Dollar Fell On Yellen’s Dovish Testimony, While NZD Slumped As Inflation

Anthony Wu | Feb 24, 2015 06:22PM ET

Major currencies rebounded against the Dollar yesterday as Fed Chairwoman Yellen showed a slight dovish tone in her testimony to the Senate bank committee. AUD and CAD led the rises by over a 1% gain after the speech. On the other hand, the GBP barely changed as it is still suppressed by the 1.5480 level.

As I mentioned yesterday, Yellen’s monetary standpoint is biased to mild dovish. Yesterday’s testimony was in line with her position. She said Fed will stay patient and the rate hike is unlikely to happen in the next couple of meetings, which weakened the US Dollar. However, the chairwoman also mentioned that the change of guidance means Fed will discuss raising the interest rate once the economic data is strong enough. Market interprets this speech as a reminder that ‘patience’ will be deleted in March FOMC meeting.

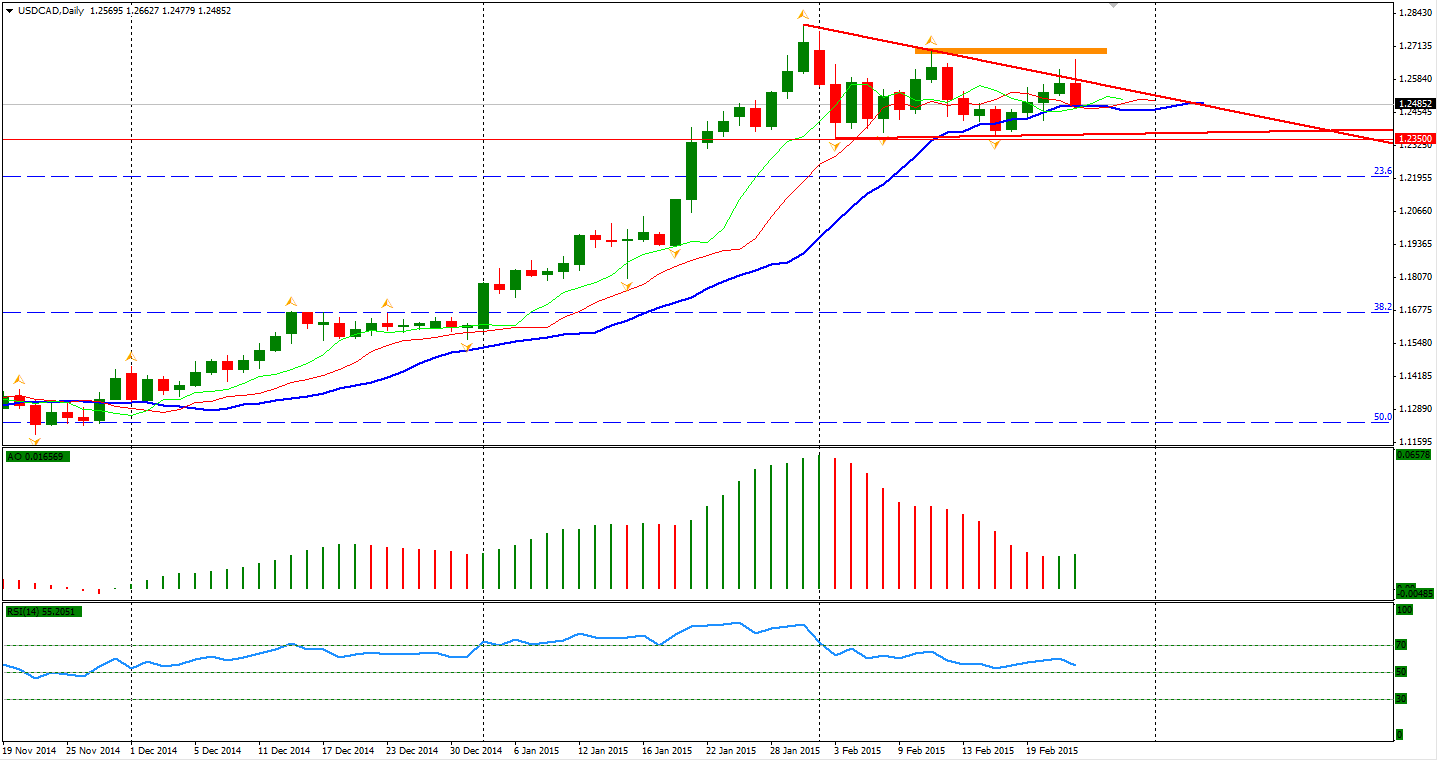

A major reversal of the USD did not happen last night as the reactions of the FX market were limited. The USD/CAD once broke the upside line of its recent triangle pattern but fell back later. It is still unclear whether the temporary breakout was successful. The consolidation can be seen as over if the pair moves above 1.27.

