Stock Market Sags To The Edge Of Oversold

Dr. Duru | Nov 02, 2016 06:12AM ET

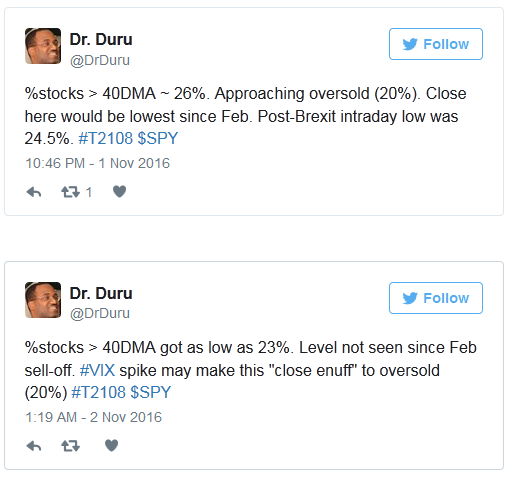

T2108 Status: 25.2% (as low as 22.9%)

T2107 Status: 52.3%

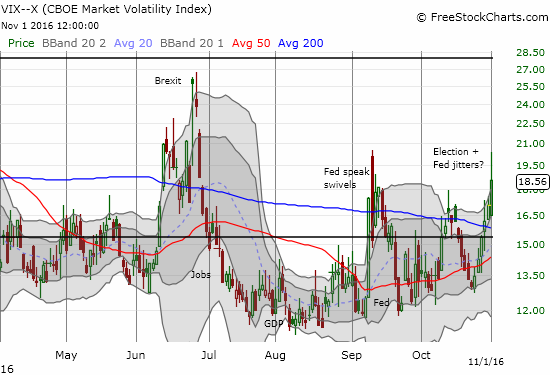

VIX Status: 18.6 (an 8.8% gain, the VIX was as high as 20.4)

General (Short-term) Trading Call: neutral (see caveats below)

Active T2108 periods: Day #177 over 20%, Day #3 under 30% (underperiod), Day #8 under 40%, Day #25 under 50%, Day #40 under 60%, Day #66 under 70%

Commentary

In my last T2108 Update, I described Friday’s rush to sell stocks in the wake of political headlines as overdone and an opportunity to fade volatility. I made this claim even while acknowledging that growing divergences in the stock market significantly raised the odds of an imminent tumble toward or into oversold territory for the stock market.

I was also a little hesitant to execute the fade because the volatility index, the VIX, had just popped over the 15.35 pivot and positioned itself to launch even higher. Sure enough, the VIX has gained two more days for a total of 6 straight days. The VIX is up 42.5% since the Monday of last week. At Tuesday's intraday high, the VIX had gained 56.9%.

The volatility index, the VIX, soared past the critical 20 level before fading hard.

As a reminder, a VIX of 20 is conventionally considered “high.” September’s burst of volatility could only produce an above 20 reading for part of the day. Brexit trading swivled around 20 before completely imploding. With T2108 – the percentage of stocks trading above their respective 40-day moving averages (DMAs) – tumbling toward oversold levels, I went back to work fading volatility.

T2108 dropped closer to oversold territory (below 20%) than it did in post-Brexit trading.

While the volatility spike is enticing to fade in of itself, I am mainly fading right now because of Wednesday’s pronouncement from the Fed on monetary policy. The Fed is typically careful to avoid generating volatility and even moreso when the market is hot and bothered going into the announcement.

When I faded volatility on Friday, I completely neglected to take into account the potential for volatility to continue rising right into the Fed announcement. With the U.S. Presidential election now around the corner, I will be VERY quick to take any profits I get from a post-Fed volatility implosion.

The S&P 500 (via SPDR S&P 500 (NYSE:SPY)) took a strong whack on a relative basis. While the index closed with a marginal 0.7% loss, it broke down to a new 4-month low. The intraday low even hit the psycholigcally important 2100 level. This new low confirms 50DMA resistance. The 50 and 20DMAs are firmly entrenched as downtrend lines.

Flipping call options on SPY was interesting at this juncture – indeed very enticing with the dip well below the lower-Bollinger Band (BB). Yet, I decided to hold off at least one more day. Hopefully, T2108 will dip into official oversold territory before I buy.

The S&P 500 (SPY) sags its way into a short-term downtrend under 50DMA resistance.

