Does Black Friday Matter For Gains The Rest Of The Year?

Chris Kimble | Nov 29, 2015 01:29AM ET

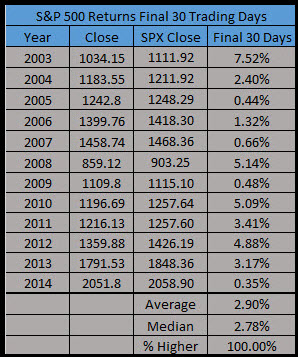

We are entering one of the most bullish times of the year historically. As we mentioned last week, the final 30 trading days of the year have been higher each of the last 12 years.

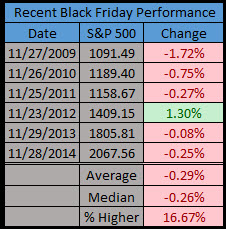

Getting to this past Friday, known as Black Friday – the official start to the holiday spending season. We’ve seen many stats that show this day isn’t quite as important as it once was. From many sales now starting on Thanksgiving, to Cyber Monday, tomorrow – there are other times people are looking for the best deals. Nonetheless, Black Friday always gets a lot of hype and we wanted to look to see if this day really mattered or not.

Recently, Black Friday has been rather weak – down five of the past six years.

Did it matter the past six years? Did a weak Black Friday hurt what happened in December? Not so much, as five of the past six years were in the green.

What about the week after Thanksgiving and Black Friday? Up six of the past seven years and up nearly half a percent on average going back 20 years.

Here’s how all Black Fridays have done going back 20 years and the subsequent S&P 500 performance the rest of the year. The rest of the year is usually bullish. In fact, 10 of the past 12 years have sported a gain after Black Friday till the end of the year and eight of the past nine years.

Lastly, does a good or bad Black Friday matter? Wouldn’t you know it, a red Black Friday bodes better for the rest of the year? In the end, when Black Friday is red, the rest of the year is higher by nearly a three-to-one margin and the median return is nearly twice as high.

The bottom line, Black Friday might get a lot of hype, but the end of the year is usually bullish for future gains.

Trading in financial instruments and/or cryptocurrencies involves high risks including the risk of losing some, or all, of your investment amount, and may not be suitable for all investors. Prices of cryptocurrencies are extremely volatile and may be affected by external factors such as financial, regulatory or political events. Trading on margin increases the financial risks.

Before deciding to trade in financial instrument or cryptocurrencies you should be fully informed of the risks and costs associated with trading the financial markets, carefully consider your investment objectives, level of experience, and risk appetite, and seek professional advice where needed.

Fusion Media would like to remind you that the data contained in this website is not necessarily real-time nor accurate. The data and prices on the website are not necessarily provided by any market or exchange, but may be provided by market makers, and so prices may not be accurate and may differ from the actual price at any given market, meaning prices are indicative and not appropriate for trading purposes. Fusion Media and any provider of the data contained in this website will not accept liability for any loss or damage as a result of your trading, or your reliance on the information contained within this website.

It is prohibited to use, store, reproduce, display, modify, transmit or distribute the data contained in this website without the explicit prior written permission of Fusion Media and/or the data provider. All intellectual property rights are reserved by the providers and/or the exchange providing the data contained in this website.

Fusion Media may be compensated by the advertisers that appear on the website, based on your interaction with the advertisements or advertisers.