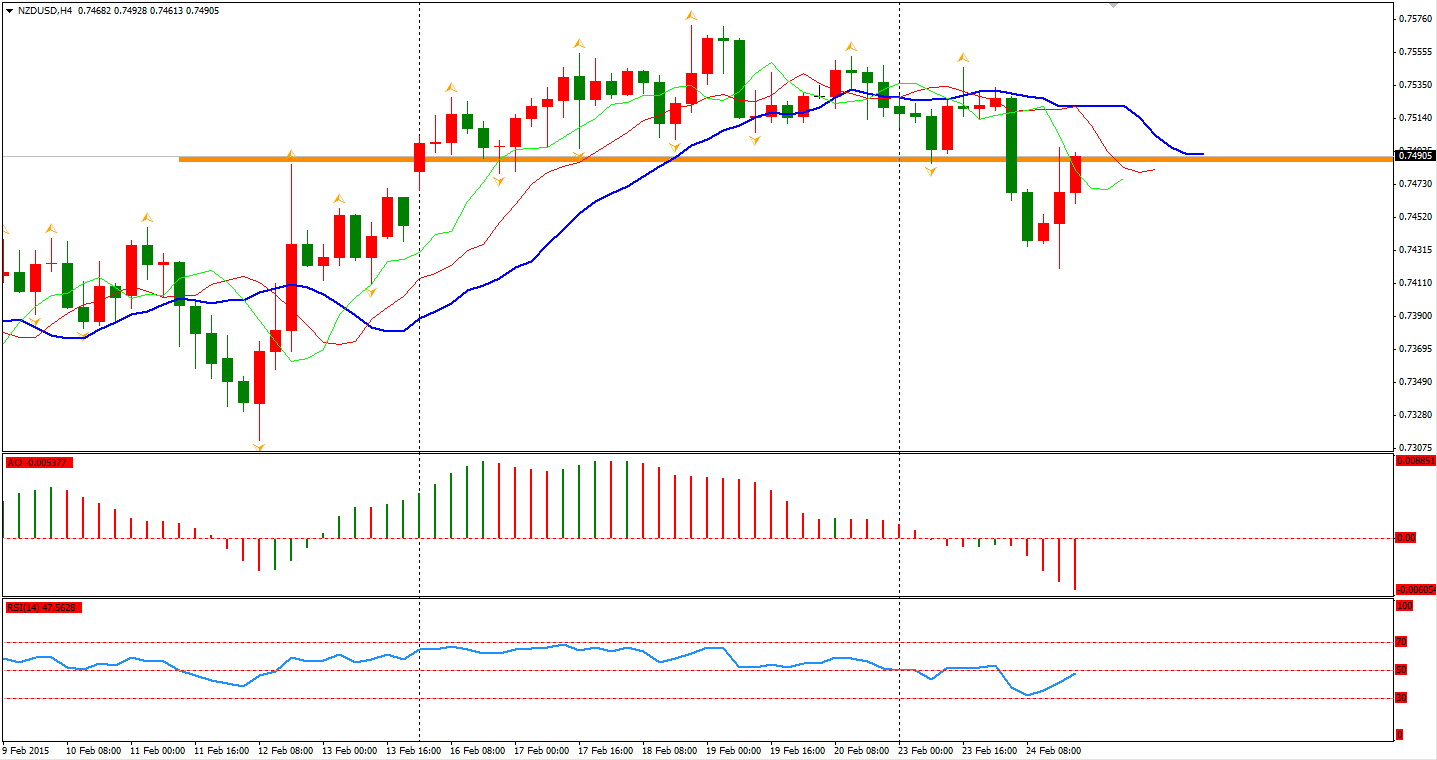

The New Zealand Dollar once slid almost 100 pips versus the USD after inflation expectations fell to 1.8% from 2.1% of previous quarter’s reading. It recovered half of its loss after Yellen’s speech but still cannot rise back above the 0.75 level. A head-and-shoulders pattern has been formed and NZD/USD remains bearish and may fall to previous lows of 0.73.

Looking to the stock markets, the Nikkei Stock Average gained 0.74% to 18603, once again refreshing its highest level of 15 years. Australia 200 rebounded 0.32% to 5927. In European markets, the UK FTSE 100 was up 0.54%, the German DAX climbed 0.67% and the French CAC 40 Index gained 0. 5%. The US stock indices broadly rose on Yellen’s dovish testimony. The S&P 500 closed 0.3% higher at 2115. The Dow gained 0.51% to 18209, and the Nasdaq Composite Index rose 0.14% to 4968.

On the data front, China HSBC Flash Manufacturing PMI will be released in the afternoon 12:45 AEDST. BOE Governor Carney will speak at 21:00 AEDST and Fed Chairwoman Yellen will testify before the House Financial Services Committee at 2:00 AEDST.

Trading in financial instruments and/or cryptocurrencies involves high risks including the risk of losing some, or all, of your investment amount, and may not be suitable for all investors. Prices of cryptocurrencies are extremely volatile and may be affected by external factors such as financial, regulatory or political events. Trading on margin increases the financial risks.

Before deciding to trade in financial instrument or cryptocurrencies you should be fully informed of the risks and costs associated with trading the financial markets, carefully consider your investment objectives, level of experience, and risk appetite, and seek professional advice where needed.

Fusion Media would like to remind you that the data contained in this website is not necessarily real-time nor accurate. The data and prices on the website are not necessarily provided by any market or exchange, but may be provided by market makers, and so prices may not be accurate and may differ from the actual price at any given market, meaning prices are indicative and not appropriate for trading purposes. Fusion Media and any provider of the data contained in this website will not accept liability for any loss or damage as a result of your trading, or your reliance on the information contained within this website.

It is prohibited to use, store, reproduce, display, modify, transmit or distribute the data contained in this website without the explicit prior written permission of Fusion Media and/or the data provider. All intellectual property rights are reserved by the providers and/or the exchange providing the data contained in this website.

Fusion Media may be compensated by the advertisers that appear on the website, based on your interaction with the advertisements or advertisers.