While signs of technical damage abound, a glaring sign of trouble comes from T2107, the percentage of stocks trading above their respective 200DMAs. T2107 fell to 52.3%. T2107 has not closed this low since day #1 of post-Brexit trading and is thus close to providing complete confirmation of a market top.

The rapid fall in T2107 since September exposes failing long-term uptrends across the stock market.

While much of the stock market was busy selling off, commodity-related stocks were busy rallying. Presumably, a tumbling U.S. dollar index (DXY0) was a main driver. This sell-off SEEMS like the market’s attempt to get ahead of a “sell the news” move after the Fed (presumably) confirms it is on track to hike rates in December. The dollar rally going into this week was supposedly all about the prospect of rising rates.

It looks like the U.S. dollar has topped out again.

Precious metals were some of the bigger beneficiaries of the dollar’s loss. Most importantly for my trading idea of a bottom for gold and silver , iShares Silver Trust (NYSE:SLV) finally broke away from 200DMA support and gapped higher to a 2.6% gain. With my fist full of call options expiring on Friday (purposely timed for post-Fed) and SLV butting heads with 50DMA resistance, I locked in my profits.

The iShares Silver Trust (SLV) rallies from 200DMA support to 50DMA resistance

Gold continued to lag silver. The SPDR Gold Shares (NYSE:GLD) gapped up for a mere 0.7% gain. GLD still has room to run to hit 50DMA resistance.

Like SLV, the SPDR Gold Shares (GLD) finally pulled away from rising 200DMA support.

The technical picture could change dramatically after the Fed delivers its latest salves for the market, so I am not posting a bunch of new charts here. I do have two quick trading updates from my last T2108 Update…

In my last T2108 Update, I noted that Alphabet’s (NASDAQ:GOOG) post-earnings gap and crap put 50DMA support into play. Just two days later, GOOG tested that support…and succeeded. I was ready with a low ball offer on a call option that filled upon GOOG breaking 50DMA support. I decided to lock in my small profit on the eventual bounce rather than hold through the Fed. GOOG remains on my list whether to play confirmed support at the 50DMA or a confirmed breakdown.

Alphabet (NASDAQ:GOOGL) (GOOG) once again survived a test of 50DMA support.

Amazon.com (NASDAQ:AMZN) hit my $800 target very quickly. Since I bought a call spread that does not expire until next week, I was not ready/willing to lock in profits just yet. By the close, AMZN had faded so hard from 50DMA resistance that it ALMOST touched its post-earnings low before bouncing back to a fractional loss. Playing 50DMA resistance somehow never even crossed my mind…

Amazon.com (AMZN) quickly tests 50DMA resistance and promptly faded…and faded hard.

Daily T2108 vs the S&P 500

Black line: T2108 (measured on the right); Green line: S&P 500 (for comparative purposes)

Red line: T2108 Overbought (70%); Blue line: T2108 Oversold (20%)

Weekly T2108

Full disclosure: long SDS, long SPY call options, long UVXY shares and short UVXY call and long UVXY put options, long CAT call and put options, net long the U.S. dollar index, long GLD, long SLV shares and call options, long WHR put options, long AMZN call spread, long IBB put options, long HSY call options

Trading in financial instruments and/or cryptocurrencies involves high risks including the risk of losing some, or all, of your investment amount, and may not be suitable for all investors. Prices of cryptocurrencies are extremely volatile and may be affected by external factors such as financial, regulatory or political events. Trading on margin increases the financial risks.

Before deciding to trade in financial instrument or cryptocurrencies you should be fully informed of the risks and costs associated with trading the financial markets, carefully consider your investment objectives, level of experience, and risk appetite, and seek professional advice where needed.

Fusion Media would like to remind you that the data contained in this website is not necessarily real-time nor accurate. The data and prices on the website are not necessarily provided by any market or exchange, but may be provided by market makers, and so prices may not be accurate and may differ from the actual price at any given market, meaning prices are indicative and not appropriate for trading purposes. Fusion Media and any provider of the data contained in this website will not accept liability for any loss or damage as a result of your trading, or your reliance on the information contained within this website.

It is prohibited to use, store, reproduce, display, modify, transmit or distribute the data contained in this website without the explicit prior written permission of Fusion Media and/or the data provider. All intellectual property rights are reserved by the providers and/or the exchange providing the data contained in this website.

Fusion Media may be compensated by the advertisers that appear on the website, based on your interaction with the advertisements or advertisers.