Dollar Index Vulnerable As Fed Rate-Cut Odds Explode Higher

Faraday Research | Jun 03, 2019 01:11PM ET

The recent price action in the U.S. dollar has been interesting to say the least.

Since the start of 2018, the greenback has benefitted from a relative yield advantage over its G10 rivals, as well as its status as the world’s reserve currency, making it a beneficiary of “safe-haven” flows during times of global economic stress. Now, though, the pro-dollar tide may be shifting as traders start aggressively pricing in (at least) one rate cut by the Fed this year.

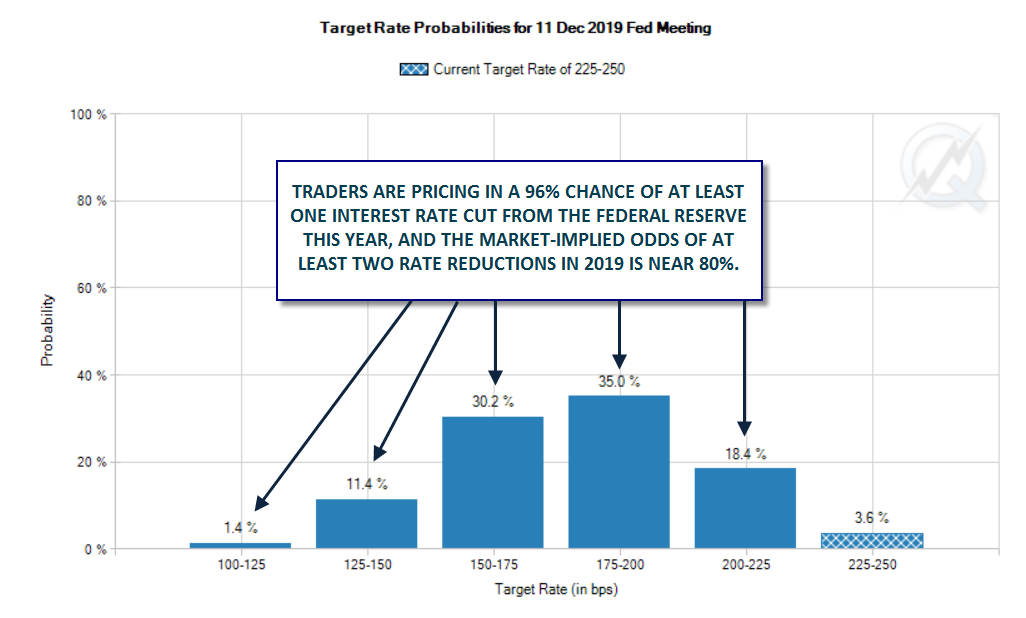

After last week’s developments, traders are now pricing in a 96% chance of at least one rate cut by December, according to the CME’s FedWatch tool. In fact, traders are pricing in a nearly 80% chance of two interest-rate reductions this year:

Source: CME, FOREX.com

While the Fed does meet later this month, the central bank hasn’t laid the groundwork for a move yet, so the next major meeting to watch will be in late July. As it stands, the market has discounted a roughly 50/50 chance of a rate cut at that meeting; those odds, and by extension the U.S. dollar’s strength, will be very sensitive to economic data and Fed comments over the next six to eight weeks.

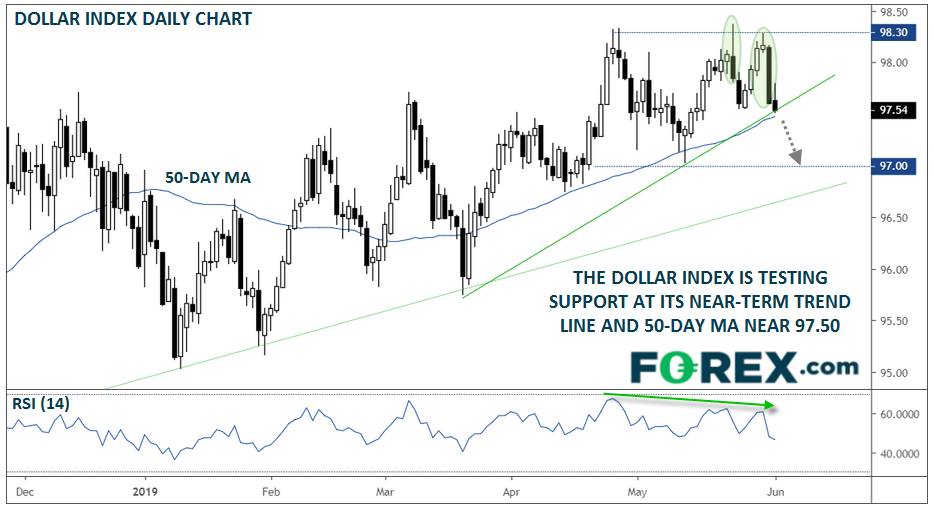

Technically speaking, the US dollar index has found a strong level of resistance near 98.30. The index has peaked on three separate occasions at that barrier, with prices forming textbook reversal patterns (bearish engulfing candle and an evening star setup) over the last two tests. Combined with the triple bearish divergence in the daily RSI indicator, there’s growing evidence that the dollar index has formed a durable top.

Source: TradingView, FOREX.com. Note this product may not be available to trade in all regions.

For this week, the key level to watch is near 97.50, where the 50-day moving average and near-term bullish trend line converge. A break and daily close below this support area could clear the way for a deeper retracement toward 97.00 or the mid-96.00s next. In terms of the major currency pairs, this could correspond to a move up toward the upper-1.12s in EUR/USD, 1.2750 in GBP/USD and a drop toward 107.50 in USD/JPY.

Trading in financial instruments and/or cryptocurrencies involves high risks including the risk of losing some, or all, of your investment amount, and may not be suitable for all investors. Prices of cryptocurrencies are extremely volatile and may be affected by external factors such as financial, regulatory or political events. Trading on margin increases the financial risks.

Before deciding to trade in financial instrument or cryptocurrencies you should be fully informed of the risks and costs associated with trading the financial markets, carefully consider your investment objectives, level of experience, and risk appetite, and seek professional advice where needed.

Fusion Media would like to remind you that the data contained in this website is not necessarily real-time nor accurate. The data and prices on the website are not necessarily provided by any market or exchange, but may be provided by market makers, and so prices may not be accurate and may differ from the actual price at any given market, meaning prices are indicative and not appropriate for trading purposes. Fusion Media and any provider of the data contained in this website will not accept liability for any loss or damage as a result of your trading, or your reliance on the information contained within this website.

It is prohibited to use, store, reproduce, display, modify, transmit or distribute the data contained in this website without the explicit prior written permission of Fusion Media and/or the data provider. All intellectual property rights are reserved by the providers and/or the exchange providing the data contained in this website.

Fusion Media may be compensated by the advertisers that appear on the website, based on your interaction with the advertisements or advertisers.