Dollar Licks Wounds, But Next Week Is A Big Test

MarketPulse | May 19, 2017 06:48AM ET

Friday May 19: Five things the markets are talking about

Global equities have inched higher overnight, while the ‘big’ dollar has held most of its gains on strong U.S economic data as some market risk appetite returns despite caution over political turbulence in the U.S.

Despite the rebound, investors remain on ‘high’ alert as they have become more sensitive to White House headlines and accusations as concerns grow over the strength of the global economy at a time when some Fed policy members are suggesting further tightening.

With no U.S data on the docket for today, the market will be preparing itself for a multiple event-risks in the week ahead. These events include the testimony by former FBI director James Comey at a Senate hearing and an OPEC meeting in Vienna, May 25.

Note: Federal Reserve Bank of St. Louis President James Bullard speaks to the Association for Corporate Growth at Washington University’s in St. Louis (09:15 EST).

1. Stocks find a small reprieve

Asian indices were mixed overnight, tracking a day of stabilization on Wall St. where equities recovered, treasury yields found support and Fed Funds futures outlook for a June hike was back above +70%.

In Japan, the Nikkei edged up (+0.2%) up on financial shares, but has managed to record its first weekly drop in five-weeks. The broader Topix index climbed +0.3%, after sliding -1.3% on Thursday. The gauge has lost -1.3% for the week.

Down-under, the Aussie S&P/ASX 200 Index fell -0.2% percent, capping its worst week since last November.

In Hong Kong, the Hang Seng Index rose +0.2% and the Shanghai Composite was little changed.

Brazil’s Ibovespa Index tumbled -8.8%, along with the BRL on Thursday, the most in seven-month, as a political crisis returned to the country after last year’s impeachment process. Brazil Supreme court has reportedly opened investigation into President Temer over obstruction of justice.

In Europe, indices are trading higher, tracking positive gains from Asia and the U.S yesterday. Financials are supporting the Eurostoxx, while commodity stocks are better supported on the FTSE 100.

U.S stocks are set to open in the black (+0.2%).

Indices: Stoxx50 +0.4% at 3233, FTSE +0.4% at 7465, DAX +0.4% at 12639, CAC 40 +0.6% at 5324, IBEX 35 +0.5% at 10737, FTSE MIB +0.6% at 21424, SMI +0.6% at 8990, S&P 500 Futures +0.2%

2. Oil prices climb on hopes output cuts would be extended, gold shines

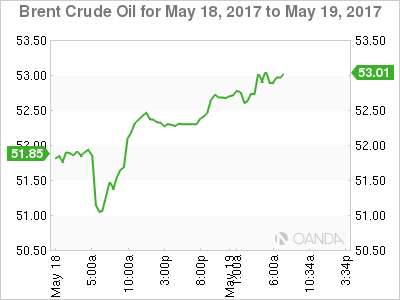

Ahead of the U.S open, oil futures are trading atop of their one month high on growing optimism that OPEC, and some non-OPEC members, will extend output cuts to curb a persistent glut in crude.

The key benchmarks are heading for their second week of gains.

Brent crude is up +28c, or +0.5%, at +$52.79 and is on track for a +4% climb this week, its second week of gains.

U.S light crude oil (WTI) is up +29c, or +0.6%, at +$49.64 a barrel, highest since April 26. The contract is also heading for a weekly increase of almost +4%.

OPEC ministers meet in Vienna on May 25 to decide production policy for the next six-months. The market is expecting producers to prolong their agreement to limit production, perhaps by up to nine-months.

Gold prices (+0.3% to +$1,250.46) have edged higher overnight and are on track for their biggest weekly gain since mid-April as the dollar softens and amid the ongoing political crisis in the U.S. The yellow metal slipped -1.1%yesterday due to profit taking in its biggest one-day percentage drop since May 3 to snap a five-day rally.

3. Global yield curves flatter on the week

Political anxiety surrounding the Trump presidency continues to stoke demand for haven bonds. This week it drove the yield on the 10-year Treasury note to trade atop of this years low yield set in April (+2.175%).

Adding support for U.S debt is the political crisis in Brazil. After the biggest one-day rally in 12-months on Wednesday, the pace of gains for U.S product seems to be somewhat moderating as we close out the week, and as U.S economic data point to improving growth outlook.

Note: The yield on U.S 10’s has climbed +1 bps to +2.24%. It ended Thursday flat after earlier sliding to as low as +2.18%.

Fed-funds futures are showing +74% odds that the central bank will raise short-term interest rates by its June 13-14 meeting, up from Wednesday’s +63% odds.

4. Dollar not out of the woods yet

The FX market continues to see some headwinds for the ‘mighty’ USD as the apparent disarray consuming President Trump’s Administration and possible impact on his agenda for the time being.

The EUR (€1.1167) is once again encroaching on the psychological €1.1200 handle on the back of stronger German inflation numbers (see below) and recent ECB speak appearing to have the central bank build the case for autumn QE decision

Sterling (£1.3010) is again making a test above the £1.30 handle. It has failed to get above the psychological level several times over the past week, however, to many, £1.3000 is the key pivot and now a lot of the structural shorts out there post-Brexit will be looking to wind back. Short-term sterling bulls are now targeting £1.3350/1.3400.

USD/JPY (¥111.51) was lower, trading down through ¥112 handle as the JPY currency is having its best week in more than a month aided by demand for safer assets.

5. German PPI records biggest jump in five years.

Euro data this morning shows that price pressure is building in German factories.

Producer prices jumped +3.4% year-on-year in April, marking the strongest gain since December 2011. Digging deeper, the increase was led by higher prices for intermediate goods, which rose +4.3%.

Note: In the last report, it was predominately energy prices that had largely supported the index.

However, ex-energy, Germany’s PPI rose sharply too. It was up +2.8% y/y, its strongest gain in six-years. Analysts are expecting rising factory-gate prices could further support German CPI, which hit +2% last month.

The markets focus now turns to the ECB and the possibility of when to begin ending QE.

Original post

Trading in financial instruments and/or cryptocurrencies involves high risks including the risk of losing some, or all, of your investment amount, and may not be suitable for all investors. Prices of cryptocurrencies are extremely volatile and may be affected by external factors such as financial, regulatory or political events. Trading on margin increases the financial risks.

Before deciding to trade in financial instrument or cryptocurrencies you should be fully informed of the risks and costs associated with trading the financial markets, carefully consider your investment objectives, level of experience, and risk appetite, and seek professional advice where needed.

Fusion Media would like to remind you that the data contained in this website is not necessarily real-time nor accurate. The data and prices on the website are not necessarily provided by any market or exchange, but may be provided by market makers, and so prices may not be accurate and may differ from the actual price at any given market, meaning prices are indicative and not appropriate for trading purposes. Fusion Media and any provider of the data contained in this website will not accept liability for any loss or damage as a result of your trading, or your reliance on the information contained within this website.

It is prohibited to use, store, reproduce, display, modify, transmit or distribute the data contained in this website without the explicit prior written permission of Fusion Media and/or the data provider. All intellectual property rights are reserved by the providers and/or the exchange providing the data contained in this website.

Fusion Media may be compensated by the advertisers that appear on the website, based on your interaction with the advertisements or advertisers.