Crude’s Coming Collapse: 5 Reasons Oil Will Fall To $25 In 2016

Investing.com | Nov 16, 2015 12:04AM ET

By Jesse Cohen

Of late, oil market players have been grappling with one key question: are prices of the commodity in the process of bottoming, or will futures see a further collapse to new lows in 2016?

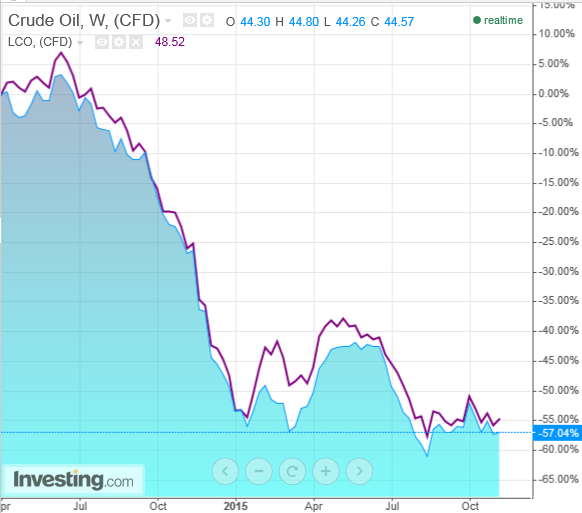

This past Friday, U.S. Crude futures ended the week at $40.70 a barrel, while Brent settled at $44.50. Just 18 months ago, in June 2014, a barrel of oil fetched more than $100.

So far in 2015, U.S. and Brent prices are down almost 18%. Dating back to June 2014, oil futures have lost approximately 60%. That’s a heart-stopping decline, and there’s no reason to believe it’s over yet.

Because of 5 bearish factors now dominating the market, I see oil prices falling even further in the coming year, to a range between $25-to-$35 a barrel.

1. Global oil production is outpacing demand following a boom in U.S. shale oil output and after a decision by the Organization of Petroleum Exporting Countries (OPEC) last year not to cut their supply quota (see chart, below). According to recent estimates, slowed to 226,500 barrels a day in September , the weakest growth rate over the last 8 months. The Asian nation is the world's second largest oil consumer after the U.S. and has been the driver of strengthening demand.

5. Oil prices will also face headwinds from a stronger U.S. dollar once the Federal Reserve starts hiking interest rates and tightening monetary policy. The policy shift, which many anticipate will be announced in December, is expected to boost the dollar and make dollar-denominated oil futures contracts more expensive for buyers who use other currencies.

All these factors indicate that a rebalance in supply and demand is distant, insuring that oil prices will stay low for a long time.

Technical analysis further supports this view. After breaking below a trend line dating back to 1999, bearish chart signals show there is no clear support until prices reach the $25-to-$30-level.

Based on the numerous fundamental and technical signals currently flashing across the broader economic spectrum, I believe oil prices will continue to spiral lower, likely bottoming at $25 a barrel in 2016.

Trading in financial instruments and/or cryptocurrencies involves high risks including the risk of losing some, or all, of your investment amount, and may not be suitable for all investors. Prices of cryptocurrencies are extremely volatile and may be affected by external factors such as financial, regulatory or political events. Trading on margin increases the financial risks.

Before deciding to trade in financial instrument or cryptocurrencies you should be fully informed of the risks and costs associated with trading the financial markets, carefully consider your investment objectives, level of experience, and risk appetite, and seek professional advice where needed.

Fusion Media would like to remind you that the data contained in this website is not necessarily real-time nor accurate. The data and prices on the website are not necessarily provided by any market or exchange, but may be provided by market makers, and so prices may not be accurate and may differ from the actual price at any given market, meaning prices are indicative and not appropriate for trading purposes. Fusion Media and any provider of the data contained in this website will not accept liability for any loss or damage as a result of your trading, or your reliance on the information contained within this website.

It is prohibited to use, store, reproduce, display, modify, transmit or distribute the data contained in this website without the explicit prior written permission of Fusion Media and/or the data provider. All intellectual property rights are reserved by the providers and/or the exchange providing the data contained in this website.

Fusion Media may be compensated by the advertisers that appear on the website, based on your interaction with the advertisements or advertisers.