Did The U.S. Slip Into Recession In Q1? GDI Begs To Differ

James Picerno | Jun 01, 2015 08:13AM ET

Gross domestic product (GDP) is down, but gross domestic income (GDI) is up. One hints at the possibility of a recession for the US while the other still points to growth, albeit at a lesser pace than we’ve seen recently. GDP retreated by 0.7% in the first quarter, but GDI—reliable signals .”

Minds will differ, of course—this is macroeconomics, after all. But while the debate will roll on, advocates of GDI say it offers support in favor of the view that the US didn’t flirt with a new recession in Q1.

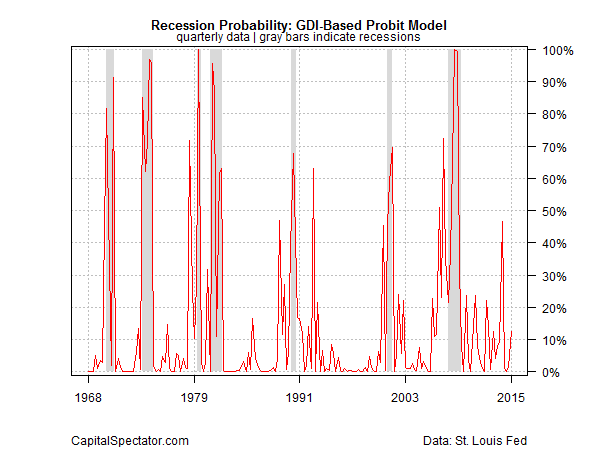

To put GDI on a relatively level playing field with GDP in terms of business-cycle signals, let’s run the quarterly changes for this alternative measure of economic activity through a probit model in search of context for deciding if Q1 has crossed the red line into contraction. The short answer: no, as the chart below shows. The current reading is quite low, at roughly 13% for this year’s first quarter.

The recession-risk estimate for GDP via a probit model looks considerably darker, of course, thanks to Q1’s slide, as I noted last week.

Which one’s telling us the truth? Let’s split the difference and for now say that the US trend turned softer in Q1 but is still short of a tipping point. That leaves us to ponder the case for a second-quarter rebound. The numbers overall are a bit shaky to date, but the monthly figures through April still translate into low odds that the NBER will declare the month as the start of a new downturn.

The main event for this week for revising the outlook (or not) is Friday’s payrolls report for May. The crowd’s looking for another respectable gain, based on Econoday.com’s consensus forecast—a rise of 215,000 for private payroll, up slightly from April’s 213,000 increase. If the prediction holds, the chatter about recession risk will fade while GDI’s reported advantages will draw more accolades.

Trading in financial instruments and/or cryptocurrencies involves high risks including the risk of losing some, or all, of your investment amount, and may not be suitable for all investors. Prices of cryptocurrencies are extremely volatile and may be affected by external factors such as financial, regulatory or political events. Trading on margin increases the financial risks.

Before deciding to trade in financial instrument or cryptocurrencies you should be fully informed of the risks and costs associated with trading the financial markets, carefully consider your investment objectives, level of experience, and risk appetite, and seek professional advice where needed.

Fusion Media would like to remind you that the data contained in this website is not necessarily real-time nor accurate. The data and prices on the website are not necessarily provided by any market or exchange, but may be provided by market makers, and so prices may not be accurate and may differ from the actual price at any given market, meaning prices are indicative and not appropriate for trading purposes. Fusion Media and any provider of the data contained in this website will not accept liability for any loss or damage as a result of your trading, or your reliance on the information contained within this website.

It is prohibited to use, store, reproduce, display, modify, transmit or distribute the data contained in this website without the explicit prior written permission of Fusion Media and/or the data provider. All intellectual property rights are reserved by the providers and/or the exchange providing the data contained in this website.

Fusion Media may be compensated by the advertisers that appear on the website, based on your interaction with the advertisements or advertisers.