Do Stocks Have 2007-Like Problems?

Chris Ciovacco | Aug 06, 2013 04:35AM ET

After seeing stocks drop over 50% in both the 2000-2003 and 2007-2009 bear markets, investors are understandably hesitant to redeploy their hard-earned money back into stocks. Given the up and down nature of the markets over the last three years, many assume a major peak in stocks must be right around the corner. Is there evidence to support an imminent 2007-like peak in stocks?

Economy Not On Ropes

The global economy is far from robust currently, which has created lingering doubts. However, bear markets are typically associated with recessions. Monday’s economic news does not align with a negative growth story. From Wall Street Journal , things may be changing for the better:

The thaw in Europe’s long crisis could warm up its stock market Fresh survey data suggest the 17-country euro zone may be edging out of a long recession, even if just barely. Some favorable winds are blowing. European stocks are still relatively inexpensive. The companies behind them generate plenty of cash and pay solid dividends. And Europe itself is less of a worry than one might think: European companies, especially big ones, generate a greater proportion of sales outside Europe than their U.S. peers do overseas.

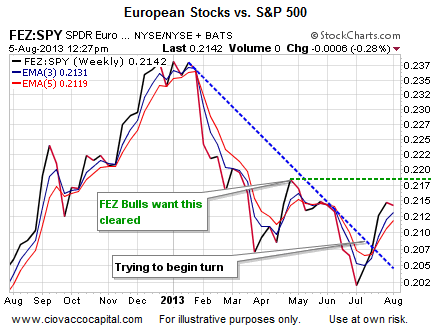

Until recently, European stocks have been lagging the S&P 500 noticeably in 2013. As shown in the chart below, the Euro Stoxx 50 (FEZ) has been gaining ground on the S&P 500 in recent weeks. We have not allocated any capital back to Europe yet, but we do have several European ETFs on our watch list.

Investment Implications

As outlined in detail in the video above, the present day tolerance for risk is much healthier than it was in October 2007. While the global economy is far from robust, it does not appear to be on the cusp of a bear market inducing recession. Therefore, unless conditions on the economic and technical fronts deteriorate in a meaningful way, we will continue to hold our broad positions in U.S. stocks (SCHB), and leading sectors, such as financials (XLF), technology (QQQ), small caps (IWM), and mid-caps (MDY).

Below you may find the video.

Trading in financial instruments and/or cryptocurrencies involves high risks including the risk of losing some, or all, of your investment amount, and may not be suitable for all investors. Prices of cryptocurrencies are extremely volatile and may be affected by external factors such as financial, regulatory or political events. Trading on margin increases the financial risks.

Before deciding to trade in financial instrument or cryptocurrencies you should be fully informed of the risks and costs associated with trading the financial markets, carefully consider your investment objectives, level of experience, and risk appetite, and seek professional advice where needed.

Fusion Media would like to remind you that the data contained in this website is not necessarily real-time nor accurate. The data and prices on the website are not necessarily provided by any market or exchange, but may be provided by market makers, and so prices may not be accurate and may differ from the actual price at any given market, meaning prices are indicative and not appropriate for trading purposes. Fusion Media and any provider of the data contained in this website will not accept liability for any loss or damage as a result of your trading, or your reliance on the information contained within this website.

It is prohibited to use, store, reproduce, display, modify, transmit or distribute the data contained in this website without the explicit prior written permission of Fusion Media and/or the data provider. All intellectual property rights are reserved by the providers and/or the exchange providing the data contained in this website.

Fusion Media may be compensated by the advertisers that appear on the website, based on your interaction with the advertisements or advertisers.