Does A Government Shut Down Mean It's Time To Sell?

Cam Hui | Sep 30, 2013 12:24AM ET

As I write these words, ES futures are deeply red and it seems that we are on track for a shutdown of the US government. Is it time to get more cautious? Looking out over the next few weeks, I can't get overly excited about the drama in Washington. Here's why:

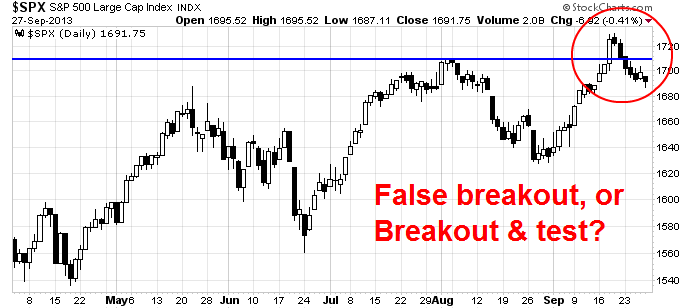

The big question for traders is, did the SPX stage a false breakout or is this more of a classic breakout and pullback technical test?

I tend to think that the latter case is the more likely one. Consider the Russell 2000 small caps, whose upside breakout has held above its resistance turned support level:

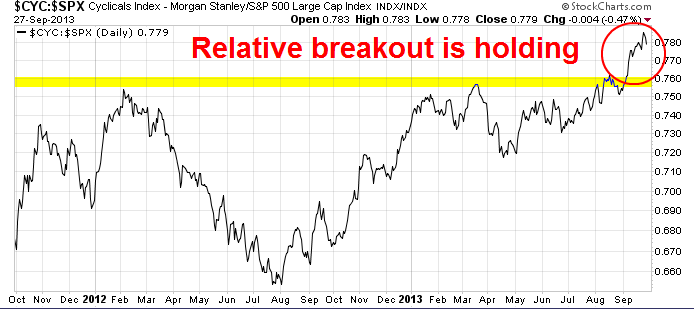

Cyclical stocks, as measured by the Morgan Stanley Cyclical Index, has staged an upside relative breakout and that breakout has also held up well. This is an indication of an improving global economy.

Across the Atlantic, the STOXX 600 also staged an upside breakout to new recovery highs. While that index has pulled back a bit, the breakout also held above its resistance turned support level after the German election of September 22.

My favorite indicator of Chinese strength is the AUD/CAD currency cross, as both are resource economies but Australia is more sensitive to China while Canada is more sensitive to US growth. The AUD/CAD rate broke out of a downtrend in early August and it remains in a minor uptrend, indicating strength in China's economy.

Near-term political risks

The fly in the ointment is the impasse in Washington. I don't have a lot to add to the analysis, but I'll quote a couple of people that I have much respect for. Anatole Kaletsky recently wrote (see Brian Gilmartin reports that forward 12 month earnings estimates fell last week. However, they had been steadily advancing for the previous few weeks. We'll have to see if the latest downtick is a blip or the start of a downtrend.

Until we see some macro event that derails the market, or the American consumer, who has been an engine of global growth and whose strength continues to surprise me, start to slow, the path of least resistance for stocks is up and I would view shutdown related weakness as an opportunity to add to equity positions.

Disclosure: Cam Hui is a portfolio manager at Qwest Investment Fund Management Ltd. (“Qwest”). The opinions and any recommendations expressed in the blog are those of the author and do not reflect the opinions and recommendations of Qwest. Qwest reviews Mr. Hui’s blog to ensure it is connected with Mr. Hui’s obligation to deal fairly, honestly and in good faith with the blog’s readers.”

None of the information or opinions expressed in this blog constitutes a solicitation for the purchase or sale of any security or other instrument. Nothing in this blog constitutes investment advice and any recommendations that may be contained herein have not been based upon a consideration of the investment objectives, financial situation or particular needs of any specific recipient. Any purchase or sale activity in any securities or other instrument should be based upon your own analysis and conclusions. Past performance is not indicative of future results. Either Qwest or I may hold or control long or short positions in the securities or instruments mentioned.

Trading in financial instruments and/or cryptocurrencies involves high risks including the risk of losing some, or all, of your investment amount, and may not be suitable for all investors. Prices of cryptocurrencies are extremely volatile and may be affected by external factors such as financial, regulatory or political events. Trading on margin increases the financial risks.

Before deciding to trade in financial instrument or cryptocurrencies you should be fully informed of the risks and costs associated with trading the financial markets, carefully consider your investment objectives, level of experience, and risk appetite, and seek professional advice where needed.

Fusion Media would like to remind you that the data contained in this website is not necessarily real-time nor accurate. The data and prices on the website are not necessarily provided by any market or exchange, but may be provided by market makers, and so prices may not be accurate and may differ from the actual price at any given market, meaning prices are indicative and not appropriate for trading purposes. Fusion Media and any provider of the data contained in this website will not accept liability for any loss or damage as a result of your trading, or your reliance on the information contained within this website.

It is prohibited to use, store, reproduce, display, modify, transmit or distribute the data contained in this website without the explicit prior written permission of Fusion Media and/or the data provider. All intellectual property rights are reserved by the providers and/or the exchange providing the data contained in this website.

Fusion Media may be compensated by the advertisers that appear on the website, based on your interaction with the advertisements or advertisers.