU will be closely watched. Sterling has proved extremely sensitive to developments on this front in the past. Also in politics, a meeting between US President Donald Trump and Australian Prime Minister Malcolm Turnbull could be attracting interest. The former might attempt to enhance cooperation between the two countries in an effort to “counter-weight” Australia’s dependence on China and thus weaken the influence of the world’s second largest economy.

In terms of policymakers’ appearances: Bank of England Deputy Governor Dave Ramsden will be participating in a panel discussion on productivity and economic rebalancing at 1200 GMT. New York Fed President William Dudley and Boston Fed President Eric Rosengren will be talking on monetary policy at 1515 GMT; the former holds permanent voting rights within the FOMC, while the latter is not a voting member in 2018. ECB board member Benoit Coeure will be speaking at the 2019 US Monetary Policy Forum. Cleveland Fed President Loretta Mester will be participating in a panel discussion titled “A Review of the Objectives for Monetary Policy” at 1830 GMT and San Francisco Fed President John Williams will be speaking on the US economic outlook and monetary policy at 2040 GMT.

Oil traders will be paying attention to the US Baker Hughes oil rig count due at 1800 GMT.

In equities, companies releasing quarterly results will be attracting additional attention.

Technical Analysis: USD/CAD bullish bias seems to ease as markets await Canadian inflation data

USD/CAD reached a two-month high of 1.2755 during Thursday’s trading. The Tenkan- and Kijun-sen lines are positively aligned, pointing to a bullish bias for the pair. However, the Kijun-sen has flatlined, indicating that the positive short-term momentum may be easing. The RSI supports this view: the indicator is well into bullish territory above 50, though it has halted its advance and is moving sideways.

If Canadian inflation figures surprise to the upside, the pair is anticipated to retreat. USD/CAD could be finding support at the moment in the range between 1.2713 (the current level of the Tenkan-sen) and 1.2686 (a previous top). A violation of this range would shift the focus to the area around 1.2641 – where the Kijun-sen is situated at the moment – for additional support.

On the other hand, disappointing CPI figures could refuel the bullish momentum. In this case, the area around yesterday’s high of 1.2755 could act as a barrier to the upside.

Trading in financial instruments and/or cryptocurrencies involves high risks including the risk of losing some, or all, of your investment amount, and may not be suitable for all investors. Prices of cryptocurrencies are extremely volatile and may be affected by external factors such as financial, regulatory or political events. Trading on margin increases the financial risks.

Before deciding to trade in financial instrument or cryptocurrencies you should be fully informed of the risks and costs associated with trading the financial markets, carefully consider your investment objectives, level of experience, and risk appetite, and seek professional advice where needed.

Fusion Media would like to remind you that the data contained in this website is not necessarily real-time nor accurate. The data and prices on the website are not necessarily provided by any market or exchange, but may be provided by market makers, and so prices may not be accurate and may differ from the actual price at any given market, meaning prices are indicative and not appropriate for trading purposes. Fusion Media and any provider of the data contained in this website will not accept liability for any loss or damage as a result of your trading, or your reliance on the information contained within this website.

It is prohibited to use, store, reproduce, display, modify, transmit or distribute the data contained in this website without the explicit prior written permission of Fusion Media and/or the data provider. All intellectual property rights are reserved by the providers and/or the exchange providing the data contained in this website.

Fusion Media may be compensated by the advertisers that appear on the website, based on your interaction with the advertisements or advertisers.